Inflation is a big topic right now.

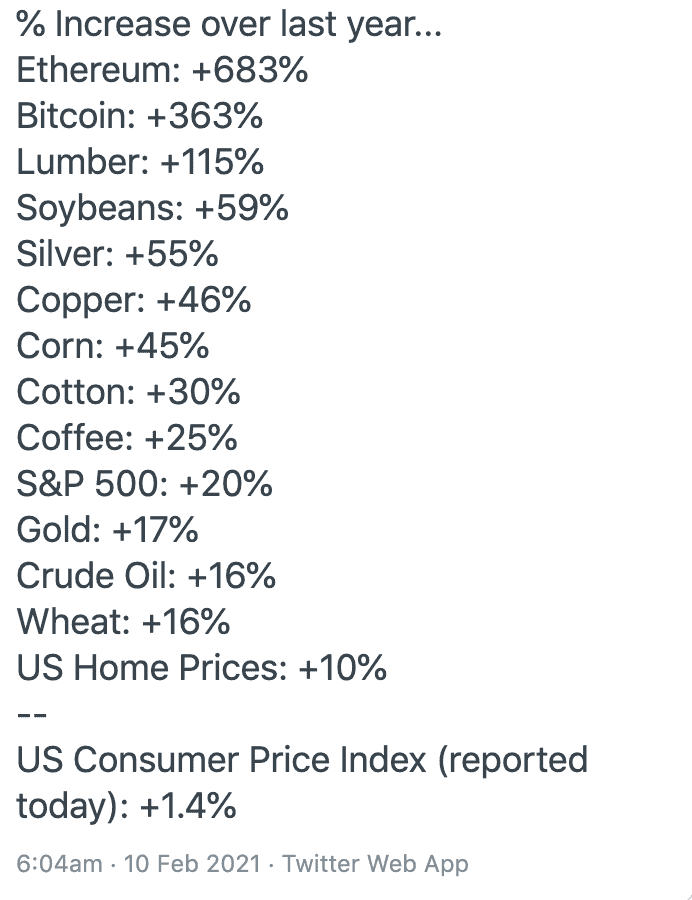

The $trillions in fresh worldwide stimulus are causing the price of nearly everything we depend on to rise sharply in price, as this chart from February shows:

(Note how both Bitcoin and Ethereum have increased a further ~50% since this chart was made just a month ago.)

Adam has had a number of excellent interviews recently with highly experienced economists, analysts and investors — like Ed Butowsky, Grant Williams, Jim Rogers, Jim Bianco, Luke Gromen, Steen Jakobsen and others — who are extremely concerned of the secular era of rising inflation they see us headed into. And these interviews contain a lot of valuable guidance about how to position your portfolio accordingly.

But I’d like to offer some guidance that everyone, regardless of net worth, can follow to help insulate their home budget against the threat of rising prices.

I offer 29 steps below — some big, some small — that my husband and I are implementing in our own life. And while these steps save money, they don’t sacrifice quality of life. No one (including me!) wants to lower their living conditions if they don’t have to.

Start by looking for hidden inflation at the grocery store

Remember when sugar came in 5 lb bags? Now that same sugar comes in a 4 lb bag but costs the same. Orange juice containers have had ounces shaved off, too.

This is an easy way for manufacturers to make up for rising costs without raising the actual sticker price at the grocery store. People don’t notice as quickly or protest as much as they would if their grocery bill suddenly shot 20% higher.

Many of those reading this may remember being taught about grocery store price tags and unit costs in math class. This is the fine print on the price tag that tells you how much you are paying per ounce or lb. This is a useful tool that I don’t think is being taught as much in the classroom. It allows you to make wiser purchase decisions at the grocery store. If you have kids, it may be a good idea to teach them this, so they develop smarter shopping habits.

Some of the items on this list are part of our household routine by now. They helped us out when we were building our small house without a bank loan.

1. Roast & grind coffee at home

We buy our coffee beans from bulk suppliers online. Coffee Bean Corral has good prices on green coffee beans in 5-132 lb bags. We typically buy 10 or 25 lbs bags and then vacuum seal the green coffee beans in quart size bags for long-term storage. Green coffee beans keep for years when sealed this way, so they are a good way to make sure you have coffee during times of shortages or financial trouble. We drink Bali Blue Moon and Mexican Chiapas most of the time. Both are certified organic and free trade. We roast it in a convection toaster oven or a cast iron pan in small batches as needed. Instead of paying $15 per lb or more, we drink some delicious coffee for half or less of that. The Bali Blue comes in at around $7 per lb after you account for the 20% loss of weight that comes from roasting. Mexican Chiapas is about $5.

