The big market-moving news this week – as you probably know by now – was the solvency problem in the leveraged UK pension funds. (Leveraged? Pension funds???) The UK pension funds were holding UK sovereign debt, the price of which has been plunging (due to rising rates), which wouldn’t normally matter (just hold until maturity, and all is well), unless, of course, they were using a ton of borrowed money to amplify the yield on the bonds. Which, it turns out, is what they were doing.

Why borrow money? Turns out the rates on government bonds were too low for the pension funds to meet their obligations (thanks central bankers), so the pension funds ended up taking much larger risks, using leverage. And using leverage to create a large portfolio of government bonds worked great, right up until the moment the rates on these bonds started to rise rapidly. And then – suddenly – it wasn’t fine anymore. There were (probably) margin calls; bankruptcy beckoned.

So, to head off this impending leveraged-pension-fund destruction, which would most likely have angered (and impoverished) a large number of pensioners, the Bank of England stepped in to buy the plunging (probably no-bid) government bonds in question. “We’ll take all of them.” Whew. Leveraged-pension-funds saved from destruction. At least for the moment. That was Wednesday. And all it cost was 65 billion pounds.

Bank of England to buy 65 billion pounds of UK bonds to stem rout (Source – Reuters).

BOE Ignites Global Rally in Everything From Stocks to Bonds (Source – Bloomberg).

Initially, this move was seen as a pivot signal by the enthusiastic herd in the risk asset markets; equities, crappy debt, etc, which rallied strongly on the news. “Yay the pivot has arrived! We’re back to central bank buying sprees!”

The optimism lasted a day. Unfortunately, equities then sold off some more, ending the week at a new low. So the leveraged UK pension funds were (temporarily) rescued, but equities and crappy debt both continued downhill.

Regardless of whether the long hoped-for pivot is in our near-term future, all this is a really big deal. It reflects a serious solvency problem in pension funds in Europe, and perhaps in the U.S. also. That’s why I’m going on about it – this event is a signal of things to come. And, it may reflect an inability of the central banks to stop printing money. That would mean there is no Volcker 20% short-term rates this time around. Too many leveraged funds will break on the way to 20%. Plus, we have another cause of inflation besides money printing: an absurdly large number of people in the workforce have been disabled, which has directly caused worker shortages, which in turn inflates wages. But that’s a story for another time. [I wrote it up, but it got too long – I’ll post it later]

I suspect this pension solvency issue is a massive – and global – problem, which is only showing up first in the UK. Armstrong has been saying this for quite a while now (pensions in the EU are toast, due to engineered low rates on government debt), and it didn’t make sense to me, but now I get it: low rates led to leverage, and leverage is fine right up until rates scream higher, and then it suddenly – overnight – it all turns into a debt-default solvency problem.

Here’s what the U.S. 30-year mortgage rate looks like right now. If some U.S. hedge fund was leveraged in long 30-year mortgages a year ago, they have been crushed by the recent moves. (Rising rates = plunging bond prices). We saw an absurd 41 basis point move just this week alone. I suspect some fund somewhere may have already blown up over this move. Possibly, a wall of forced selling could be the reason why mortgage rates have moved up so rapidly. We just don’t know who it is just yet. Does your money market fund borrow money to invest in 30-year MBS? Does mine? I sure hope not.

Remind anyone of 2008? It should. Whenever you see huge, rapid price moves after a long move higher, you should assume someone, somewhere with too much leverage is in the process of blowing up. Hmm. Maybe the Fed will start buying 30-year mortgages? And…how will this play right before the election? Positive or negative? Disasters aren’t a good look for the party in power. Especially, if they are the ones asking you to “Trust the Experts.” Then again, before you can Build Back Better, you need to have the Hiroshima-like Great Reset.

King World News had a 20-minute interview on these events. When I heard it, I laughed at how the interviewee was saying exactly what I have just written about being surprised that the pension funds would lever up long.

WEEKLY WRAP with Alasdair Macleod (Source – King World News); “we never expected our pension funds to be engaging in this sort of activity.”

Now on to the markets.

