The buck fell this week, dropping 1.22 [-1.08%] to 111.98. Most of the damage happened on Friday. The candle print was bearish, and the buck closed back below its 9 MA – although it remains above the 50, which is where it has spent most of its time during 2022. Buck remains in an uptrend, at least for now anyway. I’d have to see a close below the 50 before I’d call it trend-change bearish.

SPX rallied strongly, up 4.74%, printing a strong swing low candle pattern, but not quite managing to return to an uptrend. Half of the gains came on Friday. The sector map was bullish: energy +7.65% led, along with tech +6.06%, while utilities +1.83% and staples +2.00% did worst. Is this “the low”? Well, crappy debt (JNK) doesn’t look nearly as good; it did rally [+1.17%] but the chart just doesn’t look nearly as nice. And Wolf has a nice piece on the FINRA Margin debt and how it continues to drop – which is usually a bearish signal (Source – Wolf). Plus – as the costs of short-term money rise, using margin debt to fund your trades is less and less rewarding. Rising short-term rates could cause equity markets to move lower due to near-automatic unwinding of some of those margin loans. Want to borrow money at 4% (3-month T-bill is 3.99%) to fund a trade? It better be a good one. The 3-month was yielding (checks notes) just 0.08% at the start of 2022. Now 3.99%. Before: $1M for a year = $800. Now $1M for a year = $39,900. OMG sell!! Rising short rates drives declining leverage.

The 10-year treasury yield rose 24 bp this week, to 4.21%. It was last yielding this much back in 2010, so this marks a 12-year high. Based on the breakout above the blue line, which happened back in July, and has done nothing but get worse. I’m gonna go out on a limb and suggest the 40 year bond bull market is now over. (Steadily falling rates = bull market for bonds; breakout in rates = that’s now over).

Here’s a chart showing yields for different treasury bond durations. See how the 1-year yield (red) jumped above the 10-year yield (blue) back in July? That’s called a yield curve inversion, and it usually happens during recessions. The odd thing? The 10-year yield has continued to scream higher, as you saw from my “breakout” chart above; it is now a full point above where it was in July.

As I said, it is a bit odd to see all the rates screaming higher right now in unison. In the past 30 years, during recessions, long rates would plunge as money raced from risk-on scary equities into the relative safety of long-duration debt (i.e. the 10 year), and the Fed dropped rates to stimulate the economy, which pushed short rates lower too. But not this time. Fed will probably raise short rates 75 bp on November 2. And so now, short rates are just screaming higher even faster than the long rates – which are themselves rising due to continuing inflation expectations. Inflation due to first energy, and now “worker shortages” in services.

It is a complicated picture; it is different this time. The 10-year treasury yield “breakout” (two charts ago) shows that the steady four decade 10-year-yield decline is probably now over. So what will that look like, going forward? Here’s my guess: the 1970s. In the chart below (the one and 10 year treasury yields 1970-1983), the blue boxes mark 1-10 inversion points, and the arrows point out rising 10-year rate periods. We care, because the 1-year is less risky than the 10-year. As a result, it should be yielding less, not more. So, inversions are important events.

So where are we today? Perhaps, six months after the blue box in 1973. Note: I don’t think history will repeat, necessarily. But it will probably rhyme. But – warning – “nothing goes to heck in a straight line.” You can see that from the 1970s chart. Last note: as in the 70s, oil (energy) is part of the trouble once again. Energy = civilization. But we must also include the “vaccinated” workforce. That’s the new wildcard that nobody is taking into account. Except Ed Dowd. Will a “workforce shortage” look like an oil embargo? I really have no clue. I have no historical case study to base this on. Are “workers = civilization” too? Probably.

Technical point: why are short duration bonds less risky? It is just math. If you own a 30-year bond with a 2% coupon, and the current 30-year yield jumps from 2% to 5%, and then you decided to sell your 2% 30-year bond for cash, think of the discount you’d have to offer to get anyone to buy your stinky 2% coupon bond. Any buyer would face 30 years of a 3% rate differential from what he could get from Treasury today. Convincing someone to buy this poopy bond would end up demanding you provide a very big discount to price. Here’s how this plays out in the real world: TLT, the long-dated (20-30 year) bond fund, has seen a 39% loss to capital from the highs back in November, 2021. And that’s due to just a rise of 2% in the 30-year yield. Takeaway: losses in long-duration “safe” bond funds can be monstrous when the long rates (10/20/30 year) are screaming higher. And – remember – this is just a 2% move. Another 2% = another 39% loss??! “But my pension fund!” Indeed. For 40 years, since 1981, buying the 20/30 year bonds have been a no-brainer money-maker. That time appears to be over.

