The Fed raised rates by 75 basis points on Wednesday; looking forward, Powell is hawkish, and talks about maintaining a “restrictive policy for some time.” For those who want to get it from the horses mouth, and have a lot of time to kill, you can listen here (Source – FOMC/YouTube).

Wolf Richter’s take on the Fed rate increase, as well as inflation, can be summed up in one word: services. While the prices of goods due to shortages (supply chain issues, mysteriously destroyed processing plants, etc) were the initial cause for all the inflation, now inflation has migrated into services as well (Source – WolfStreet). Wolf more or less sees a repeat of the 1970s. Minus any ability to really control this outcome. And, I believe the current, mysterious “labor shortage” just adds fuel to this services-inflation too.

This week saw a massive rally in the buck; it wasn’t the biggest weekly move ever (that was an almost -5% move in October 2008), but the buck did rise 3.46 [+3.06%] to 112.96. This move marked a new 20-year high. Anyone overseas who borrowed in dollars in 2021 when Grandpa moved into 1600 Pennsylvania now is looking at a 26% increase in their loan balance. If they want to pay it off, they must raise 26% more than their original loan balance in their own currency to get out of debt. This, as the world is headed into recession. A dollar rally of this magnitude is a clear risk-off signal.

And from the other side of the pond – the Euro. This week’s plunge below parity (1.00) was relatively dramatic also; down 0.03214 [-3.21%] to 0.969. Money appears to be leaving Europe for the U.S., although I don’t want to just single out Europe, as money is leaving the UK too: GBP/USD: -0.05 [-4.76%] to 1.09. A falling currency magnifies the effects of inflation for items that have an international price, such as oil. A 5% one-week drop in the GBP/USD is not a small thing.

Equities didn’t like all the talk about more rate increases; S&P 500 (SPX) fell 4.65% on the week, with all the losses happening post-announcement. The sector map looked bearish, with sectors energy -11.29% and discretionary -7.87% leading lower, with staples and utilities doing best. Crappy debt (JNK) fell too [-2.74%], falling to a new 8-month low. Coal mine canary (JNK is chirping loudly. Risk off.

The Epoch Times had an interesting take; for them the Fed meeting was about housing:

Fed Chair Says Housing Price ‘Correction’ Would Put Market in Better Balance (Source – ET) “Federal Reserve Chairman Jerome Powell said that the U.S. housing market will probably face a reset after a period of ‘red hot’ price increases that have put home ownership out of reach for many Americans.”

I was triggered by that word “reset” in the quote. I wondered: was Powell talking about a “normal reset” for housing, or will it be a “great reset”? The 30-year mortgage rate (a weekly series; MORTGAGE30US) jumped to 6.29% as of Thursday. Each 1% increase (from 5% to 6%, for example) results in a 12% increase in monthly payment. Effectively that makes the house 12% more expensive, per percentage point increase in the mortgage rate. It looks like mortgage rates are going to continue to climb. Here comes your housing great reset!

The yield on the 10-year Treasury also broke out to a new high this week, up 24 bp to 3.69%. Bondholders are not happy, as the price of the bonds drop as the yield rises. Usually, bond yields drop when bad times arrive, because money pours into bonds from equities. Not this time.

Most commodities did poorly; silver dropped 0.47 [-2.49%], copper fell 0.17 [-5.18%], lumber -46.20 [-10.62%], crude -6.02 [-7.65%]. The miners were hammered [-5.96%, all on Friday], breaking down to a new 2-year low.

Gold actually did fairly well; while it did fall 27.90 [-1.66%] in USD, Gold/Euros climbed 26.98 [+1.60%]. So, rather than showing you a less-fun gold/USD chart, I’ll show you the more positive Gold/Euros chart instead. Gold’s drop in dollars is mostly just a currency effect.

While silver had a bad week, there was an interesting observation (Source – KWN) about an obscure thing called the “COT Report” – veteran goldbugs here know about this, but nobody else really cares. Anyhow, the interviewee pointed out that the commercial net position (net = # longs – # shorts) in silver was positive – this means the banksters (“The Commercials”) were net long silver, just last week. This is an extremely rare event – it has happened only one other time in history. In the past, a “very low” commercial net position (0 to -10,000 contracts net) has sometimes marked a low in the price of silver. Why? Well, if the well-connected banksters sniff out that a low for silver is approaching, they’ll react by increasing their longs (and covering their shorts), resulting very occasionally in a “net long” (with longs > shorts), so they’re on the “right side” of the upcoming bull move in the metal. The banksters were net long silver last week. Does this event mark the low? As I said, this has only happened one other time in history. Look at the quarterly silver chart below, to see what I mean. It isn’t a perfect indicator, but it is a pretty good one. The banksters know things that we don’t – that’s my thesis.

