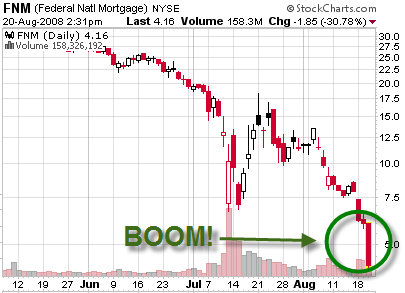

The stock of Fannie (FNM) is down -30%

as I write this. There are rumors that the CEO of FNM is headed over to

the Treasury for some ‘discussions.’ I am shocked that the US stock

market (currently up

on the day) is simply shrugging its shoulders at the complete capital

destruction of the largest financial company in the world.

I am further

shocked that the US dollar is holding up. I know that the foreign

central banks feel a bit trapped, and that they have to support the

dollar, but sooner or later it is going to sink in; the US fiscal

deficit is about to get a whole lot worse due to the taking-on of $5

trillion of FNM and FRE mortgage debt. Both the fact of the blow-up and

the apparent market responses to this are simply shocking to me.

Free

markets? No, not any more. We now have socialized markets, and we got

there without any sort of serious discussion by Congress. Note also

that, even as recently as a week ago, Hank Paulson was still (publicly)

proclaiming that it was “very unlikely” that FNM or FRE would require

any public money. Either our leadership is fantastically out of touch

with reality, or it thinks nothing of telling lies to the public. Of

the two, which is worse?

Reliving the S&L Meltdown (August 20 – WSJ)

It was the worst of times — or maybe not so bad.

Such was the tale of three conference calls. Merrill Lynch sold $30

billion of subprime mortgage-related debt to a hedge fund for 22 cents

on the dollar. Does that mean the houses underlying these debts

(assuming an improbable 100% default) are worth only one-fifth of what

owners paid for them?

Whereas Freddie Mac and Fannie Mae

avoided any big writedowns of their dodgy "Alt-A" mortgages, on grounds

they don’t need to sell these to any hedge funds and will hold them to

maturity, when they will be seen to have paid off after all.

In

effect, we are reliving the S&L crisis, with two giant S&Ls

gambling on survival with taxpayer funds while politicians summon the

will to act. Fannie and Freddie have started lending new money to

delinquents to avoid foreclosures; they’re dangling cash incentives in

front of loan servicers to delay recognition of hopeless cases.

On the one

hand, we find that a pool of mortgages sold into the open market took a

79% write-down (loss), but on the other hand we see that Fannie and

Freddie are steadfastly maintaining that their mortgages are deserving

of a 0% write-down. On the one hand, we have an open and transparent

price discovery process, and on the other we have to take word of

FNM/FRE executives at face value. In short, FNM leadership is asking us

to trust the same leadership that did not see this crisis forming,

expanded aggressively into it to reap profits, and cashed out hundreds

of millions in stock options right before the troubles started.

Further, and most eggregiously, the CEO of FNM recently gave this statement to the Washington Post:

"In 2006 and early 2007, the industry,

many analysts and market observers were generally not predicting a

downturn in the housing and credit markets to the magnitude of what has

since emerged, and outlooks for particular market segments at that time

varied significantly."

Note to Mudd (<– actual name of FNM

CEO), there were LOTS of observers who were calling for massive pain as

far back as 2004. To claim that there was some confusion as ot the

direction of the housing market even as late as 2007 is especially bad form for the CEO of a mortgage company.