There are lots of opinions on where the price

of oil is going. Some think that it’s headed back to $38. Some, like

the expert oil analyst ´Zapata’ George Blake, think it‘s

going much, much higher. Depending on which story you believe, your

likely actions and decisions will be (and should be) vastly different.

Better choose wisely.

I am going to repost the whole article here because it’s packed with

very important information. As always, prices are a function of supply

and demand, with excess money creation lurking underneath, creating a

bias towards higher prices.

Experts Predict Imminent Oil Squeeze

London, Apr 3 (Prensa Latina) The oil price could

hit $160 a barrel as soon as next week, says ´Zapata’ George Blake, the

Texan oil analyst quoted by the London-based online newsletter Money

Morning.

‘Zapata’ George has a habit of making bold calls that often seem to

be proved right. He thinks there’s an imminent supply squeeze ahead,

which will cause the oil price to spike.

But, first, Money Morning dispels a couple of common myths about

oil. Number one, there is a belief that demand for oil will go down in

a recession.

In the last 58 years, according to Worldwatch estimates (based on

sources such as BP and the International Energy Agency), year-on-year

demand for oil has grown every year, except for two brief periods.

Between 1973 and 1975, amidst a global energy crisis, global demand

decreased annually by a whopping 0.01 percent. And between 1979 and

1984 consumption growth levelled, the biggest annual decrease being in

79-80 – down a devastating 0.04 percent.

Thus, demand for oil will not fall by any significant amount, even if the US goes into recession.

Oil myth number two is that increased production will meet demand.

Money Morning reminds those who affirm that, where are the discoveries that will lead to new production?

The last major oil frontiers were discovered as long ago as the

late 1960s – the North Sea, the North Slopes of Alaska and Western

Siberia.

Since then, there has been some reduction in the number of

discoveries, but, more significantly, a huge reduction in their size.

In the 1960s over 500 fields were discovered; in the 1970s, over 700;

in the 1980s, 856; the 1990s, 510.

But in this decade just 65 oil fields have been discovered.

Of the 65 largest oil producing countries in the world, up to 54

have passed their peak of production and are now in decline, including

the USA in 1970/1, Indonesia in 1997, Australia in 2000, the North Sea

in 2001, and Mexico in 2004.

‘Zapata’ George points out that the extreme cold spell in February

in Alberta in Canada meant that the tar sands couldn’t be mined. One

refinery in Edmonton had no oil to refine, while the larger Strathcona

Refinery was running at significantly reduced rates due to ‘operational

problems’.

He then mentions Australia, where there are currently gasoline

shortages. BP and Shell have apologized, citing ‘constraints on

imports’, leading to ‘unprecedented level of fuel shortages’. The four

biggest oil refineries in Australia are not operational.

Meanwhile, Chinese oil demand went up by 6.5 percent in February,

and their oil imports have risen by 18.1 percent. In brief, the Chinese

are getting the oil, while Canada and Australia are going short.

Bottom line: Supply is pinched, and

demand for the #1 source of worldwide energy does not ever fall by any

appreciable amount. Meanwhile, the world’s money supply is on an

absolute tear as the global central banks lock arms and pump, pump,

pump to try and sustain the unsustainable.

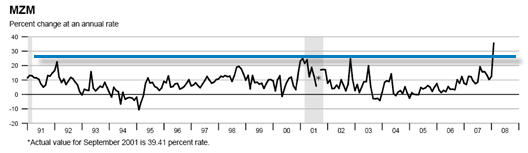

What’s going on with the US money supply? Ever since the Federal Reserve stopped reporting on M3, the most comprehensive official measure of the US money supply we’re left with is "Money

of Zero Maturity," or "MZM." Think of MZM as the summation of all the

checking, savings, and deposit accounts that are denominated in US

dollars. Check out this chart taken directly from the Federal Reserve website:

I drew the blue line on there for easy

reference. What we see is that except for the September 11th anomaly,

money supply growth is at a 17 year high. And not by just a little bit

either. By a lot.

All I have to say about this chart is ‘wow!’ Even as regular

Americans are entering foreclosure and personal bankruptcy at record

levels, those who are more directly connected to the US money spigot

are gaining wealth at the most astounding levels seen in recent memory.

That’s what this chart means…all that newly created money is going

somewhere, and it sure as heck isn’t ‘trickling down.’

Yesterday I posted about food prices going up 8% in a single three

month span. That data and the chart above are consistent with each

other. Oil prices are again heading towards record territory this

morning. That, too, is consistent. In fact, everything I can find

relating to prices of things we need, as opposed to things we want, is

consistent with the graph above. The only things that are badly out of

step are the Fed’s preferred measure of inflation (the Personal

Consumption expenditure or PCE) and the US government’s preferred

measure (the Consumer Price Index or CPI).

Or, as I like to say, reality and our official story are now so far

apart that our collective story has migrated from farce to tragedy.