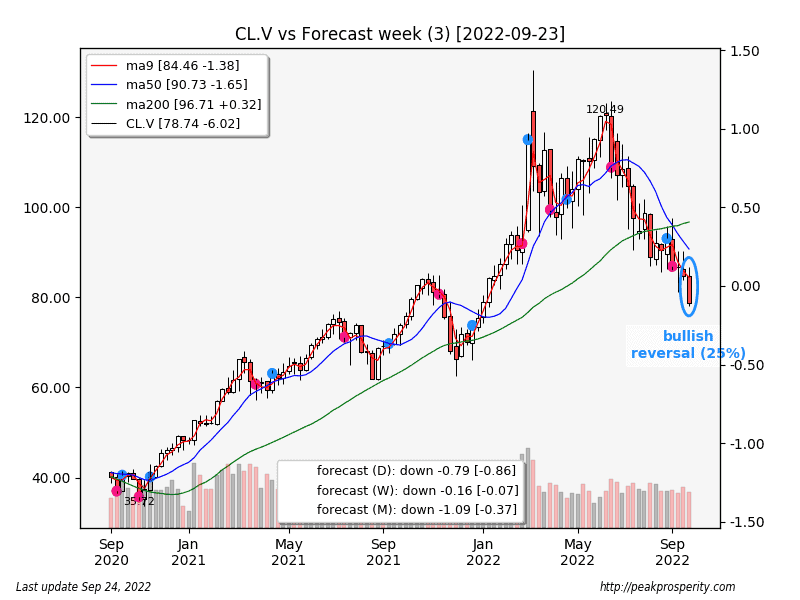

Crude fell below 80 [-6.02 -7.10% to 78.74], probably due to the monster dollar rally, the weekly Biden-Handler U.S. emergency oil pillage-and-sell operation, as well as the increased chance of a more severe recession, which will presumably hurt demand. This is the lowest oil price (in USD) since early 2022. Crude is down more than $40 from the high.

Here is the weekly review of the oil-reserve pillaging – 61 weeks left until America literally has no emergency oil remaining. Once the strategic petroleum reserve (SPR) oil is gone, during the next oil crisis (and since we are probably at or near Peak Oil, a new oil crisis could be right around the corner), the Plebes will be faced with a de facto oil-crisis-lockdown. Thinking about that, this oil-crisis-lockdown may well be one of the WEF/Biden-Handler goals of this emergency-oil-stripping exercise, to reward the rich compliant Plebes who can afford Teslas (assuming the grid stays up), while locking the poorer Plebes down.

Certainly as an emergency transport option, a small, solar-panel-charged electric vehicle would seem to be a good thing to have in the back pocket, as some members have suggested. This is just in case our 30+ year SPR is completely exhausted by the predatory WEF/Biden-Handlers prior to the next oil crisis. At least until “hydrogen” or “free energy” becomes more of a reality. But that is a story for another time.

China:

Flight tracking website shows empty sky over China amidst rumours of coup; over 9,000 flights cancelled (Source – zeenews india); “Netease, a major Chinese news portal, reported yesterday that the cancellations were primarily due to recent COVID-19 flare-ups in multiple Chinese provinces.”

Xi’s Absence From Public Eye Ahead of Third Term Bid Sets Rumors Flying (Source – ET); “By Sept. 24, Xi Jinping had become one of the top trending topics on Twitter. His name appeared on hashtags more than 42,000 times and the term “China coup” circulated 9,300 rounds on the platform.

China analyst Gordon Chang deemed a coup unlikely, pointing to the lack of supporting evidence on the ground.

“I don’t think there was a coup,” he told The Epoch Times. “Because if there were a coup, we would see, for instance, a lot of military vehicles in the center of Beijing. There have been no reports of that. Also, there probably would be a declaration of martial law that has not occurred.”