If you don’t care about fancy varieties and blends, you can buy Colombian coffee beans for around $3 per lb.

2. Buy tea in bulk & use a tea ball

Years ago, I added up the cost of buying tea in boxes of 20 bags. The price was a staggering $45-$50 per lb to buy a pound of dried organic green tea in bags.

For $10 or less, you can purchase a pound of loose leaf organic green tea, or for under $15, you can get blends like Earl Gray. If you like to have a few bags of tea on the go, you can buy empty ones and fill them with your choice of tea or keep a 100 ct box of some basic tea on hand for those times.

Tea balls come in different sizes. You can get strainers that make a whole pot. If you’re a tea drinker, this is a simple thing that can save a ton of money.

Buying multiple bulk teas also offers you the opportunity to make your own blends.

3. Buy staple foods in bulk

These classic staples are much cheaper when purchased in bulk, can be used to make a wide variety of meals, and can store in your pantry for a very long time:

- Rice

- Beans

- Flour

- Cereals

- Cooking Oil

- Condiments

For guidance on how to buy and store bulks staples to create a deep pantry, read Peak Prosperity’s comprehensive Guide To Home Food Storage.

4. Grow a garden.

With organic salad greens selling for $7 per lb at the supermarket, it is not hard to see how even a small garden can cut down your grocery bill. For some tips on planning your garden, check out my PP article “Planning Your Spring Garden.”

5. Subscribe to CSA boxes or online discount produce and food boxes like Misfits Market

This winter, while our gardens were not productive, we subscribed to Misfits Market. I am happy with the quality and quantity of fruit and vegetables we received. You also get the option of adding on other healthy grocery items, including dry goods.

I pay $35 plus tax and $5.50 shipping for the base box. If I purchased everything at the grocery store that is included, I would easily pay double that. The last time I ordered the box and added dry goods and additional fruit, I spent around $112 for groceries that would have cost me $250 at my local grocery store.

6. Always look for coupons when shopping online. I can usually find a 5% or better off coupon, especially on the first purchase.

A simple search using your favorite search engine can yield a lot of coupons. I usually just search for the merchant name and put “coupon code” after it. Retailmenot.com and other sites typically yield the best codes.

7. Produce part or all of your electricity

Switching your home over to solar or other renewable energy sources is a big deal. It is simply not possible for some people because they either rent or don’t have the financial means to do it all at once. The beauty of solar power is that you can start small. Portable systems can help out those that do not own their home.

Solar power centers and panels come in a variety of sizes and price points. Over the years I’ve been sent a few of these in exchange for an honest review. Here are some that we use and recommend on our farm. I do not make any commission off recommending these products. We know that they perform well in a farm environment.

Jackery Power Centers– We have tested the 240, 500, and 1000 models. They all performed well. Matt and I gave the 240 to his parents, so they have some backup power in case of a power outage. His Dad uses it and a 50-watt panel to keep his electric bicycle batteries charged up.

Goal Zero– I have an older Yeti 400 that my Dad uses for backup power at his house. It has come in handy during winter storms. Goal Zero makes some larger units on wheels that are meant to act as a backup for an entire home. They are a good choice for people that want a system that works well right out of the box.

8. Find ways to cut down on energy costs

- Don’t leave lights on all the time.

- Consider replacing your hot water heater with an on-demand unit or turning down the thermostat. While an on-demand has upfront costs, it could save you a lot of money over time.

- Check for drafts and seal with foam insulation or caulk.

- Avoid using air conditioners until you really cannot stand it or set the thermostat to a slightly higher temperature. Even a few degrees can save you money.

- Look into solar energy programs through your power company. You may be able to get panels at a reduced cost and sell power back to the grid.

- Look for energy vampires. Televisions, speakers, and chargers can all burn some electricity even when turned off. Some people have found that using a power strip that they turn off when not in use helps a lot.

- Older appliances and electronics burn a lot more power than newer ones. My husband and I were given a used flat screen tv that was made 10 years ago. We did not use it long. It burned 10x the power of a newer model! Our older chest freezer used 5 amps of power, while the new chest freezer we bought burns a mere 1.5 amps! That really adds up over time. While I know getting rid of all your old appliances and electronics may not be realistic, please consider the energy consumption of older items if you are shopping for them used.

9. Make your own beer or wine

My husband and I have made beer for decades. It is easier if you buy a small 5-gallon kegging system. There are countless videos and websites online to help you get started. Wine takes longer to make, but there are some amazing wine kits out there, or you can make fruit wines from juice or fresh fruit if you find a good deal.