The S&P 500 (SPX) fell -2.91% on the week, making a new 6-month low. The sector map was mixed; energy rallied (+2.14%) and materials were second-best (-0.62%), while utilities did worst (-9.54%) along with tech (-4.18%). Boy, that’s a horrific one-week move for the normally-safe-haven utilities. You’re telling me that energy and materials are the safe haven sectors right now? Very unusual, but that’s what prices are saying. The new low is a very bad look for SPX.

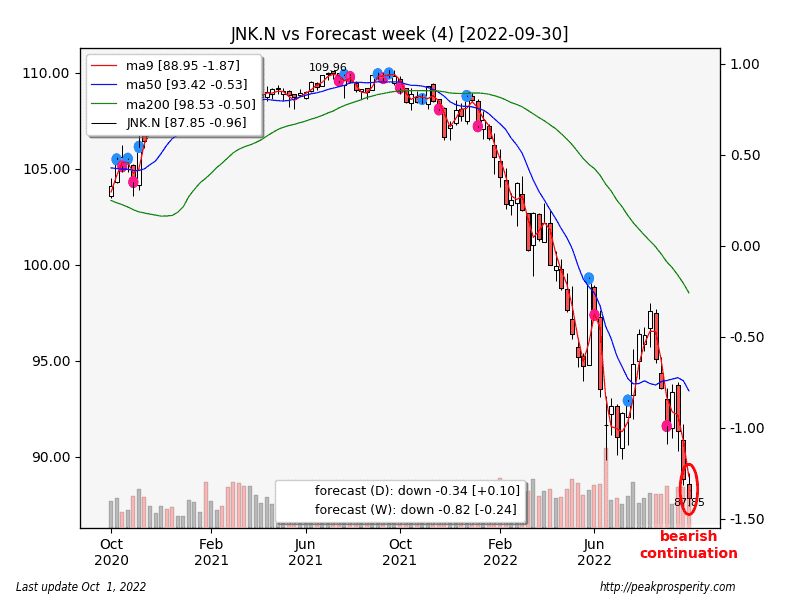

Crappy debt (JNK) dropped -1.08%, making a new 2-year low. Last time we saw prices here was back in March 2020. Crappy debt is down (roughly) 23% from its highs in mid 2021. That’s pretty disagreeable when the fund itself yields about 5.2%. Annually. Now, imagine you’re at 2:1 leverage owning JNK. You make a 10.4% annual yield, but you just lost 46% in capital. At 4:1 leverage? You make 20.8% yield, but you just lost 92% in capital. And, of course, at 5:1 you’re BK. The UK pension funds in a nutshell.

So, both of those charts looked bearish; new multi-month (or multi-year) new closing lows are bearish signals. By contrast, the buck was just slightly bearish, not even one percent off its highs; the buck fell 0.78% on the week, but at least so far, no bearish reversal on the weekly timeframe. Is the BOE action (buying 65 billion in UK bonds with newly-printed money) bullish for British pounds (GPB)? No. So, why didn’t the buck scream higher with all those new GBPs being printed? Well, just maybe, the currency markets are anticipating that other central banks – including the Fed – will have to perform the exact same operation in the relatively near future to rescue their own leveraged bond-holding funds. That’s what prices are saying to me anyway. Price moves provide information. I do not believe that “all markets are manipulated.” Sure, they might try, but, if it were easy to do, then why would the BOE have to buy 65 billion in bonds?

