Every year, friend-of-the-site David Collum writes a detailed “Year in Review” synopsis full of keen perspective and plenty of wit. This year’s is no exception. As with past years, he has graciously selected PeakProsperity.com as the site where it will be published in full. It’s quite longer than our usual posts, but worth the time to read in full. A downloadable pdf of the full article is available here, for those who prefer to do their power-reading offline. — cheers, Adam

David B. Collum

Betty R. Miller Professor of Chemistry and Chemical Biology – Cornell University

Email: dbc6@cornell.edu – Twitter: @DavidBCollum

Introduction

“I hope David comes to his senses.”

~ Nassim Taleb (@nntaleb), best-selling author and Professor at NYU

It is that time of year again when I sit down and, in a frenzied stream of subconsciousness, bang out my view of the world. It’s my 11th chronicling of human folly and anthropogenic global idiocy (AGI).1 It’s like when Forest Gump jogs: I start writing, go on too long, and then just stop. Forty years of writing about organic chemistry has taught me that you do not understand something till you finish writing about it. Constrained by time—you can’t write an annual synopsis in May—I have made sure to sacrifice quality not length.

“Huge fan. Please continue to remain above the din.”

~ Guy Adami (@GuyAdami), trader and commentator on CNBC’s Fast Money

*I am the din, Guy.

Figure 1. An original by Candace E. Cornell (my wife) dedicated to Jeff Macke (my Bud and the Banksy of Wall Street).

There was a mad chemist named Dave

His Year In Review is the rave

With Epstein and Powell

And repos most foul

His comments are sure to be grave.

@TheLimerickKing

The writeup is a little different this year; there are fewer topics, especially on the finance side. Despite all the reading, sorting, and culling, I have little to add about Trump, impeachments, beltway politics, and swaths of the finance world. Our debts, pensions, and valuations were beyond repair last December; they have only gotten worse. The markets have been muffin-topping for too long; I am waiting for change and tired of being the Gail Dudek of the modern era. I also fought the Balrog way more than usual on a few topics just to get thumbless grasps. That pain is here for all to see.

For the newcomers, I am a non-Easter Worshipping, openly white male who vaguely remembers being heterosexual. The first section is my first-ever authorized autobiography. This is for parents who think their kids are incorrigible idiots; that won’t change, but your kids might become functional. The Table of Contents follows, allowing you to cherry pick topics.

About the Author–A Brief Autobiography

The question that I am always asked on podcasts is how does a chemist end up writing about economics and politics and why? With that said, here are some low- and high-water marks en route to the present. Think of it as my college essay, including the omnipresent dead grandparent that seems to be irresistible to high school seniors looking for a tear jerker. It’s tangential and vaguely inappropriate but free and worth every penny.

I’ve always had extracurricular stuff, been a little nuts, and located somewhere on the humor spectrum. There were plenty of sports and a smattering of school. The rest was “sex and drugs and rock and roll.” I was getting shitfaced and hitch hiking around town at 12, smoking pot at 14, and dropping acid by 15. I took a friend’s college boards to get him a Texas football scholarship with better scores than on my own. By 12th grade the drugs were in the rearview mirror. Having bagged a 3.4 GPA it was off to Cornell. Really? You can get into Cornell with a 3.4 GPA? In a word, no. Not even close. Rumors of being 1/1024th native American on my paternal grandmother’s side remain undocumented. I was a gymnast at Cornell but, having grown to a towering 6 feet, no Nike endorsements appeared. (Relatively speaking, I sucked.) The admissions mystery resolved itself decades later from my grandfather’s obituary revealing he was Vice Chancellor of the Board of Regents of New York, President of Cornell’s National Alumni Association, and member of the Cornell Council. You think that might have helped, eh? Don’t need bribes with that dossier.

