[Every year, friend-of-the-site David Collum writes a detailed "Year in Review" synopsis full of keen perspective and plenty of wit. This year's is no exception. Moreover, he has graciously selected CM.com as the site where it will be published in full. It's quite longer than our usual posts, but by any measure, 2011 offered an over-abundance of 'business as unusual' developments to summarize. We hope you enjoy David's colorful observations and insights, which are very much his own. — cheers, Adam]

Background

Governments gambled on a return to growth solving all the problems. That bet has failed.

—Satyajit Das—

Every December, I write a Year in Review. Last year's was posted at several sites including Chris Martenson’s [1]. What started as summaries posted for a couple dozen people accrued over 13,000 clicks in total last year. It elicited discussions with some interesting people and several podcasts, including a particularly enjoyable one with Chris [2]. Each begins with a highly personalized survey of my efforts to get through another year of investing. This is followed by a brief update of what is now a 32-year quest for a soft landing in retirement. These details may be instructive for some casual observers. I have been a devout follower of Austrian business cycle theory since the late 1990s and have ignored the siren call for diversification. I vigilantly monitor my progress relative to standard benchmarks. The bulk of the blog describes thoughts and ideas that are on my radar. The commentary is largely stream-of-consciousness with a few selected links that might be worth a peek. Some are flagged as “must see”. Everything else can be found here [3].

So why do people care what an organic chemist thinks about investing, economics, monetary policy, and societal moods? I can only offer a few thoughts. For starters, in 32 years of investing I had only one year in which my total wealth decreased in nominal dollars; whatever I am doing has worked. I also ride the blogs hard, am fairly good at distilling complexity down to simplicity, seem to be a congenital contrarian, and am pretty well connected (for a chemist). I am Joe Sixpack, a 99er of sorts with a growing unease.

Every year I feel like Bill Murray in ground hog day. Issues including the housing crises, hidden inflation (of a kind that even John Williams is not discussing), and interest rates have not disappeared, but I hit them hard last year and will not rehash them. I spoke of civil unrest in 2009 but not 2010. That topic has returned with a vengeance. The temptation to say "I told you so" can be irresistible. I have cordoned off a section to get it out of my system. Ad hominem attacks are reserved for jerks and morons, and I will try to avoid trite phrases of little content. I saw "risk on-risk off" so many times that I thought the Fed had hooked the markets to The Clapper. So let's quit kicking the can down the road and get started.

Contents

- Background

- Investing

- Just Thoughts

- All the Devils Are Here

- Buffett Takes a Bath

- Precious Metals and Currency Wars

- Energy and Resources

- Europe

- Federal Reserve, Bailouts, and Bank Reflations

- MF Global and Rehypothecation:

- Leverage in a Fractional Reserve World

- Nobody Saw It Coming

- Apocalypse Now—The Sequel: A Casting Call for Colonel Kurtz

- The Constitution and the Fourth Estate

- Where to From Here?

- Books

- Acknowledgement

- Links

Investing

Time for this turtle to come home.

—Mr. Wizard—

2011 in Review.

With rebalancing achieved only by directing my savings, I changed nothing in my portfolio year over year. The total portfolio as of 12/31/11 is as follows:

Precious Metals et al.: 53%

Energy: 14%

Cash Equiv (short duration): 30%

Other: 3%

It was a turbulent year for all hard asset investors, eliciting wild oscillations in my portfolio within a 20% range. An overall return on investment (ROI) of -2% was edged out by the S&P 500 (0%) but bested Berkshire Hathaway (-5%). Precious metals (largely CEF, FSAGX, and physical metals) gyrated throughout the year but finished even over all physical and paper forms (Figure 1). Gains in gold (10%) and silver (-10%) were offset by a drop in the premium of CEF (Central Fund of Canada)—one too many shelf offerings—and profoundly disappointing results for the precious metal equities (-19%). The metals are discussed in detail below.

