The big market/economic news this week was the Consumer Price Index.

If you were pro-Grandpa, you focused on the month over month figure of 0%, which Grandpa himself gloated about; if you were anti-Grandpa, you focused on year over year, which was 8.48%. Below, find the y/y chart: it shows the worst inflation since the early 80s. The m/m number at 0% definitely showed some modest progress in controlling inflation – but it will take a dozen of these 0% months, one after the other, to tamp down the inflationary fire already burning. It is like getting a good grade on your quiz this month, after getting bad grades on your quizzes for the past 11 months. Just one good mark by itself isn’t going to fix the problem.

So, how close was the CPI measure to the real inflation rate? My favorite indicator – FRED:PPIACO – fell (m/m) by 3.15%, a very strong move down, while the y/y change fell 5.37% to 17.16%. That’s some good progress. So, I’m calling the reduction in inflation both significant and confirmed by Producer Price Index, although PPI is still up 17% y/y which is the worst since just after Nixon took us off the gold standard, so there is a lot of work still to be done. But, according to the PPI, inflation definitely did decline.

When the 0% m/m CPI news hit at 08:30 Wednesday, equities promptly shot higher in response. For the week, equities were up 3.26%, a reasonably strong move, and that was a new cycle high for equities. Crappy debt also moved higher [+1.29%], as did copper [$0.12 +3.28%]. These rallies are all indicators of “risk on.” The Grand Pivot thesis seems to be front and center, with the thought being: surely the Fed won’t raise rates any further with inflation now completely under control? Right! Currently, the futures markets aren’t quite there yet; they are projecting a 50 bp increase at the Fed meeting in September, and another 50 bp increase at the meeting in November to 3.25%. (Source) So, some optimism, but no actual Pivot just yet.

How does this match up with all the dreadful recessionary news out of Europe? Dry rivers, absurdly expensive electricity, French nuclear reactors with ratty pipes (convenient timing, that), barges that can’t transport product (see: “dry rivers”), prospects of “No Industry For You, Germany!” this winter due to projected natural gas shortages – Chris has catalogued (Source) all this stuff, and it sure looks like an approaching EuroIndustrial Götterdämmerung – the Twilight of Europe.

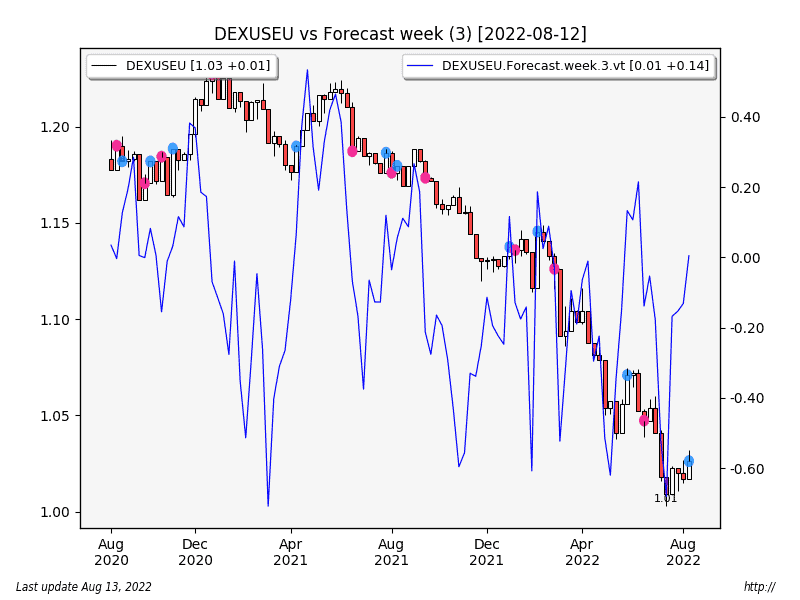

Except, the Euro actually moved slightly higher this week [+0.91%], causing the dollar to fall [-0.92%]! Was that Euro rally just due to the much-anticipated “Pivot” (any projected reduction in the pace of U.S. rate increases = a weaker dollar = a stronger Euro)? Even so, I’d think the possible impending economic disaster in Europe would encourage Big Money to flee the continent, as would usually be the case, and that theoretically should have pulled the Euro lower. Perhaps the traders haven’t noticed? I don’t really know. I tend to focus on prices, and if Big Money isn’t fleeing, maybe its not all that bad? This week’s Euro move higher was fairly minor, but it doesn’t match at all with the possible disaster we’re seeing in the fundamentals.

