Okay, so you are worried that your

bank may be in a spot of trouble, or maybe you just want your money in

the safest bank in town. How do you pick one?

One thing you should absolutely do is obtain a $35 report from Veribanc.com

called the Blue Ribbon report. You select the report that covers the

region in which you live, and then you only consider banks on that

list.

You then cross-check the Blue Ribbon list with the Weiss Ratings (now owned by TheStreet.com), found here. I only consider banks with a B+ or higher rating to be sound in this environment.

There’s a pretty good chance you won’t find your bank on both lists, because their coverage is not universal. I feel better if the bank in question is highly rated on both systems, okay if it is highly rated in one but missing from the other, not so good if it is ranked on the Blue Ribbon report but below B+ on the other, and terrible if it is missing from the blue ribbon report and ranked below B+.

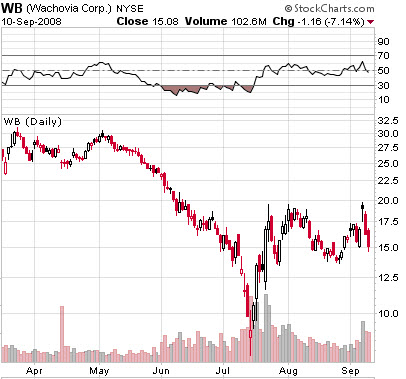

Now that you have assembled a list of candidates, it is time to go and check their stock prices. Why? Because the bank ratings are not infallible; they tend to rate based on how certain bank characteristics have fared historically (and these are unprecedented times), and the ratings are assembled relatively infrequently, meaning that if something changes for the worse, the stock price is going to be your best early indicator of health.

Here are a few banks I would most assuredly exclude, based on their stock charts. Note that I could put many, many more here…