10. Get a Soda Stream or kegging system and make your seltzer and soda

Fizzy water costs a lot, and commercial sodas are usually made with high fructose corn syrup, something a lot more people are trying to avoid. We make a lot of seltzer water at home and flavor it with concentrates from Nature’s Flavors.

11. Purchase a good water filter and water filter bottle rather than buying bottled water

There are so many water filter options for your home. Brita makes attachments that go on your kitchen sink, or you can opt for a pitcher. Another option for those on the go is to buy a water filter bottle that you can refill anywhere. I used a water filter bottle in college all the time because I was used to drinking water that was not treated with chlorine or fluoride. Water filter bottles by brands like Lifestraw can also filter out environmental contaminants and bacteria that can make you sick.

12. Find creative ways to avoid food waste. Make your leftovers count.

It is incredible how much food is wasted because it is forgotten in the fridge. Soup is a good way to use up leftovers. Casseroles are another classic go-to. Pot pies are another option. A quick “leftover recipes” search online will yield a ton of different recipes to be inspired by.

13. Make your own convenience foods and freeze them for easy meals during the workweek

Below is a short list of foods that you can make ahead and freeze. You can purchase aluminum pans and other packaging from Amazon or restaurant supply companies.

- Individual or family-sized pot pies

- Meatloaf

- Pizza

- Vegetables and meat for slow cooker meals

- Baby food purees

- Stir Fry

14. Utilize a slow cooker for delicious one-pot meals that don’t use a lot of electricity or other cooking fuel.

I love using slow cookers for easy meals that I can make ahead of time. They are great for soup and cooking tougher cuts of meat. They also make it easy to cook meals in bulk that you can then eat as leftovers all week, again making your food budget stretch farther. Adam’s wife Ashley is addicted to her InstaPot pressure cooker, which yields similar results as a slow cooker but in a fraction of the time.

15. Make treats for your pets.

Have you ever added up how much you are paying per pound for pet treats? The number is shocking. If you pay $4 for an 8 oz bag, that’s $8 per lb. This means you can catch meat on sale and use it to bake treats or use a dehydrator to make snacks and save money. The ingredients you use are likely much higher quality than what pet companies are using. Dog biscuits are nothing more than some flavoring added to wheat flour and cornmeal. You can make a lot of dog biscuits on your own for just $10.

16. Consider making your dog or cat food if what you normally feed is expensive.

Consider that canned pet foods are 78% water. You’re paying for much more water than your are food.

Making your pet food is not always cheaper than buying. The only way to calculate your savings is to consider the cost of what your pet typically eats. If you’re buying dog food that costs $2 or more per lb or your pet requires a special diet, then you may be able to save some money making your own. Your veterinarian can help you plan out a home-cooked diet that is appropriate for sensitive dogs or those with health issues.

17. Buy ‘open box’ shoes

Living on a farm means going through some boots. Low quality will not hold up here. From a preparedness perspective, it’s a good idea always to have a new pair of good shoes stashed back.

Amazon Warehouse Deals often saves me $75-$100 on a good pair of boots. I keep a watch on Amazon Warehouse and regularly get shoes for a fraction of the retail cost. The boots I am wearing now are normally sold on Amazon for $130, but I paid $30.

If you’re a woman that wears a size ten or larger, try looking for men’s boots or shoes. You can find a lot of markdowns on size 8 or 9 men’s shoes in my experience.

18. Purchase a chest freezer so you can take advantage of big sales

As soon as we got electricity and a covered space on our property, we bought a chest freezer. Raising and butchering our own meat required a larger space unless we wanted to just pressure can it all. Even a smaller chest freezer can help out a lot because it allows you to stock up on meat or other foods when there is a good sale. We are ordering a lot from Instacart. When they have a good buy one get one free sale on chicken, I order 25 lbs and then repackage and freeze it. Local farms in your area may sell ¼ cow or pig shares that save you money. If that is too much meat for you at once, you might be able to find a friend or family member to split the order, so you both save.

Berries, peaches, cherries, and more are less expensive when in season. Buying a few bushels of fruit and freezing it can save a lot over buying small packs at the grocery store out of season.

19. Change your own oil if you can

If you know how to change your car’s oil on your own, you can save over 50% on each oil change. YouTube is chock full of videos to teach you how to do this if you don’t already know how.

Having the added know-how of basic auto maintenance is also a key resilience skill. Both for possible tougher times ahead, or just the run-of-the-mill caretaking of your primary form of transportation.