Gordon Chang: no signs & symptoms of a coup. Still, China’s Plebes are not happy. Housing is where Chinese Plebes put their life savings, as it is normally safer than China’s stock market, or China’s banks. Now, their life-savings are being obliterated by the 20+ year housing bubble pop, which they all thought could never happen. Will Engineer Xi end up paying the price? If not him, then who? This slow-motion housing crash is China’s version of a massive set of bank failures. Best of luck to China’s Plebes. The little people of every country need all the help we can get during this time.

Domestic U.S.:

A giant fire is burning at a BP refinery in Ohio (Source – NBC).

Is Joe Biden Still President? His Aides Won’t Let Him Decide China Policy (Source – 19fortyfive).

GOP to Immediately Repeal Hiring of 87,000 IRS Agents If Republicans Flip House: McCarthy (Source – ET).

FBI hero paying the price for exposing unjust ‘persecution’ of conservative Americans (Source – nypost); “[Agent] Friend says his concerns are shared by large numbers of rank-and-file FBI agents across the country who believe they are being used as pawns to pursue the political agenda of the bosses in Washington, DC.”

Military’s Recruitment Shortfall a Direct Result of Vaccine Mandate: GOP Lawmakers (Source – ET); 40% of military-age possible recruits have chosen not to be vaccinated. Why on earth would they want to join the military, where they will end up as pincushions for the WEF/Biden-Handlers?

Biden calls on Americans to ‘fight back against extreme MAGA Republicans’ just days after killing of MAGA teen (Source – postmillenial); the “extreme” MAGA teenager was (allegedly) run over following a political argument.

Poll: GOP is winning on the economy, immigration; Democrats are ahead on abortion and health care (Source – NBC); in terms of who is perceived to do better on an issue (Red vs. Blue): border (56-20), economy (47-28), immigration (46-29), abortion (25-47). In terms of what people care about (Source – Pew): top is the economy (77%), violent crime (60%); middle is immigration (48%) and climate change (40%), and the bottom is the pandemic (28%). Many more ratings are behind the links. The caring-about-pandemic rating @ 28% is probably why the pandemic is now over. What would the numbers look like if Pew and NBC were able to accurately poll the 70+ million “semi-fascist” MAGA voters?

Venezuela Empties Prisons and Sends Criminals to US Border: House Republicans (Source – ET); perhaps this helps explain the heightened voter concern about violent crime.

Alex DeGrasse Gives Analysis Of Polling Showing Potential MAGA Blowout In November (Source – Bannon); 15m video. “The most energized voter is the person who believes the election in 2020 was stolen.” The analyst projects a 74 seat switch in Congress.

Europe/Ukraine:

Bank of England hikes by 50 basis points, says UK may already be in recession (Source – CNBC); “The Bank of England voted to raise its base rate to 2.25% from 1.75% Thursday.”

Putin mobilizes more troops for Ukraine war, threatens nuclear retaliation and backs annexation of Russian-occupied land (Source – NBC); Escalation. Perhaps the WEF/Biden-Handlers have a Secret Plan to End the War? [History trivia question: did Nixon actually have a secret plan? This site (Source) says no, although…Nixon did talk about ending the war – in 1968 – but didn’t explain how he’d do it. My conclusion: the “secret plan” line (re: Nixon) appears to be a little bit snarky. Which of course I never, ever do myself, perish the thought.]

Germany nationalizes energy giant Uniper as Russia squeezes gas supplies (Source – CNBC); this was a bailout; choices were either nationalizaton or bankruptcy.

German Domestic Intelligence is Running Hundreds of Fake Right Wing Extremist Social Media Accounts (Source – RMX news); “…the opposition conservative Alternative for Germany party (AfD) is actively surveilled in certain federal states, with membership in the party the only prerequisite for agents being able to read emails and listen in on telephone calls of private citizens.” A reincarnation of East Germany?

Opinion: The political charmer who repacked Italy’s far-right (Source – CNN); the author of the CNN piece is hoping that Meloni, the likely new “far right” (non-WEFer) Italian PM, will end up being like WEFer-Technocrat Draghi. Election this weekend.

“Health”:

Pilot of Boeing flight from Novokuznetsk to St. Petersburg dies suddenly on board plane (Source – euroweeklynews).

New York judge rules COVID vaccine mandate for NYPD union members invalid (Source – Fox).