A basket of Fidelity-based energy and materials funds underperformed from -4 to -12%. These are represented emblematically by the XLE spider (1%) and XNG Amex natural gas index (5%) in Figure 2. My own fund foisted upon me by Cornell's Fidelity connection (FSNGX), although 10% annualized over the decade, was total garbage this year (-7%) relative to its peers. I keep adding to an already chunky position in natural gas equities for reasons discussed in detail last year [1]; a secular global shift toward natural gas should reward patience but this year was pure patience.

These results were buffered by the cash (0%). In addition to the -2% return on investment (ROI), personal savings equivalent to 29% of my gross income added a couple more percent to sneak me into the black (1%) in units of accumulated wealth (vide infra). College tuition and a new car attenuated what would have been a stellar year for savings. Alas, such exceptions seem to appear every year.

Figure 1. Precious metal-based indices (CEF in red, XAU in green, SLV in purple, and GLD in yellow) versus the S&P 500 (in blue) for 2011.

Figure 2. Energy-based indices (XLE in green and XNG in red) versus the S&P 500 (in blue) for 2011.

32 Years in Review.

My imbalanced portfolio changed in decadal rhythms as follows:

1980-88: nothing but bonds (100%)

1988-99: classic 60:40 equities:bonds

1999-2001: cash, precious metals, shorts (minor), tobacco (minor)

2001-2011: cash, precious metals, energy, tobacco (minor)

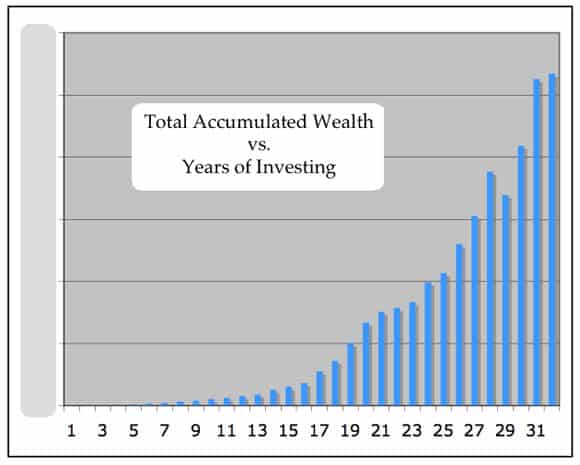

My total wealth accumulated through a combination of savings and investment as shown in Figure 3. (I blocked out the absolute dollars.) Years ago I chose to exclude physical precious metals from my analysis using classic gold bug logic that I measure them in ounces not dollars. Over the last dozen years, however, I have steadily bought gold (with cash) a couple ounces at a time. I have been prompted to include them in all analyses.

Avoiding 1987 and 2000 equity crashes and capturing the bull market in precious metals proved fortuitous. You can see that 2008 and 2011 were the only down years. Berkshire has dropped five years since 1991.

Figure 3. Total wealth accumulated (ex-housing) versus year of employment. Absolute numbers of dollars have been omitted. Y-axis omitted intentionally.

I monitor progress by what I call a salary multiple, which is defined as the total accumulated investable wealth (excluding my house) divided by annual salary (line 22 of on the 1099 form ex capital gains). Over the 31-year period my salary rose twelve-fold, which I can fairly accurately dissect into a fourfold gain resulting from inflation and a threefold gain (relative to starting salaries of newly minted assistant professors) resulting from increasing sources of income and merit-based pay raises. My accumulated wealth normalized to the moving benchmark of a rising income is plotted versus time in Figure 4. The fluctuations visible in Figure 4 but not in Figure 3 result from income variations. A quick calculation shows that my 12-year accumulation rate beginning 01/01/00, a period in which the S&P returned almost nothing, is annualized at 12%. My five-, ten-, and fifteen-year rate of wealth accrual also beat Buffett's.

Figure 4. Total wealth accumulated measured as a multiple of annual salary versus years of investing.

Just Thoughts

More than any other time in history, mankind faces a crossroads. One path leads to despair and utter hopelessness. The other, to total extinction. Let us pray we have the wisdom to choose correctly.