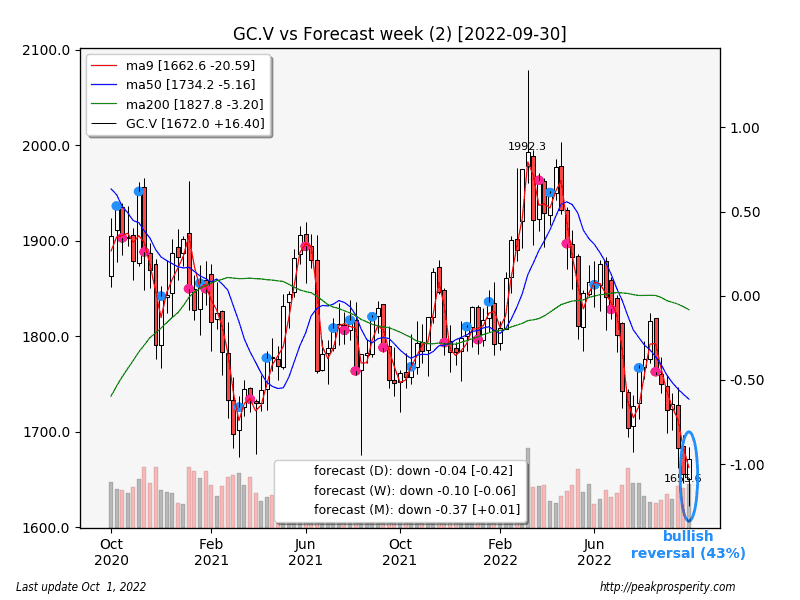

That brings me to gold, which rose 16.40 [+0.99%] to 1,672 on the week, with most of the gains happening on Wednesday. But, unlike the risk assets and the dollar, gold held on to the Wednesday gains into end of week. The long white candle pattern looks reasonably positive, and even though gold made a new low this week, the fact that gold closed back in positive territory, and it outperformed both crappy debt and equities, is a bullish signal.

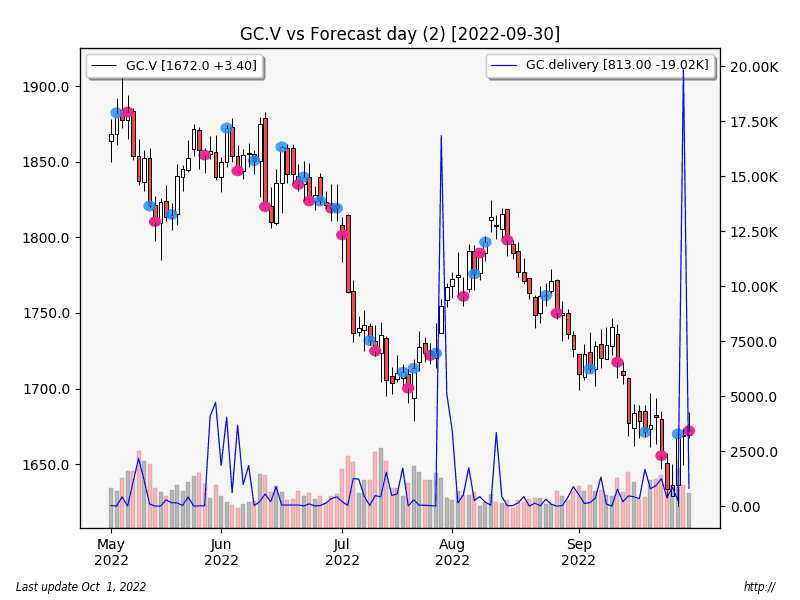

Part of the explanation for gold’s rally could be deliveries and/or a huge drop in open interest. Below are deliveries: Thursday was the highest COMEX gold delivery day in the past two years. Interesting how people want to take delivery of actual gold bars right now. What’s more, Friday saw the lowest open interest (OI) in four years. And this week’s Commitments of Traders (COT) report shows the lowest level of commercial shorts in gold since the end of 2018. These are all signs of us being at or near a low for gold. I know I keep saying stuff like this. Like a stopped clock, I’ll be right someday.

Silver didn’t do quite as well, rising just 0.13 [+0.68%] to 19.04. But unlike gold, silver didn’t make a new low this week, the weekly candle pattern looks reasonably strong, and silver’s open interest is so low that it (checks chart twice) was last here back in 2013, in the middle of the big silver smash! Holy crap. For whatever reason, banksters do NOT want to be short silver. Lowest OI in nine years. That generally only happens at or near the lows.