Providers: The estimated number of patients needing anticoagulants is expected to double by 2050. Learn how you can improve the use of these therapies to optimize care for your patients at this webinar: (Source – Twitter/CDC); comments on the CDC’s tweet/announcement less-than-supportive.

OTC nasal spray being tested against Covid-19 (Source – royalgazette); McCullough told us about this almost a year ago. Now that “the pandemic is over”, we’re allowed to know about nasal sprays – according to the studies I’ve read, they are very effective when properly formulated. And cheap too.

15% of American Adults Diagnosed With New Condition After COVID Vaccine, Zogby Survey Finds (Source – CHD); I missed this earth-shaker when it came out [July 27th]. “…67% of respondents received one or more COVID-19 vaccines, while 33% are unvaccinated. Furthermore, among those vaccinated, 6% received one dose, 28% received two doses, 21% received three doses, and 12% took four or more. Of those receiving a COVID-19 vaccine, 15% say they’ve been diagnosed by a medical practitioner with a new condition within a matter of weeks to several months after taking the vaccine.” 15% with a new condition = huge numbers. Check out the age skew at the article; younger people are hit the hardest. The top five conditions were:

- 21% blood clots

- 19% heart attack

- 18% liver damage

- 17% leg clots/lung clots

- 15% stroke

COVID-19 Infections Increase Risk of Long-Term Brain Problems: Strokes, Depression, Anxiety, Migraines (Source – scitechdaily); “In addition, the post-COVID brain is associated with movement disorders, from tremors and involuntary muscle contractions to epileptic seizures, balance and coordination difficulties, and hearing and vision abnormalities as well as other symptoms similar to what is experienced with Parkinson’s disease.” Spikeopathy manifesting as Parkinsons could be something else that niacin might help with; detailed review article here on niacin and Parkinson’s. A number of studies in the article. (Source – scienceofparkinsons).

Panel says US adults should get routine screening for anxiety (Source – BBC); looks like another symptom of Spikeopathy; Niacin eliminated my anxiety for literally five cents a day.

I’ve Had COVID-19. Do I Still Need the Omicron Booster? (Source – time); “That means getting booster doses even if you’ve been infected, about three months after you recover.” I have a question for “the experts”: why is that toxic Wuhan spike protein still present in the 8-mice booster? Another question: is the Omicron spike as toxic?

Long COVID Experts and Advocates Say the Government Is Ignoring ‘the Greatest Mass-Disabling Event in Human History’ (Source – time); It appears as though MSM is trying to plaster the words “Long COVID” on top of the massive number of probable vaccine injury events revealed in the Zogby poll. Good news: The Narrative has just now admitted that spikeopathy has resulted in the greatest mass-disabling event in history; some four million Americans. Spikeopathy signs and symptoms, as well as impacts, described in the Time article, include:

- “… chronic conditions including heart disease, asthma, and diabetes”

- “… exhaustion, cognitive dysfunction, neurological issues, and chronic pain”

- “Up to 4 million people in the U.S. are out of work….”

- “…abnormal immune system activity, reactivation of other viruses previously lying dormant, tiny blood clots throughout the body”

- “Those with [Long COVID] often say they feel like they’re screaming into the void, trying to get through to people who either aren’t aware of or don’t care about the condition and the possibility it could affect them.”

This is a long, detailed, modified-limited-hangout. They have no choice but to write such an article. If they don’t blame this historic 4-million-person disability-event on Long COVID, what else would people blame? They might start to blame the vaccine. Note this lines up in magnitude with that Zogby poll. Their hope: “you don’t have vaccine injury, you have Long COVID.”

Naomi Wolf Discusses The Vaccine Bioweapon And Suppression Of Harm To Women From Vaccines (Source – Bannon); according to Naomi Wolf, there has been a 30% increase in disability to women, and a 19% increase in disability to men. She asks us to “read events backwards”; events are planned and then the narrative for them is created. So reading backwards, who might benefit most by (event) disabling a large number of working-age men and women? Especially the (mandated) victims: healthcare workers, military, police, and firefighters. Perhaps a foreign power? The WEF has told us via narrative that America won’t be “the sole superpower” by 2030. Our greatest adversary, the CCP, would also be a beneficiary. And Naomi Wolf can’t help but notice that the CCP has shown no interest at all in using the mRNA vaccines, even though a Chinese company (Fosun Pharmaceuticals) now produces it. Except the CCP does seem quite happy to push the mRNA shots in Hong Kong. Just not in Beijing. It’s all very curious. Who benefits?