(I’m pretty happy with the way my TLT model forecasted the decline. When the trends are strong, I think my models do a lot better. Too bad I just looked at this today! I digress.)

The weekly Strategic Petroleum Reserve pillaging continued, but at a reduced level. This week saw “only” a $300 million “release” from the SPR – that weekly campaign contribution that the Biden-Handlers execute, paid for by You and Me. Some good news: the pillaging story has totally made it into the national consciousness. The Biden-Handler MSM is saying that the pillaging is mostly no big deal (Source CNN) – mostly – while the Republicans have belatedly noticed, and are making snarky comments (Source – Epoch Times). Most significantly for us, one of the Biden-Handlers promised that they’d start refilling the SPR when price dropped sufficiently – to $67-$72/bbl – because they have just now realized that the SPR Is That Important (Source – Fox).

Two thoughts.

#1 This is what a “Public Knowledge” transition looks like. I’ve been whining about the SPR for months. Finally, people have noticed. How many people? Go to gettr, search for “strategic petroleum reserve”, and see the volume of commentary. It is an avalanche. And – cartoons:

#2 I believe the “Grand Refill-The-SPR Campaign” will start on November 9, regardless of what the price is, because the Biden-Handlers will belatedly discover – post election – Just How Important the SPR is for national defense and readiness. Because – PUTIN! No price is too high (for You and Me to pay!) in order to protect the nation from a Bad Vlad Oil Disaster! And thanks to the Uniparty, this will be Bipartisan. Just a guess, mind you.

And if this happens, this will of course cause oil prices to scream higher, but only after November 8 – which aligns nicely with the WEF agenda to reduce fossil fuel consumption and cause a Great Reset through energy deprivation that drives inflation, and middle class bankruptcy. But only after the election.

Did I mention this would only happen after the election? The Uniparty is a Big Club. And you ain’t in it (Source – YT/Carlin).

Since I’m in the cartoon zone, here is another one – on the failed Biden-Handler begging trip to Saudi Arabia. This was an act of rebellion from the Resource Colony. If I were them, I’d switch my allegiance to the CCP. Maybe that’s the plan: facilitated by “10 held by H for the Big Guy.” Perhaps the CCP bribery pays off once again? If so, I have to admire the CCP. They sure are good at bamboozling the West.

Crude fell 0.56 [-0.65%] to 85.05 this week. Crude remains in a slight uptrend right now. The open interest (OI) is telling us that the banksters really do not want to be short crude right now; this remains the lowest OI in six years, and it just continues to drop. The low OI appears to be a bullish signal directionally, but it is difficult to use this for trade timing. The OI patterns for crude looked mostly normal through about March 2022 (OI rose as price rose, OI fell as prices dropped), but then after the $120 high, the shorts mostly just fled and OI plunged regardless of peaks and valleys. Perhaps the risk managers on Wall Street received a message: there will be lower prices heading into the election, followed by a price increase that will come shortly afterwards. All us little people can do: just read the tea leaves and guess. We aren’t invited to the Biden-Handler meetings where this is all decided. I can see why Wall Street is so behind the Biden-Handlers: being plugged in to “Climate Change” policy is a money-printing machine. Its almost like the Climate Change thing is a Big Club. Which we ain’t in. Or something.

Anyhow, that OI sure has plunged, even though prices are nowhere near the lows – say of October 2020. I’m convinced that means something – and it is bullish for oil.