That brings us to the miners. Did they do well? Yes, indeed, XAU rose 7.57%. This week’s bullish engulfing pattern got a perfect rating (compared with other historical pattern outcomes for the “engulfing” pattern, it rated in the top 1%), which sums to a 70% chance of this being a near-term low. And, when the miners outperform the metal (GDX:Gold +6.04%), that’s also a bullish sign. In addition, this week the GDXJ:GDX ratio (+1.47%) tells us that money is moving into the much more risky junior miners in preference to the seniors. This is about as bullish as I’ve seen the metals get – they’ve literally checked every one of my bullish boxes. This is right when all the open interest and COT (commercial short) positions are also signaling a low may be in.

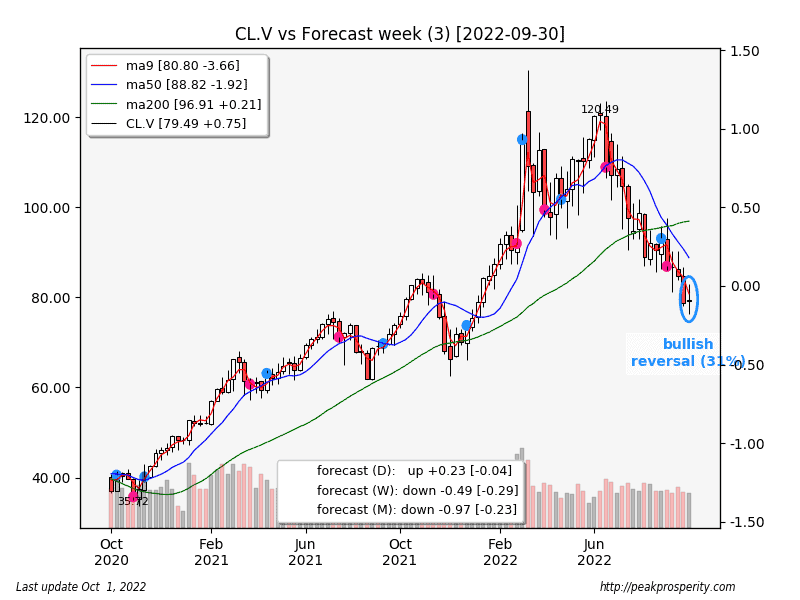

Crude went mostly nowhere – it rallied Wednesday, then sold off on Friday, ending the week up 0.75 [+0.95%] to 79.49. The doji candle was just mildly bullish. Open interest in crude has been low for the past several weeks – last seen around these levels in 2015, when price was around $50/bbl. The well-connected banksters have rung the cash register – i.e. closed out their short positions. As with silver and gold, the banksters do not want to be short crude at this moment. Why might that be? Do they know something we don’t? Outside-edge prediction: I predict a rally in crude in about (checks calendar) five and a half weeks. After all, higher oil prices are required in order to address “Climate Change” by causing a Great Reset. But only after November 8. Just a guess. Not financial advice.

Another indicator: the energy sector (XLE) was the best performing equity sector this week. Energy, along with gold and silver, appears to be – maybe – a “safe haven” trade right now. Again, very unusual.

So, how’s the U.S. petroleum reserve doing? Down again this week, of course, as the WEF/Biden-Handler pillaging continues ahead of the election. The dollar value of the campaign-supporting sale was valued at $363 million – just for this week alone. It is as if they sent the FBI on raids to siphon gasoline – that we paid for – out of every one of our cars (and not just the cars of the “semi-fascists”), and then sold the confiscated gas on the open market, just to lower gas prices. This SPR-pillaging, in advance of an election, has never happened before. It is the kind of behavior we can expect from Technocrats like the WEF/Biden-Handlers. “Trust the Experts.”

All my complaining about the SPR-draining has finally made it to the semi-mainstream.

Biden Draining Strategic Petroleum Reserve Like ‘Campaign Credit Card’: Industry Official (Source – ET)

The BOE intervention this week was a canary falling over dead in the coal mine. Defaults are ahead. Can’t say where, or in what. Looking at prices and the actions of the banksters: the defaults won’t be in physical gold, silver, or crude oil. Otherwise, be careful out there. Those banksters – and the central banksters – like to change the rules when things go against them. That’s just how they roll. I’ve seen them revert trades that they didn’t like, where normal people had “stink bids” that got hit during a time of turbulence. “Sorry, that price you got was just too good when that stock went no-bid. Your trade has been reversed.” If you use their system, and you win too much, they will change the rules. They do not like it when little people win.