Here’s a possible explanation – a longshot, maybe – from Ed Dowd. Ed’s Big Money friends tend to get the news ahead of us Plebes:

https://gettr.com/post/p1m6i6ac298

Hearing rumors of cease fire in Ukraine as Russia has effectively won. Europe is [motivated] due to looming winter and Russia’s leverage with energy. Equity rally may extend a bit but this is starting to be discounted into markets.

Peace would be a game-changer. Could such an attack of common sense be happening in today’s WEF/Young Global Leader-run world? Certainly, if peace broke out, Europe would be the primary beneficiary. And the Euro would rally – like it just did – in anticipation. I don’t rate this as any sort of certainty, but, let’s call peace an early warning/possibility.

And, of course, when the Euro rallies, gold tends to move higher also. Gold actually did quite well – it gained more than I would have expected just from a modest Euro rally – up $39.70 [+2.24%] to $1,815. Silver did even better, up $0.86 [+4.31%] to $20.70. These moves feel more like the influence of “the Pivot” – the expectations of more Fed-money-printing-to-come.

In addition, we have the by-now usual weekly Biden-Handler “success” story: they continue to “successfully” drain our emergency supply of oil – the Strategic Petroleum Reserve – probably in order to attempt to stay in power by reducing the price of gasoline. At our expense. By using up our emergency reserves. Another week, another five million barrels gone. Who needs emergency “energy oxygen” – the Biden-Handlers have an election to win, and power to retain! There are 87 weeks of oil left, at this rate, until the reserve is bone dry. While we collectively own the oil, and we are also paying for their salaries and bodyguards, the Biden-Handlers definitely aren’t working for You and Me.

Speaking of oil: in spite of the Biden-Handler sucking sound coming from the SPR, crude climbed $3.08 [+3.46%] to $92.09, while gasoline (a new chart for me) rose $0.19 [+6.67%] to $3.05. Year high for gas is $4.31. The gasoline chart is from the futures contract RBOB (Reformulated Blendstock for Oxygenate Blending), named RB.V in my system. Gasoline (RB.V) is still in a downtrend, but may be bottoming out. Last month RB.V fell about 15% ($0.55); that probably explains the big drop in PPI-inflation. My new RB model appears to be working reasonably well. It doesn’t get confused as easily as some of my other models do. Are the Biden-Handlers losing control over gas prices? It’s too soon to tell, I think. Maybe.

The Fed appears to be in no hurry to shrink its balance sheet; it actually gained 4.52 billion this week to 8.88 trillion. With a lame “taper follow-through” like this, no wonder traders are enthusiastic about an upcoming Pivot.

There was a ton of news this week; FBI raids, CDC walkbacks, monster government-spending bills that pretended to reduce inflation, quintupling the number of now-gun-toting IRS agents (which are definitely not going to be targeted at the political enemies of the regime), the upcoming Winter of Difficulty in Europe, just to name a few. But this week I’m focusing on Monkeypox. Because I (maybe) had an insight. Warning: this got a little long. But the story has a fair number of moving parts…so…here goes.

“Monkeypox”:

Undervaccination Nation: Data Shows Struggling COVID Booster Effort in U.S. (Source). As of Aug. 3, only about 32% of Americans had received their first booster shot…. these figures point to a struggling vaccination program…

With supplies low, FDA authorizes plan to stretch limited monkeypox vaccine doses (Source) “Gay, bisexual and other men who have sex with men [GB/MSM] in recent history have demonstrated significant confidence in vaccines, with COVID vaccination rates that are well over 90%”

‘Like winning the lottery’: Americans struggle to get monkeypox vaccines (Source). (Note: “Americans” = GB/MSM).

The GB/MSM group is way above average-compliant in COVID vaccination. I believe that is because this group has been habituated to take medicine to deal with viral infection: there are Pharma compounds for HIV treatment, for HIV prevention, as well as a periodic testing regime in place for HIV. Mostly, they seem to trust Pharma. It has been decades since the events depicted in The Dallas Buyer’s Club – back when Fauci gave the dreadful advice that everyone who tested positive with CD4 < 500 take the unfortunate – and eventually lethal – chemo drug AZT (Source). Since those bad old days, Pharma (and Fauci?!) appear to have reformed. In general, people don’t die from AIDS these days, nor are they dying from treatment.

So, why is this important?

Well if you were Pharma-Oligarchy, and you were in the process of enduring the drip-drip-drip of a humiliating, and ever-growing vaccine disaster with the COVID-19 shots (in spite of the official “safe and effective” propaganda campaign, that 32% booster uptake rate is their current “vaccine grade”, and you wanted to re-establish “faith” in mass vaccination, what would you do?