A crash course in maturation—12 hours a day, 7 days a week in the library—got me another 3.4 GPA and a BS in biology. Survival skills? You betcha. Genius? Not a chance. The path, however, was tortuous. Following a one semester non-majors sophomore organic chemistry course—Yup: pre-med—I went straight into a second semester graduate-level organic chemistry course. There were a few bumps—some really big ones actually—but I survived. Taking physical chemistry for laughs but with no calculus and surrounded by engineers was problematic too. My only F on a test at Cornell was a physical chemistry test on “kinetics”, which I basically blew off being too busy trying to not flunk that organic grad course.

Recognizing that my concentration in genetics was leading me into a dying field, I used electives to take more graduate-level organic chemistry courses and then headed off to the Big Apple to study organic chemistry at Columbia. Their peachy idea was to make me take graduate level quantum mechanics—the real stuff with Bessel functions, second-order perturbation theory, and unrecognizable symbols. This time, lacking calculus transcended problematic to third-trimester fugly. An 8 on a test and a totally unearned D foreshadowed greatness. (They had to fake a pass on the now-defunct German test too.) After dodging expulsion, in cahoots with another second-year grad and brand-new assistant professor, I synthesized a molecule that was sufficiently ginormous and complex to catch the world’s attention. After completing my second year of graduate school—two friggin’ years—I was on the job market. WTF? Unsolicited interviews from Cornell and Cal Tech were particularly heady stuff for a total meatloaf. One thing was clear: I was the most overrated graduate student in the 1,000-year history of graduate education. I got my PhD in a little over two and a half years, skipped the usual two-year post-doc, and returned to Cornell at the ripe old age of 25 as the most unprepared assistant professor in history. (It was awkward running into my freshman chemistry TA—the one from whom I earned a C+— trying to finish his degree.)

Undeterred by my lack of prowess in math (polymathless) or kinetics, and never having studied anything with a metal in it, I set out to become….wait for it…an organometallic kineticist. I thought it would be fun. With considerable pride I am now a reasonably prominent organometallic kineticist, although I still can’t count to 21 without removing my shoes and dropping trow. (That joke caught me some serious flak at a meeting from angry prototypes of social justice warriors.)

As an assistant professor, I was also head gymnastics coach for two years and casual gymnast for four. I took up Taekwondo, eventually attaining the rank of 3rd dan (3rd degree black belt). The TKD team members and I loved the symbolism-rich beatings on each other. It was probably my happiest decade. After some health issues, a subsequent back surgery, and a failed comeback, my next goal was to get fat as shit and way out of shape. I was a natural. I also am now a chair professor and was director of undergraduate and graduate studies, associate chair, and department chair for four years (four years longer than I should have been), prompting many to channel Scott McNealy and ask, “What were they thinking?” I have enough scars—chicks dig scars—to guarantee I will not be a dean of any flavor. All this time my wife’s chronic health problems called on me to do waaaay more child rearing of two boys than I had bargained for. I really don’t want to hear whining about how hard it is to balance personal and professional lives. It’s fiction. If your gonads are big enough, gravity keeps you grounded through the chaos.

So now you can see that writing about politics and economics as a chemist follows the pattern. I became a financially woke boomer and hunkered down. I will retire from chemistry at either 70 or 75, identify as a 20-year-old super model, and walk the runway for Victoria’s Secret.

Contents

Trigger Warning:

This is satirical and comedic. Somebody has to get hurt. Today it may be your turn.

If you are a douche bag who cannot take a joke, remember: nobody is making you read this.

Footnotes appear as superscripts with hyperlinks in the Links section. The whole beast can be downloaded as a single PDF here or viewed in parts via the hot-linked contents as follows:

Part 1

- Introduction

- About the Author–A Brief Autobiography

- Contents

- Sources

- Creation of the Year in Review

- My Personal Year

- Investing

- Almond-Eyed Aliens and Other Conspiracy Theories

- Gold

- Bitcoin

- Modern Monetary Theory

- The Fed and Repo-Madness

- Share Buybacks

- Climate Change

- Links In Part 1

Part 2

- The Jeffrey Epstein Affair

- Thoughts on College

- Political Correctness–Collegiate Division

- Political Correctness–Adult Division

- Political Correctness–Youth Division

- Political Correctness–Corporate Division

- Civil Liberties

- Conclusion

- Acknowledgments

- Books

- Links In Part 2

Sources

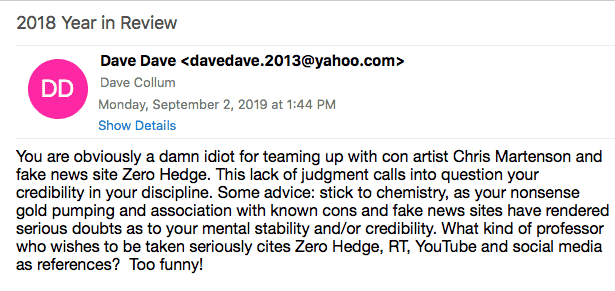

I read many blogs, but those I read religiously include mailings from Ron Griess’s The Chart Store, Jim Grant’s Interest Rate Observer, Bill Fleckenstein’s Daily Rap, Tony Greer’s daily TGMacro mailings, Grant Williams Things That Make You Go Hmmm, Automatic Earth, Jesse Felder’s blog, and selected podcasts from Grant Williams’ and Raoul Pal’s RealVisionTV. I am a huge supporter of Adam Taggart’s and Chris Martenson’s Peak Prosperity. And then there’s Zerohedge: you can love ‘em or hate ‘em, but I am a die-hard fan of Zerohedge.

“Maturing is realizing how many things don’t require your comment.”

~ @LifeTipsPage

The personalized chat board called Twitter is also amazing. For a chemist trying to snarf up wisdom outside my discipline, it is irreplaceable. Although you can follow anybody you want, it gets special when you get the double follow—you follow each other—because communication kicks up three notches. You both see each other’s Tweets, and you can direct message (chat privately). My double access to such luminaries increased in 2019 to include Bass, Hussman, Adami, Bianco, the Pomboys, McClellan, Mish, Achuthan, Hemke, Roche, and Chanos. And then there are those “holy shit” moments that are Twitter Trophy Catches:

The challenge posed by Twitter, however, is that you progress from being highly connected to hyper connected, which mutates you from a reader to a responder. I haven’t fully adapted because I’m having too much fun. Customized “lists” become imperative. Of course, there’s no shortage of people to fill your echo chamber and trolls to question your parentage.

Creation of the Year in Review

“It was either write or die for me.”

~ Michael Hastings, killed while researching corruption in the FBI

I am also asked how and why I write this beast? I wake at around 7:00 AM, make The Boss breakfast, read and open email, go to work, and camp in front of my computer doing my job and my “extracurriculars.” I am in front of a computer for 18 waking hours day, which leaves plenty of time for both work and screwing off. The weekends are no different. All year I throw notes, quotes, and links into word files kept open on all computers and drag graphics into folders. By October I have amassed up to 1500 graphics and approximately 500-600 pages that look like this:

I sort in October, write in November, and edit in December. (During crunch time it invades my work day.) By the end of November I am in the Valley of Death having amassed >120 pages of poorly written, unedited, unreferenced, and humorless text unsupported with graphics. That is my Epstein moment, but I edit my way out.

“The brightest people I have met share a superpower that would serve investors well—the ability to make inherently complex things simple and understandable.”

~ Jim O’Shaunghnessy (@jposhaughnessy), Founder, Chairman & Co-Chief Investment Officer, OSAM LLC

Why bother is a relatively subtle question that I have to answer for myself every October. Many let news events, pithy quotes, world-class wise cracks, deep thoughts, flashes of wisdom, and random musings pass them by into the void of lost memories. I try to capture and make sense of them. This is true even for the parts that reside on the cutting room floor mercifully hidden from the reader.

“I know. You get it, but let me write it anyway. I need the catharsis.”

~ Grant Williams (@ttmygh), hedge fund manager, blogger, and founder of RealVisionTV

My Personal Year

“The only thing nearly as enlightening as reading David Collum’s epic Year in Review is listening to him and Chris Martenson riff about its highlights. Strap in, grab some eggnog, and listen to this year’s recap.”