—Woody Allen—

2011 may prove to be an historical turning point. In 2008 the visionary James Grant asked “Why no outrage?” [4] In the early spring of this year I sensed rage but thought maybe it was only mine. As the year progressed, however, change was in the air and protracted social crises seemed possible. Many issues owing their origins to economics seem to be metastasizing into social movements. One senses winter is coming. With rich irony, Arabs might call it American Spring. Strauss and Howe predicted it in 1996 and would call it a Fourth Turning.

All the Devils Are Here

Look what they've done to my song, Ma.

—Melanie—

I cannot get that refrain out of my head as I watch the markets. This year the Devils brought us a wealth of nauseating and irritating stories that made you want to hurl (both lunch and laptop.) Here are some of the highlights. Others worthy of elaboration have been allocated their own subsections.

In an op-ed, Joe Nocera (author of a book bearing the title of this section) noted that one guy is in jail as a result of the entire mortgage fiasco: he lied on a liar's loan. By contrast, Gary Cohn, COO of Goldman Sachs testified to Congress under oath that Goldman went to the discount window only once, for a nominal sum when in reality Goldman went multiple times. I had occasion to ask Joe if Gary would get charged. "No." Apparently, perjury in Congress is only a crime if you are lying about baseball.

Thanks to Steve Kroft's 60 Minutes episode we found out that Congress can legally trade on all forms of insider information [5]. (It helps if you write the laws.) The frothy mix of money and politics is simply too awesome to overcome. Congress shirked its stated job of providing leadership by refusing to make even nominal budget cuts. They set up a super committee to make the cuts (and to give the lobbyists a much more focused target for their money cannons.) They failed too. I am sure the money cannons worked.

The NY Bank-Mellon (and, by the cockroach model, many more banks) got caught after a multi-decade crime spree involving back-dating of Forex trades of pension funds—that would be us folks—scalping 0.3% on every trade. I am sure they will be fined pennies on the dollar and not forced to admit guilt.

We found out this year that the SEC destroyed 18,000 files of fraud cases over many years because they were deemed "inactive", including those emanating from the Madoff case [6]. The magnitude of this blunder, a generous term for absolute corruption, can only be appreciated when you realize that all fraud cases at the SEC are inactive. David Einhorn's book (Fooling Some of the People; vide infra) includes horrifying tales of SEC corruption. I imagine Markopoulos' book about Madoff is the Bible on the subject.

There was a brief glimmer of hope. Standard and Poors grew a spine and downgraded US sovereign debt. I am not sure what rating you give to sovereign debt in which the authorities have explicitly stated that they intend to deracinate creditors with inflation, but it certainly is not AAA. Of course, the CEO of S&P was promptly fired, and, in a delicious irony, was replaced by the COO of the completely insolvent Citibank.

In a wondrous moment in journalism, Bloomberg pried over 20,000 documents from the Federal Reserve using the Freedom of Information Act (FOIA). The Federal Reserve fought the suit, but then agreed to "cooperate" with the Supreme Court's decision. How magnanimous. There emerged a cottage industry to dig nuggets from this treasure trove. We discovered, for example, that most of the $800 billion of Quantitative Easing II, money reputed to boost the US economy, went straight to European megabanks. Matt Taibbi of Rolling Stone described how a few hundred million found its way into the pockets of the wives of two Morgan Stanley executives to purchase distressed assets and shoes. The system sprang into action after Bloomberg’s score and initiated legislation that will allow the Fed to deny a document exists in an FOIA lawsuit if it should prove inconvenient. I guess that's the FODA (Freedom of Denial Act).

I thought I could get through a year without taking a whack at Alan Greenspan, but I couldn't let this one go. The Maestro announced that we should burn down houses to alleviate the supply problem. He seems to have forgotten what historians have written about Federally sponsored food destruction programs during the Depression to prop up prices as people went hungry. This clown destroyed lives. Could somebody at least put a sock in his face?

I try to stay non-partisan, but the White House deserves a little scorn. White House pressure to give solar cell company Solyndra $535 million dollars backfired when they went bankrupt. I remember seeing Obama's speeches and thinking that they were shameless infomercials. I must admit that I like having an intelligent president who formulates full sentences in real time, yet distrusted him from the start for a simple reason: Nobody comes from the Chicago political machine uncorrupted. Once elected, he filled his cabinet with establishment thugs. Chief of Staff Rahm Emanuel then left to become mayor of Chicago and was replaced with the infamous mayor Daley's son. You can’t make this stuff up.