The metals are giving off incredibly bullish signals. That’s not a measure of timing or certainty. Next week they could drop some more, and they might look even more bullish. But, there are signs that Big Money is moving into the miners, and the metals, on the long side. There are lots of deliveries in physical gold too. Things are starting to look positive for crude as well – although I suspect the Big Crude Rally may still be five weeks away. Because, Climate Change must wait for the election.

“Health”:

The U.S. Centers for Disease Control and Prevention (CDC) quietly dropped its universal masking recommendation for healthcare workers last week (Source – breitbart); after only 30 months.

Yougov Poll: Q#33: Frequency of Wearing a Facemask (Source – Yougov); ” Always: 14%, Mostly: 14%, Sometimes: 27%, Never: 45%”. The Mass Formation group size: 14-28%.

Did a Famous Doctor’s COVID Shot Make His Cancer Worse? (Source – Atlantic); Are they “telling the truth, slowly?” It is a wild headline for that group to print.

CDC walks back COVID guidance again, finds lasting post-vaccine heart problems in young adults (Source – justthenews); “A CDC study of 12-29 year-olds with heart inflammation following mRNA vaccination, published last week in The Lancet Child & Adolescent Health, found that 1-in-6 still had not “fully recovered” at least 90 days after myocarditis onset, including 1-in-100 who hadn’t improved at all.” Now, do 14-18 year-old male teens.

Trace amounts of #COVID19 vaccine mRNAs were detected in the breast milk of some lactating women. (Source – JAMA tweet via Archive); medical misinformation – this time, from JAMA.

The #1 way you can help end the vaccine insanity: support US Senator Ron Johnson (Source – Steve Kirsch); Steve is a life-long Democrat. Now, he doesn’t care about party anymore; he just wants the crazy stuff to end, especially the deadly vaccine mandates.

Europe/Ukraine:

Rush to deposit paper £20 and £50 banknotes ahead of deadline to remove them as legal tender (Source – Sky News); repeated currency cancellation is a Central Bankster technique that makes holding cash difficult long-term. Popular in Europe, but the U.S. has never done this. Not yet.

YouTube Removes Incoming Italian Prime Minister Meloni’s Passionate Speech on Family Breakdown (Source – yahoo); too may “likes” – the WEF was probably displeased.

Giorgia Meloni (Italy’s New Prime Minister): The Perfect Consumer! [2m14s] (Source – rumble); the speech; Meloni seems authentic. She spoke from her heart for two minutes, right up until she had to give a scholarly quote – then she had to search through her notes. I found that charming.

Putin speaks to massive crowd celebrating new territories (Source – RT).

India, China, Brazil Abstain From UN [Security Council] Vote Condemning Russian Annexation (Source – zerohedge); BRIC says “no problem” to annexation.

US:

Judge Orders FBI to Produce Information From Seth Rich’s Laptop (Source – ET); a blast from the past.

Stopgap Funding Bill Includes $12.3 Billion in New Ukraine Aid (Source – WSJ); Ukraine’s borders are inviolable and sacrosanct – Signed, The Uniparty; membership provided by Epstein.

Hurricane Ian ‘biggest flood event’ in southwest Florida, DeSantis says (Source – Fox).

Joy Behar: DeSantis Doesn’t Believe In Climate Change And Now His State Is Getting Hit With One Of The Worst Hurricanes (Source – realclearpolitics); does Kerry still fly private? If so, then I hold him personally responsible for this hurricane and all the damage it has caused. Because – carbon.

Zoonotic diseases like COVID-19 and monkeypox will become more common, experts say (Source – npr); Hints that the “Climate Change” WEF may have more lab-grown surprises for us, waiting in the petri dishes.

We Are in a Hybrid War -Maajid Nawaz (Source – rumble); an awesome 22-minute interview which provides chapter and verse what this last two years were all about. Maajid brings receipts, gets spiritual, talks unity and humanity vs. AI and homogenized transhumanism for power and profit.