~ Seeking Alpha (@SeekingAlpha), finance blog

“You have a great voice—a combination of Andy Rooney and Albert Brooks.”

~ Mark Spiegel (@mrkbspiegel), Stanphyl Capital and “wiseguy”

I did a lot of interviews and podcasts this year, all unscripted. I’ve concluded that there is almost no topic for which I cannot muster an opinion. A record-setting seven chats with Chris Irons at Quoth the Raven (QTR) included one that lit off some fireworks (below).1–7 (It is said that those who curse are “more authentic.” Chris and I are the Real McCoys.) Phil Kennedy orchestrated three multi-participant interviews with gold bugs Dave Kranzler of Investment Research Dynamics, Bill Murphy of GATA, Rob Kirby of Kirby Analytics, Peter Hug, Mises Institute head Jeff Deist, and Bitcoin hodler Trace Mayer.8,9 A Zach Abraham interview (KYRRadio) was a planned prelude to a debate with David Andolfatto of the Saint Louis Fed that broke off at the last minute.10 (I suspect David finally realized he doesn’t share my views of the Fed.)

Other podcasts include long-time friends and confidants Jim Kunstler11 and Chris Martenson of Peak Prosperity,12 Kenneth Ameduri of Crush the Street,13 Craig Hemke of TF Metals Report,14 Jason Burack of Main Street for Wall Street,15 Elijah Johnson of Silver Doctors,16 Patrick Donohoe on Wealth Standard Podcast,17 Jason Hartman of the Creating Wealth Podcast,18 Lee Stranahan and Garland Nixon on RT’s Fault Lines,19 Kevin Muir and Patrick Ceresna on Market Huddle,20 Sam McCulloch on End of the Chain (out of Moscow),21 and the San Francisco Book Review,22 State of the Markets Podcast with Tim Price and Paul Rodriguez,23 Fergus Hodgson and Brien Lundin of the Gold Newsletter Podcast,24 Max Keiser and Stacy Herbert on RT’s Keiser Report,25 and even a local radio show.26

“One reason I quit doing interviews after years and years and years was because I was making things up.”

~ Bernie Taupin, Elton John’s lyricist

I got a bucket-list interview with Tony Greer on RealVisionTV that became “The Lost Episode”. The fully formatted 50-minute version disappeared and was replaced by a relatively content-free seven-minute version mysteriously timed with a staff change.27 It was gone until divine intervention resurrected it just weeks ago.28 Now if I can get one more—a Joe Rogan podcast—it will be off with Frodo on the boat loaded with elven chicks to a better place.

I seem to get up to my kneecaps in at least one brouhaha each year. This year I joined a flash mob that included some serious academic thought leaders like Pinkus and Petersen to keep Peter Boghossian from getting fired from Portland State.29 I also unknowingly joined forces with Donald Trump Jr. and Nigel Farage to pressure Facebook to stop blocking links to Zerohedge articles.30 Meet-ups with Tony Greer, Steve Moore, and Hootie (Figure 2) were notable. My amateur profiling of Moore detected profound concern about Kavanaugh-like hearings for his appointment to the Federal Reserve. I suggested beta blockers. He dropped out instead. Could be worse, Steve: Hootie died of West Nile Virus that night. People, not places or activities, are my bucket list.

Figure 2. Moore, Greer, and Hootie (over shoulder).

A few million bucks arriving from the National Institutes of Health for five years of research is what Wall Street calls “fuck-you money.” My record of 22 out of 23 funded Federal grants over the last three decades is satisfying given how many folks assured me I would never get funded. I published a modest 7 papers, but they are beasts. My current goal is to convince the chemistry world that after 4.5 billion years it is about God-damned time we take organosodium chemistry seriously.

