While the actions of the SEC to suddenly change the rules mid-game were troubling, as were the recent Fed decisions to blatantly ignore its own charter, I am seeing something equally worrisome developing out there.

There is a breakdown between what the paper markets (futures, options, stocks, Foreign Exchange, etc) are saying is "the price" and what we are experiencing out in the real world.

Here’s one example from the gas shortages plaguing the Southeast:

[quote]The shortage began two weeks ago in Atlanta, the region’s largest city, when oil refineries on the Gulf Coast were shut down by hurricanes Gustav and Ike earlier this month.

The effects on motorists have been dramatic. Most service stations in Atlanta are out of gas, with plastic bags placed over the pumps or signs saying "out".

As a result, drivers are cruising the city hunting for gas — often with a fuel meter needle hovering close to empty. When they find gas, it’s often above $4 a gallon.

"It’s a little scary. It’s concerning. You see how fragile our whole world and economy is and how reliant we are (on oil)," Stuart Canzeri, 39, a financial planner.

A free market can address a shortage in a number of ways, including raising prices to curb demand and increasing supply, according to Hashem Dezhbakhsh, professor of economics at Emory University.[/quote]

I wholeheartedly agree with this assessment…the way a free market works is that together, supply and demand influence the prices of goods.

At least that is how it is supposed to work.

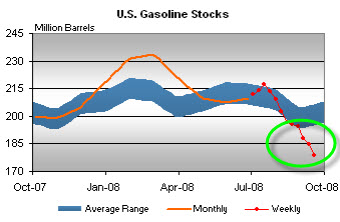

Let’s check our national supply of gasoline at the Dept. of Energy.

The blue smear undulating across that graph is the five-year average range for gasoline stocks. Well before the hurricanes ever hit, gasoline stocks began to fall pretty seriously, and are now farther below the five-year average than I have ever seen them.

This represents a severe shortage of product.

So we know we have a shortage of gas. In a free market that is functioning, we would expect to see a sharp rise in the price. Let’s check on that.

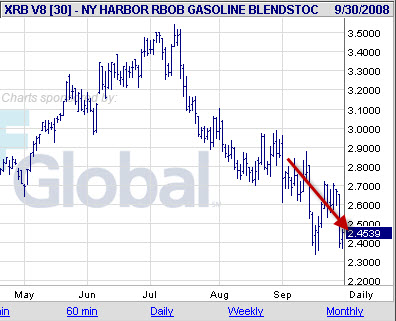

Huh. How about that? During the exact same time that gasoline stocks began their plummet to all time lows (in mid-July), price also began its harsh decent, culminating in an astounding 9% decline just yesterday alone.

What sort of ‘free market’ mechanisms can we concoct to explain this backwards supply/price behavior? Did demand drop enough to explain all this? Well, demand has dropped 3.4% from last year, but supply is down 6.6%, more than canceling that out. The only possible "free market" mechanism that makes any sense is that the free market has decided that demand is going to start dropping faster than supply, and soon.

Otherwise, we have to admit that something is broken here. We don’t know what, we can speculate about what it might be, but it doesn’t matter. A country with broken supply/demand markets is a country in trouble. It is a very serious issue, as it prevents accurate and timely information from reaching people. At this pace we could easily see a severe gasoline crisis for this country, coincident with a return to wholesale gasoline prices in the single dollar range. That’s what I’m talking about.

The same situation exists in the silver markets right now in an enormous way…the US paper markets are setting one price, while in the real world there are shortages and a very different price. Try finding retail silver in any appreciable quantity, and you’ll find your self on a long search and paying anywhere from 30% to 40% over the "official" spot price for silver. Why? A severe imbalance between price, supply, and demand.

And this is true for a lot of other commodities out there. Very strange behavior indeed.

And here’s the most mystifying of them all:

This massive move is utterly counter to everything contained in any economic textbook regarding supply and demand.

There are two possibilities here:

- The free market is speaking, and all price levels reflect all available information.

- Price levels reflect heavy interference by market-movers (governments, central banks and/or their proxies), who are attempting to set prices for key items because they don’t like, or are afraid of, the free market prices for these items.

One of these possibilities requires believing that market behavior that’s held true over thousands of years suddenly no longer applies. The other requires believing that its possible that the many known and admitted market interventions might have been extended into a few other not-as-yet-admitted areas.

Your faithful information scout,

Chris Martenson

P.S. For the record? The last time I saw such a mystifying move in gasoline prices was in September/October of 2004….also a presidential election year.