Hank "The Hammer" Paulson has done a credible job of looking like a good guy, despite his nickname and Goldman roots. There's no way that an environmentalist and avid bird watcher could be ruthless, right? We found out, however, that Hank had tipped off a bunch of ex-Goldman hedge fund managers about what the Fed and Treasury would be doing. Of course, Hank let guys like Buffett and Gross help design bailouts and then front run them, but a bunch of hedge fund managers? They don’t even have Congressional appointments.

I would be remiss by not noting that the investment bankers got a few IPO scalps. It's nothing like the glory days, but they came out with Groupon (flush), Pandora (unobtainium-induced flush), and Zynga (nouveau flush). Buyers of GM and AIG, the newest GSEs, got pummeled with 50% losses this year. You should not buy what Wall Street sells.

Forget Bin Laden, we got Rajaratnam! What a score for the authorities—a big-time hedge fund manager making money off leaked secrets. To top it off, he's a foreigner, so we get a xenophobia boost. And now for the rest of the story. The guy who leaked the information—the guy who should be credited with a massive breach of trust—was Gupta. He's a foreigner too so why did Gupta get a pass? He works for Goldman (golf clap). One can only wonder how many more breaches of trust can occur before we simply run out of trust.

Paul Krugman knows how to make friends and influence people. He incessantly pleads for another $5 trillion dollars. Please let it go. A 2002 op-ed resurfaced in which Krugman had called for Greenspan to create a housing bubble [7]. OK. It's not a crime to be wrong (or a buffoon), but somehow they keep publishing his drivel. Krugman also suggested:

If we discovered that space aliens were planning to attack and we needed a massive buildup to counter the space alien threat and really inflation and budget deficits took secondary place to that, this slump would be over in 18 months. [8]

Jeepers Paul: Put down the bong. This box-office-ready variant of Bastiat's "broken window fallacy" illustrates what a complete Keynesian boob he is. He also waxed philosophically about how the East Coast earthquake in August could have stimulated the economy if only it had done more damage. Why think small? How about global thermonuclear war or an extinction-event asteroid? The earthquake quote is rumored to be a fake, but how would you know? Since socks come in pairs, put one in his face too.

Buffett Takes a Bath

You should thank God [for bank bailouts]…Now, if you talk about bailouts for everybody else, there comes a place where if you just start bailing out all the individuals instead of telling them to adapt, the culture dies.

—Charlie Munger, Berkshire Hathaway—

Let 'em eat Twinkies, Charlie! (but I digress). Warren Buffett (WB) claims he decided to invest $5 billion in Bank of America while taking a bath. Total absurdity aside, the last guy who did his thinking in the bathtub single handedly destroyed the global economy with his bubbles. To pilfer Buffett's Wright Brothers logic, we should have drowned that guy, but I digress (again).

Buffett lost a little money this year—no big deal—but he took quite a metaphorical bath. WB is possibly the most famous and successful investor of the modern era—a world-class stock jobber, Master of Wall Street, and a hype machine. Come again? Yep. That sweet little old grandfather buying banks while eating ice cream in Dairy Queen in Too Big to Fail is a world-class hoser. In 2009 I caught Buffett in a big lie: he declared a bullishness for equities with interest rates in the basement, completely contradicting his 1999 article in Fortune Magazine declaring that rising interest rates cause secular bear markets in equities [9]. While pondering a blog denouncing this hypocrisy, I discovered Michael Lewis had scooped me by a mere 17 years. In 1992, Lewis’s Temptation of St. Warren excoriated WB; it’s quite a read [10]. I stole Michael’s title, wrote my blog, and moved on [11], but Buffett and the Buffettologists continue to irritate me.