The huge rally in the buck came alongside selling in a large number of sectors; its hard to say that the dollar’s rise caused the sell-off, perhaps they were both caused by the same force: fear of a recession brought about by the prospect of much higher interest rates. Any thoughts of a “pivot” by the Fed seems off the table at this point.

Russia looks to be getting more serious about the war. It is really unfortunate nobody listened to … Kissinger, of all people. The ancient WEFer dealt with a previous U.S. policy disaster – Vietnam. His secret plan to end the [Vietnam] war: “declare victory, and go home.” I’m in favor. Failing a West “victory declaration”, will Russia’s next move involve a gold-backed currency? They already know how irritated the Western central banks would be if they did that. The US allegedly has 8000 tons of gold. Russia has more, and their economy is much, much smaller. More signs: the gold price is still doing reasonably well – especially when viewed in currencies other than the sharply rising USD. In addition, the well-connected banksters were net long silver last week, for only the second time in history. If gold rallies, as it definitely would if Russia went onto a gold standard, silver will rally even harder. I know, I’m long silver. But that “commercial net long” position is not something I just invented. And they typically know stuff we don’t. I am just guessing at what that might be.

There is more evidence this week that the pandemic is over. Polling data shows that few people in the U.S. care – it is lowest on the priority list for voters going into November. The “narrative energy” has switched to explaining to the 4-million people who are now disabled what caused their issue: it is “Long COVID” rather than vaccine injury. One way to describe this is a modified-limited-hangout. Another description is gaslighting by the MSM. It feels like we are in a relationship with a narcissist: “That black eye? You fell. Don’t you remember? The fall clearly affected your memory!” (Slap!) “No, I didn’t just slap you. You fell again.” Rinse, repeat.

Here’s a question: why did all the vax manufacturers design every single vaccine to use the toxic spike protein? If we “read events backwards”, who benefits from the huge amount of spike-induced damage occurring in the West? The beneficiaries of all the spikeopathy damage keeps going back to two groups: the WEF, and the CCP. Both groups want the Plebes in the West to “Own Nothing” by 2030, due to “Climate Change” (but really, Peak Oil). Pilots, the military, police, healthcare – all of our defenders, many of whom are now disabled by the mandated spike-assault. Who benefits? The disability will make an invasion of Taiwan much easier. Strategy: have your agents mandate the vax, then boost-and-boost-and-boost…and then just wait. Meanwhile your company makes the shots, and profits therefrom.

I find myself curious as to why Mr. Gates didn’t want to give free spike-vaccines (Moderna even calls its shot “SpikeVax”) to the third world. Only the West was targeted with a spike assault. China doesn’t use the mRNA spike vaxes, but Hong Kong did. And Singapore. And Taiwan. And Japan. Every place that leans “Western” had to use mRNA spike-vaxes. Was there a group that organized the West’s spike-vax response to the pandemic?

How Bill Gates and partners used their clout to control the global Covid response — with little oversight (Source – Politico).

Politico tells us right there in the headline. While the Politico article is another modified-limited-hangout – it is really campaigning for more money and power for the Pharma/CCP-controlled WHO. But it does provide names, if not the actual plan behind the pandemic operation/response.

But even with all that – I still say, focus on what you want to create. There are lots of options. And the FLCCC has treatments for the spikes. It’s helpful to remove them before they cause permanent damage. And – the WEF/CCP/Mr Gates & Friends aren’t invincible. While they have an iron grip on the MSM, the WHO, the NIH/FDA/CDC, the CIA/FBI, the UN, and the Biden-Handlers, I will leave you with this: the video summarized in this article is six minutes, and well worth watching. With all that power, the vibe in the video tells the story. What has happened with the 8-mice booster may be a metaphor for something larger. The 8-mice booster uptake: 1.3% – down from 60% at the start of 2021, to 40% for the prior booster. And now: 1.3%.

Over 98% of Eligible Americans Say NO THANKS to Updated C19 Boosters Three Weeks After Rollout (Source – vigilantfox); “I think we are reaching a cultural shift or a tipping point. Once people are no longer fearful, they start to ask questions. And once they start asking questions, the truth spills out. And once the truth spills out, oh boy… ”

Video here: (Source – Rumble/Bannon)

A tipping point. The key is: no fear. Oh boy indeed.