Dow futures are sitting at -418, or nearly -5% from their close yesterday. SNP futures are in equally bad shape.

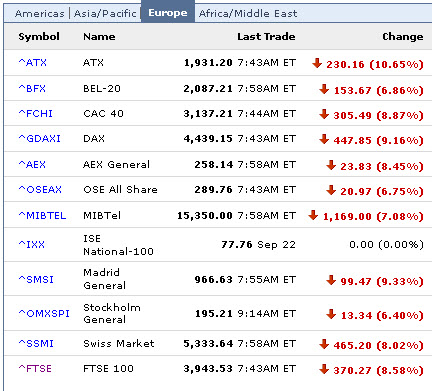

The world markets are having an even worse time of it.

I now raise the prospects of a banking holiday to being a world-wide event. I will not be even the slightest bit surprised if Monday is the beginning of a market holiday. Followed quite possibly by a banking holiday.

What I think is happening here is that a derivative nightmare, long fretted about on these pages, has finally arrived. It is impossible under current market conditions to know who is bankrupt and who is merely illiquid.

Through it all I have to give a golf clap to the central banks, who have done their very best to keep the price of gold and silver capped in an attempt to keep people from fleeing their defective paper currencies.

Rumors are swirling across Europe that the central banks/banks are considering banning the sale and/or ownership of gold. We know that physical shortages exist for retail gold and silver in the US, Canada, France, and Germany.

Some banks have already said that they do not have any more for sale…yet the "official" price comes under continued attack.

If you can find any, and have not yet gotten any, your window is rapidly closing. I checked all my favorite gold dealers here in the US and I’ve never seen such a pronounced shortage of supplies.

Good luck to the banks in their attempt to hide the ugly truth – their paper promises are built on sand and their currencies horribly mismanaged. Too many people have already figured that out and are not fooled by their attempts to suppress the price.

Consider these attempts at price suppression one last subsidy to the alert. Thanks!