This year WB denounced low taxes on billionaires. Sounds altruistic, but it leaves a bad taste given that his corporate attorneys protect him from taxation while fighting underpayment of Berkshires' taxes. (Michael Vick denounces dog fighting too.) WB also helped write bailout plans for banks (including Goldman Sachs and Wells Fargo) while scooping up shares of bank stocks (including Goldman Sachs). He’s no Martha Stewart, but this smells. WB defiantly maintains that he couldn’t care less about Berkshire’s share price, yet he spent billions buying Berkshire shares above book value, which smacks of a stock pump (and it worked). He became Obama’s BFF (best friend for you non-teenagers) and then, miraculously, two of WB's favorite companies, Wells Fargo and Moody’s, somehow managed to slither out of Federal legal actions targeting their peer banks and ratings agencies. It’s good to have friends in high places (and a reputed $10 million dollar lobbying budget.)

People around WB didn’t help his image either. His long time partner, Charlie “Let ‘Em Eat Cake” Munger, certainly displayed a tin ear with his quote. David Sokol, WB’s anointed heir apparent at Berkshire, got caught getting a little on the side to supplement his ample wealth. Of course, you can’t have Buffett’s clone look like a crook so his career at Berkshire was vaporized. Legendary hedge fund manager Michael Steinhardt beat Warren like a rented mule in a must-see interview on CNBC [12]. He said WB "conned the press", is "thoughtless", a “snow job”, and even implied dishonesty while WB’s pregnant groupie listened in stunned silence. When pressed about the Sokol affair, Steinhardt indicated that “it is not common for Buffett to get caught.”

Steinhardt also touched a topic that has me conflicted. Buffett and Gates have pooled their gargantuan empires—resources accrued from the miracles of American capitalism—into a single tax exempt organization of unprecedented scale (Catholic Church aside). One lobe of my brain says they are free to do as they please; another thinks that American capital should be plowed back into American soil for the next generation. I keep thinking about a strip-mining metaphor. In any event, a tax-exempt organization will be allocating this massive pile of capital for eternity (or maybe not). Let’s hope it does so efficiently and for good causes.

Precious Metals and Currency Wars

Gold standard supporters are lunatics and hacks

—Nouriel Roubini—

Precious metals were in a Utopian bull market for almost a decade. The early bulls lounged poolside, taking the occasional dip and enjoying returns in the high teens. It was a leisurely path to wealth. Predictably, the speculators showed up, a few at first but then in number, forcing repeated chlorine charges of the pool. The high frequency traders began playing digital Marco Polo, causing raucous turbulence. Now the market is anything but leisurely. I miss the sane days when only crazy people bought gold.

The volatility, however, is not just the traders. There were some serious shenanigans at the Chicago Mercantile Exchange (CME). They are charged with maintaining orderly markets, but apparently fell waaaay behind the curve. Five margin hikes on silver in eight days isn't orderly; it's a drive-by shooting. Just days later, the new Shanghai metals exchange jumped in with its own margin hike, triggering a 15% flash crash. Mysterious put buying on low volume in the wee hours of the morning while most of Asia was on extended vacation elicited serious gold sell offs. To ensure that commodity traders across the board got the memo, 60 million barrels of oil were released from the strategic petroleum reserve for no apparent reason. (Does anybody believe that actual oil entered the market place?) The message was clear: metals and commodity bulls will be dealt with severely. Those without a position in metals are braying that the bull market is over and have been energized by recent precipitous drops. Others see the margin hikes as an effort to allow an orderly retreat for big-money shorts. There may have been some serious collateral damage, however. I suspect that some of MF Global's problems may have started from this forced selling.

So where are we, heading back to the barbequed relic era for gold or taking a pause that refreshes? I labor over this question without a definitive answer, but I suspect that we are somewhere in the middle of a secular bull. The damage looks minor when placed in perspective (Figure 5). The retail customer is not yet in the game; I have dozens of smart colleagues who listened to me squeal for a dozen years without ever buying an ounce of gold. My local coin dealer still has only 2 or 3 steady buyers kept on speed dial. Sometimes he can't move even a couple of ounces of gold. Japan is offering gold coins with the purchase of government bonds, placing gold at the status of a free toaster oven. In what was a spectacular Twitter flame war between Rickards and Roubini, Roubini launched his "lunatic" quote (vide supra). One intrepid reporter denounced gold, indicating that "gold is unbacked whereas the dollar is backed by the US government." (I blew a snot bubble on that one.) The symptoms of a blow-off top are absent.