Your trusting, highly compliant friends in GB/MSM group might be able to help. Here’s how that might work:

First, Pharma-Oligarchy could rummage around in the gain-of-function bag of tricks, locate a relatively mild disease for which they already have an approved vaccine, and then use gain-of-function on the virus so it can infect (more or less) just this Pharma-compliant population. Then they might seed the modified disease in this population at a few strategic locations, wait for it to spread, get their captured MSM to make a ton of noise, they’d order their friend Teddy at the WHO to declare a Public Health Emergency International Concern – overriding his own panel – some Young Global Leader governors in Blue states would go along, as would the Biden-Handlers, and then they’d use MSM to bully/terrify – sorry, “encourage” – their highly-compliant GB/MSM buddies into lining up for the shots. After all, the shots are just a needle-based PREP (pre-exposure prophylaxis) – or PEP (post-exposure prophylaxis) which the GB/MSM 90% Pharma-compliant community is already habituated to taking. Call it HIV, Round 2, but this time with a vaccine instead of a pile of pills.

How is it going? So far, the story is playing out pretty well. Even if only hundreds are lining up at the moment, the captured MSM can make it look and sound like millions. “There’s a shortage!” Run, don’t walk to get your Monkeypox shot!

Goal 1: a “vaccine victory.” Goal 2: if the GB/MSM crowd is scared enough, and most of them get the “life-saving” Monkeypox shot (for a disease with no deaths), they may eventually be prodded to accept a WEF-constructed “vaccine passport” – first for admission to sex parties, then gay bars, then dating apps, then eventually restaurants, gyms, stores, as well as public transit in the deep blue cities. That’s what that 90% compliance number might just get them.

There is one problem:

Monkey Pox Vaccines (Source)

About 2% of recipients had a serious adverse event

3) According to the label, between 1.3% and 2.1% of recipients had a cardiac event of special interest, compared to 0.2% of placebo subjects. According to the FDA review document, not mentioned in the label, there were 10% and 18% of subjects with troponin elevations in two sub-studies. This suggests that somewhere between 1 in 90 and 1 in 6 people will have a troponin elevation or EKG abnormality, indicating some degree of cardiac damage due to the shot.

Can Pharma-MSM get away with calling a 2% incidence of cardiac damage “rare” and “mild”? If GB/MSM falls for it, Pharma could still get that vaccine victory. That, after executing the obvious NPI: a “four week sex party ‘lockdown’ – to slow the spread” – implemented only after they get a few million shots-in-arms first, so the shots get the credit. At the same time, the antiviral medicine TPOXX, which can be used to treat Monkeypox, must be made difficult-to-get. Sorry GB/MSM, we love that you mostly vote for us, and that you comply so very nicely, but – No Treatments For You! (Source)

Then again, there’s that possible sour note: “Hey, I got heart damage!” In one out of 50. Is that “rare”? All in order to – maybe – reduce or prevent a non-lethal (but painful) rash. For which there is a treatment. In reality, Monkeypox is nothing like HIV. They aren’t even on the same continent. Will GB/MSM notice this in time? It’s hard to say. Not-so-amusingly, the Monkeypox shot also happens to worsen HIV+ patient immune systems too.

[Digression; after 35 years, and half a trillion spent on the response (Source), there is no cure yet for HIV. Just a $4,000/month payment – lifetime – for Pharma-Oligarchy’s on-patent medicine. I’m guessing insurance and/or medicare pays for most of it, but there’s probably a copay in there too. After half a trillion spent, Fauci and Pharma wouldn’t keep this medical hamster wheel running all this time on purpose. Would they?]

In the bigger picture, there are lots of variables. But my insight – and the takeaway for those outside the GB/MSM group – you probably aren’t the target. Not this time. I think this “pandemic” could just be performative. And if you do happen to be in the highly compliant group, and you get unlucky, you might consider Early Treatment. Although, Early Treatment looks about as easy to get as Ivermectin is for COVID-19 outpatients, and it is probably not quite as benign. (Source)

Perhaps doing some research ahead of time might be useful, since – as usual – the game plan seems to be dissuading doctors from prescribing Early Treatment, and by this action, maximizing the suffering of the highly compliant group so as to incentivize vaccination.

So, that’s my hypothesis: monkeypox is a search for a vaccine victory, conducted by Pharma-Oligarchy, executed on the highly-compliant GB/MSM group, and motivated by the great Omicron immune escape disaster.