I live a Utopian existence in Ithaca, the #1-ranked college town for the third year in a row.31 My colleagues are great because we work hard to avoid dickweeds [insert joke here]. Real estate is cheap: my house hangs off a 100-foot cliff looking over Cayuga Lake with a 12-minute commute to work along the lake. A potential brush with Parkinson’s disease proved to be mild “essential tremors” (the Katherine Hepburn Golden Pond thing). I did, however, convince the neurologist that I am a seriously twisted bastard.

Investing

“I fought the Fed, and the Fed won.”

Over my 40 years I’ve done pretty well despite painfully sitting out the most recent decade-long equity ‘roid rage hunkered down with gold (about 25%), laddered 2-year treasuries, and a TIAA fixed-income account paying out guaranteed 3.6% per annum. My house is too costly to not call an asset and will likely track inflation over the years when taxes and expenses are factored in.1 For me, investing is all about valuations and process. While many were selling in fear in ‘08–’09, I was buying way too timidly out of greed. I had joined the ranks of those who could not fathom that central banks would dump over $20 trillion into the system and acted on that disbelief while others rode the rip. Thousands saw the bubble and ensuing crisis in ‘08–’09, but nobody saw the interventions. The central banks clipped 5–10 years off a standard secular bear market and pulled markets off valuations that never dropped significantly below historical “fair value”. (Read that again: it is true.) I am pondering how not to repeat mistakes made in the next recession while not making even bigger ones when the Fed is shown to be impotent. I hope to buy stocks that act like real bonds—pay you to own them—because I don’t think capital gains from story stocks will be the game (see Japan).

Last year I spilled my guts providing 20 metrics showing equities were >2x over historical fair value.2 It’s only gotten worse, so go read it cause I am not gonna repeat it. What I will do is offer a plot that I created last year (Figure 3). Those blue lines represent blocks of time that the inflation-adjusted capital gains (ex-dividends, fees, taxes, and demographics) treaded water. It should scare the crap out of y’all because they are 40–75 years long. As the boomers become more and more late cycle and old enough to be carbon dated, their days of averaging into the markets are over. If you are fully invested at a secular top, your pain will follow you to the old folks home or to a van down by the river.

“Noah: How long can you tread water?”

~ God

Figure 3. Inflation-adjusted S&P capital gains. Blue arrows show time required to return to the previous secular peak for the last time (hopefully). (Chart without arrows came care of Ron Griess of The Chart Store.)

How’d I do in 2019? My clinical paranoia has largely kept me very light on equities. I missed the fake-meat bubble, and long discussions with Todd Harrison failed to get me into the pot stocks. For a while I felt stupid watching them run up 300%, but the jury started re-deliberating. (They gave it all back.) My biggest equity positions are tobacco, which disappointed in 2019 after their newly acquired vaping companies started killing people. Deja vu all over again. But here is an important point that will come in handy, maybe even profoundly important, in the future: those companies paid me huge dividends over the decades just to own them. There is a case for buying even more based on large cash flows, potentially rising dividends, and manageable debt,3 but the next big whoosh seems so close now. My faith-based pessimism means I’ll wait.

My large gold and much smaller silver positions went up 19% and 16%, respectively. Gold equities don’t interest me as levered proxies for the price of gold. I remain unconvinced they know how to generate cash flow. Fixed income returns were nominally positive but surely did not beat the real (uncooked) inflation. I am well aware that bond traders might try to scalp a trade, but low-net-worth investors should buy investments whose stated return is acceptable rather than fixed-income timeshares. That, for example, excludes 10- and 30-year treasuries in my world. I have routinely saved 20–30% of my gross salary every year but have formally started passing wealth along to the next generation. Preliminary estimates put my savings at 15% of my gross salary and overall wealth accrual at 5.7%, about 1.4 gross-salary multiples.

Almond-Eyed Aliens and Other Conspiracy Theories

“Few people are capable of expressing with equanimity opinions which differ from the prejudices of their social environment. Most people are even incapable of forming such opinions.”

~ Albert Einstein

“The only thing dumber than believing in conspiracy theories is believing in none.”