Meanwhile, the supply-demand stats look great. HSBC estimates that only 0.14% of investable assets are precious metals whereas Sprott says 0.75%. Both are far cries from the 5% target of traditional portfolio theory. Central banks are buyers after decades of selling. India, Korea, Mexico, Russian, and Vietnam were visibly active. (Rumors abound that big buyers are going straight to the miners, rendering the Comex increasingly irrelevant.) Chavez repatriated his gold to Venezuela, presumably to avoid rehypothecation (vide infra). Jim Rickards is in Northern Europe at this moment discussing similar repatriations. Why would any sovereign state keep their gold elsewhere? The 500 lb gorilla, however, is China. They are rumored to have 1,000 tons of gold with a target of 8,000 tons. How do they buy 7,000 tons? They bid for it like everybody else. Chinese citizens have been encouraged to save using gold (a defacto gold standard and covert accumulation). Although the gold bugs in the US occasionally discuss confiscation, I think the Chinese proletariat are the ones being set up. Last but not least, we have charlatans running the central banks of the world. When they say they are going to debase their currencies to help their banking friends, I take them seriously.

Figure 5

With timing that would make Robert Shiller proud, Jim Rickards published Currency Wars, a carefully reasoned description of past and future mercantilism and currency debasement. The oddest thing about a currency war, however, is that you are said to win if you inflict the most damage to your own currency. This is akin to circling the wagons and shooting inward. To stretch the wild west metaphor a little further, I am reminded of the classic scene in Blazing Saddles when the sheriff (Bart) points his gun at his own head and threatens to shoot himself if anybody moves. As the logic goes, everybody debases their currency to make exports cheap and imports expensive. Of course, consumers pay up, but nobody cares about consumers. Even the Swiss—the Swiss!—debased the Swiss franc by 10% in one Draconian swoop to energize sales of army knives. I have no doubt that this form of mercantilism is driven by greed and avarice of politically connected special interest groups. Those who do not directly benefit but sign off on the ideas (economists and journalists) are cranks in my opinion. (I am not completely sure if that passes for an ad hominem attack.)

I must pay lip service to the precious metal equities. Starting in late 2010, equities and metals began diverging quite markedly as evident in Figure 1. Some argue it's GLD sopping up demand, which I suspected at the outset was the reasoning behind its creation. My best guess, however, is that some big money players began placing spread trades by going long metals-short equities. If so, this gap will eventually narrow. Many bulls assert that the equities are dirt cheap, should be levered heavily to metal price, and will eventually soar (possibly all the way to the moon!) Despite a chunky position in these equities, I am not so sanguine. I aggressively bought tobacco stocks in early 2000 with p/e's in the mid single digits and dividend yields of 8-12%. (My best bottom call ever paid for a college education.) The gold stocks do not look dirt cheap by that standard. The notion that there is gold in them thar hills (i.e., assets in the ground) is meaningless if these miners can't get it out profitably. The darker possibility is that the equities are foreshadowing a downturn in the metal price. I don't take that too seriously because markets seem pretty damned myopic.

I can't exit a discussion of metals without talking about silver, a bi-curious metal with both industrial demand and pornographic appeal for precious metal investors. (I have spittle dribbling down my chin as I type.) The world-renowned CPM group says that annual industrial demand (approximately 900 million ounces) exceeds mine supply by 200 million ounces. The shortfall is made up from above-ground bullion stashes accrued through the millennia and from recycling. Gold-silver price ratios of 16:1 are often cited targets based on 1:16 ratio of gold and silver in the Earth's crust. The above-ground stashes, however, tell a very different story. Smart guys like Sprott and Martenson are now quoting 1:1 ratios of accessible above-ground supplies (1-2 billion ounces of each). It was claimed by a highly reliable source (the internet) that the global above-ground