20. Bake your own bread

Bread is quite easy to make. I highly recommend the book “Artisan Bread in 5 Minutes a Day”. Using this method, you can mix up a batch of bread dough every week and keep it in your fridge. When you want a loaf, break off a chunk of dough, shape it, let it rise, and bake. You can also make a lot of bread at once and freeze the loaves and unthaw as needed.

21. If you read ebooks a lot, shop for used books rather than ebooks. They’re often much cheaper, and you can pass them along to others later.

I like my Kindle, but an electronic book’s cost is higher than the cost of a used copy for many titles. For newer books, the hardcover cost is often very close to the price of the ebook. Even if I have to buy a new book, I opt for the hardcover because I can resell it online, pass it along to someone else, or donate it to my local library to either put in the main circulation or sell it to raise money.

22. Start keeping a few laying hens in your backyard

Rules for chickens vary if you live in town. Many small and medium-sized towns have passed ordinances that allow for some laying hens but no roosters. One hen per household member is often enough to keep the household in fresh eggs. If you want a specific breed of hen, online hatcheries now allow for smaller orders for an additional fee. If you have neighbors or other family members that want a few chicks, a single larger order of chicks is more cost-effective.

Check out Peak Prosperity’s excellent guide “Raising Your Own Chickens” for the details of becoming a backyard chicken farmer.

23. Shop discount grocery stores for food you will use soon

When my husband and I were living in a camper and building our house, we bought a lot of food at discount stores that salvaged either damaged boxes or food that was close to expiration dates. Most of the food was high quality and organic, but it had to be eaten soon. We saved 50-70% over typical prices. Some of these types of stores you have to be careful at, particularly if they offer salvage goods. Look at expiration dates so you can make a good buying decision.

24. Look for open or damaged box deals on eBay for specialty items

I started using eBay more for everything from automotive and small engine parts to household goods during the pandemic. Now that I’m pregnant, I’ve been stocking up on baby supplies over the last few months. I recently saved over $100 on a single must-have item because the box had been opened and slightly damaged. There’s nothing wrong with buying used with many items, though you will want to avoid buying food and medical items as open box for health and sanitary reasons.

25. Split large bulk food orders with friends or family

Shipping costs can be reduced, and large food orders can become more manageable when split with friends or family. The price of staple goods can go down substantially when bought in volume. Buying 500 lbs of flour may be too much for one household, but when split with 2-3 families, it adds up to some great savings for all.

26. Use old windows or shower doors to make a cold frame

Over a decade ago, we were given some salvaged construction materials from a remodeled house. The two shower doors we received were not usable in the house we were building at the time, so my husband used them to cover a small cold frame made with concrete block sides. It is impossible to say just how many hundreds of dollars worth of vegetables we have eaten as a result. Old windows are another usable option. Some creative types make entire greenhouses out of salvaged household windows and doors.

27. Invest in perennials like fruit trees or berry bushes

Quality fruit can be expensive, especially if you are buying it out of season in the frozen section. According to Stark Bros, a single apple tree can produce over $658 of organic apples per year at $1.95 per lb. Over 16 year’s that is over $10,000 of apples! Consider columnar apple trees if you want to grow apples in a portable container. The yield is lower, but you can take them with you if you have to move.

A blueberry bush, when in full production, can produce over $100 worth of blueberries, and they are very easy to grow. You don’t need a big space — you can grow a nice-yielding blueberry bush in a large pot.

28. Do your hair at home

I was never a big fan of paying a barber/hairdresser a lot of money to do something I feel I can do myself. My husband and my father feel the same way as I do, so I take care of their haircutting needs.

And my husband cuts mine. He has learned how to do more complicated haircuts on me and I love both the savings and the personal value of the cut. In my area, haircuts cost $15-$60 depending on where you go and what extra services you want — some hairdressers will even serve you a beer in the Asheville area, but it sure adds a lot to the cost!

29. Avoid extra trips for shopping and other errands

Extra trips can really add up in a world of rising fuel costs. Consider how much extra time you are spending on all those short trips that could be used towards something that benefits your household budget more. Less time in the car is more time to garden, for example. If you work in town, try to do your shopping while you are there rather than making a separate trip on your day off. You may not feel like shopping after a long day at work, but by doing so, you will have more time on your days off for other things or just relaxing with your family from time to time.

Shopping online and picking up your order can save a lot of time and get you home faster. If you can arrange a pick-up right after you get off work, then you are going to save a ton of time, gas, and wear and tear on your vehicle over the years. Another benefit is that letting people at stores put your order together helps support jobs in your area.

What tips do you have for fighting household inflation? Please share in the comments below! Have any questions about the tips in this post? Please ask in the comments, and I will do my best to answer.