~ Nassim Taleb

Every year I denounce those who use “conspiracy theory” and “conspiracy theorist” pejoratively, but that Tweet hit a nerve.1 Chris Irons of Quoth the Raven pounced, and we did a three-hour podcast in which Chris dragged my sorry ass through every imaginable popular theory including 9/11—I’m a truther—to moon landings, false flags, and almond-eyed aliens.2 (If you were an alien who traveled across the galaxy would you make a crop circle, drill through some guy’s eyeballs, and then leave?) I listened to the interview twice and heard nothing deplorable, but something—probably the mention of the school shootings—triggered the YouTube Gestapo:

That was catnip for Chris. Out popped colorful headlines like…3

My dean must be proud. The funny part is that about a week later YouTube made some very public declarations:

“YouTube to delete thousands of accounts after it bans supremacists, conspiracy theorists, and other ‘harmful’ users.”

~ The Independent

“Without an open system, diverse and authentic voices have trouble breaking through.”

~ Susan Wojcicki, YouTube CEO inviting “offensive” content back onto the site

Don’t believe Wojcicki for a minute. YouTube’s newest rules turned the knob to 11 on the neo-Stalinist scale. The Supreme Court must align the Constitution with the digital world (before it becomes ruthless). Your honors: please stop fretting over baked cakes and revisit the interface of free speech and private corporations.

The whole affair inspired me to read Michael Shermer’s new book on the hows and whys of conspiracy theories and theorists (See “Books”)—a kind of penitence. To say my review is unflattering would be an understatement. That guy can suck my salty balls. Meanwhile, the FBI has declared “conspiracy theorists” to be “domestic terrorist threats”.4 I am way too old for Fertilizing the Tree of Liberty, but don’t push me.

Gold

“When the Trump tweet went out, I went from 93% invested to net flat, and bought a bunch of Treasuries… Gold’s not bad either”

~ Druckenmiller on Mexican trade war

”…mainstream commentators have made a point of dismissing anyone sympathetic to a gold standard as crankish or unqualified. But it is wholly legitimate, and entirely prudent, to question the infallibility of the Federal Reserve in calibrating the money supply to the needs of the economy….it’s entirely reasonable to ask whether this might be better assured by linking the supply of money and credit to gold…Central bankers, and their defenders, have proven less than omniscient.”

~ Judy Shelton, one of Trump’s possible appointments to the Federal Reserve

“I believe it would be both risk-reducing and return-enhancing to consider adding gold to one’s portfolio.”

~ Ray Dalio, Bridgewater Associates

“I maintain my call to hedge the equity risk in a portfolio with gold, since bondholders are most likely to be the victims of the next crisis.”

~ Charles Gave, founder of GaveKal

“The best trade is going to be gold…It has everything going for it in a world where rates are conceivably going to zero in the United States.”

~ Paul Tudor Jones, legendary hedge fund manager

“Here is the best thing about gold: It yields more than 11 trillion dollars’ worth of bonds. So, it’s a high yield asset.”

~ James Grant, before negative yielding bonds reached $17 trillion

“…it’s possible that we go into a recession. That would make one think that rates in the US go back toward the zero bound, and in the course of that situation, gold is going to scream.”

~ Paul Tudor Jones

“For the first time in my life, I bought gold because it is a good hedge. Supply is shrinking and that is going to have a positive impact on the price.”

~ Sam Zell, real estate mogul and the founder of Equity Group Investments

“If you want to ever own gold, the time to do it was last summer.”

~ Jeff Gundlach (@TruthGundlach), Doubline CEO

“…central banks to ease more aggressively, making gold an even more attractive asset to hold.”

~ Bill Dudley, former president of the New York Federal Reserve and ex-Goldman

If you wanna see the best bullish case for gold that I have ever seen, check out this talk by Grant Williams.1 Gold had a good but relatively uneventful year, sitting at $1250 this time last year and currently $1487 (+19%). Silver posted a more modest 16% gain (Figure 4). An 8-day winning streak was the longest since 2011. That was fun despite the end-of-year pullback. Given that the alternative hedges (bonds) offer little