FDIC shutters Silver State Bank of Nevada (Sept 5 – CNNMoney)

WASHINGTON (AP) — Regulators on Friday shut

down Silver State Bank, saying the Nevada bank failed because of losses

on soured loans, mainly in commercial real estate and land development.

It was the 11th failure this year of a federally insured bank.

Nevada regulators closed Silver State and the Federal Deposit Insurance

Corp. was appointed receiver of the bank, based in Henderson, Nev. It

had $2 billion in assets and $1.7 billion in deposits as of June 30.

The FDIC estimated its resolution will cost the deposit insurance fund between $450 million and $550 million.

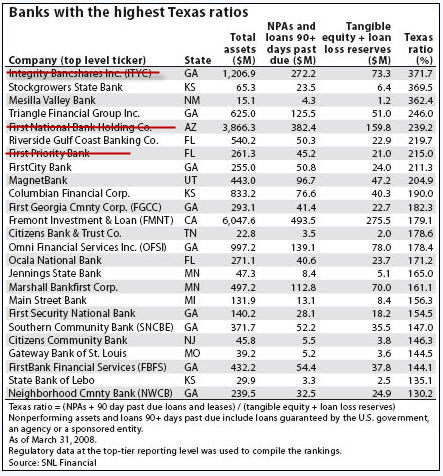

Well, there goes another half-billion of FDIC

money. Let’s check our handy Texas Ratio chart to see if Silver State

was among the worst of the worst.

Nope, wasn’t on there.