This news is from yesterday, but it bears mentioning.

[quote]From 2002 to 2007, U.S. lenders made a total of $2.5 trillion in subprime mortgages, according to the newsletter Inside Mortgage Finance. "Given the magnitude of the bad loans still on bank balance sheets, it would be miraculous for the FDIC to squeak by with losses of less than $200 billion,” Whalen says. [/quote]

The pace at which these monster cost estimates are piling up tells us that there’s a very high probability that the Federal Reserve is going to be directly monetizing debt, if they haven’t started already.

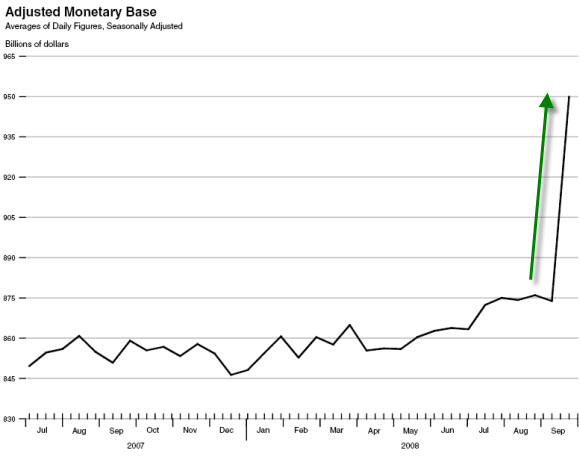

This little chart from the Fed raises the prospect that direct monetization has already begun.

This chart reveals that the Fed has been expanding the monetary reserve base of the banking system at a fabulous clip lately. Consider that it took from 1913 until August to get to $875 billion. Consider that it only took two more weeks to expand that number by nearly 10%.

I am watching this because this is the fuel of inflation. It is also the very reason Zimbabwe is where it is, and also the #1 reason that any fiat currency finally dies. Overprinting (meaning too much being created electronically for the US – physical cash and coin is not what we’re mainly talking about here).

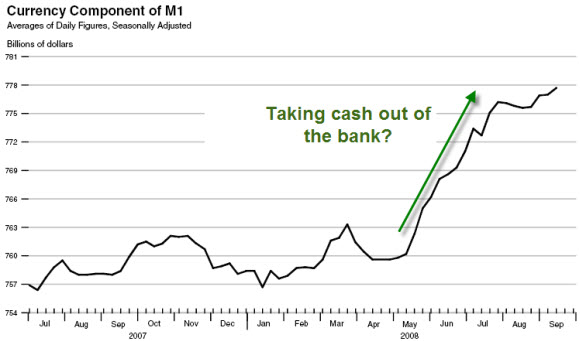

Another interesting chart from this little publication is this one. It makes me wonder how many people have been taking cash out of the bank besides me….

The race right now is about whether the Fed can create enough new cash fast enough to stave off deflation. If they are successful, then great, I guess. If they fail, it is deflation on one side (probably leading to another Even Greater Depression), and hyperinflation on the other.

Either way, everyone should be heading into this weekend with both cash and gold in their physical possession.