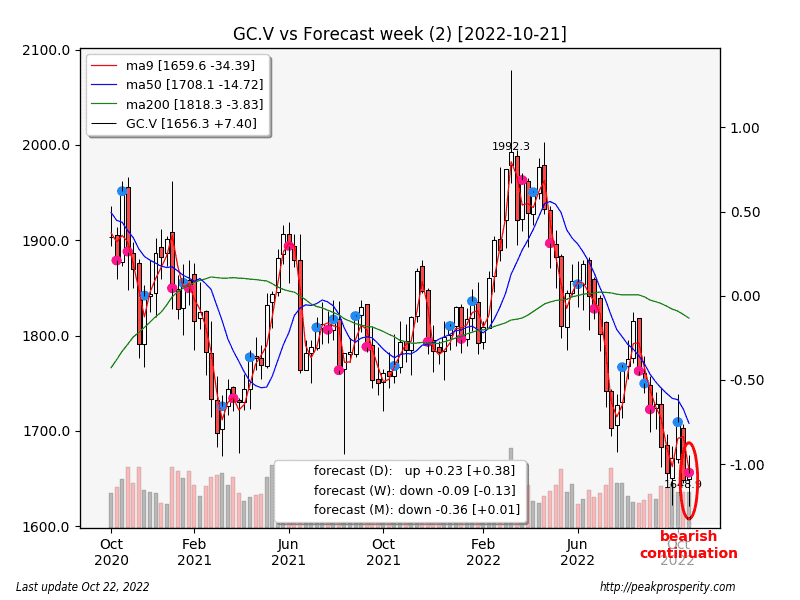

Gold mostly just chopped sideways this week, up 7.40 [+0.45%] to 1656. Gold is bouncing around its 3-year low. The metal did rally on Friday [+19.50] – most everything rallied on Friday – but that was just enough to pull gold out of a weekly loss. Gold remains in a slight downtrend. My sense with the metals: something in the system will have to break in some major way before the WEF/bankster grip on the metals prices is pried loose. This is a waypoint that has yet to arrive, and as with many complex systems, it is difficult to predict timing.

That said – silver looks healthier than gold, moving up 0.99 [+5.51%] to 19.07. While Friday was a strong day, Monday looked pretty good also. And unlike gold, silver didn’t make a new low this week. Mostly, it has been chopping sideways-t0-higher over the past few weeks. I don’t want to read too much into it, but it does look better than gold.

More bullish metal signs: GDX/Gold ratio +6.24%, GDXJ/GDX ratio +0.41%, SIL/Silver ratio +0.43%. Miners also tend to be risk signals for the metals; they drop harder during downtrends, and rise more sharply during uptrends. Generally speaking. And XAU [+7.54%] managed a weekly close above its 50 MA, for the first time since April 2022. See how XAU looks stronger than both gold and silver? I just talked myself into seeing this week in a positive light for the metals. Thanks, XAU.

Domestic:

Now six: Two more Republican committees in Alaska blast Sen. Mitch McConnell for bullying Kelly Tshibaka (Source – mustreadalaska); Turtle-Uniparty McConnell dropped $7 million into candidate Tshibaka’s opponent’s campaign. Turtle-Uniparty clearly doesn’t like the thought of losing Murkowski, but the people in the State are now starting to fight back. I’m happy that normal people have discovered the whole Uniparty con. In which Turtle-Uniparty is an important player.

Ghislaine Maxwell Breaks Silence On Her ‘Special Friendship’ With Bill Clinton (Source – conservativebrief); “Florida-based attorney Spencer Kuvin, who represents some of Epstein’s victims, said that Maxwell has until [June] 2023 to cooperate with authorities to get her free from jail quicker.” If Maxwell tattled, what percentage of the Uniparty would the Oligarchy end up losing? Boy, if that data ever leaked…

George Floyd’s daughter announces $250M lawsuit against Kanye West (Source – yahoo); Kanye (now “Ye”) West is being repeatedly spanked by the Oligarchy for his “White Lives Matter” t-shirt fashion event, and then, that hour-long interview with Tucker. This lawsuit is just one of the many recent assaults, apparently to encourage him – and others – to “stay on the plantation.” He claims to have been physically threatened for wearing the t-shirt: “you will be green-lit.” Apparently, the Oligarchy really doesn’t like it when black men (and black women) wear such garments. Picture below: CBS News. I’m guessing: “white lives matter”, worn by a black man, subtracts votes from the dutiful, Uniparty narrative-following candidates this November. To paraphrase Clinton: it’s about power, stupid. Stay on the plantation, or you will be punished. What else might Ye be saying that’s so threatening to the Oligarchy? Interview [1h] here: (Source – bitchute/kanye west).

Biden administration demands Arizona remove shipping containers in gaps along border (Source – thehill); any doubts about the open border being a deliberate act of policy?

Biden Admin Weighs Blocking Twitter Deal On ‘National Security’ Grounds… Just As Musk Wanted (Source – zerohedge); Musk probably wants a discount. But – what would happen, short term, if Oligarchy lost control of Twitter? Mind = boggled. Maybe the Handlers will allow the transaction on November 9.

PayPal facing House inquiry after $2,500 ‘misinformation’ fine controversy (Source – justthenews); The PayPal Disinformation Bureau lasted a day due to mass cancellation. CAF’s “stop feeding the tapeworm” strategy really does work. Strong reactions matter. “Montgomery Bus Boycott” = a knee right in the Oligarchy’s wallet. Trust me, knees hurt.

Energy:

French nuclear availability is currently at 51% of total capacity with 26 reactors offline for maintenance (Source – reuters); Curious how all that “maintenance” started shortly after the war in Ukraine. The Young Global Leader at work.

The Integral Fast Reactor (IFR) project (Source – steve kirsh); “Next gen nuclear power is clean, efficient, and environmentally friendly. Most of the waste products can be recycled over and over and the remaining part is short lived. Why was it killed?” Because clean, efficient, distributed, and safe electric power generation might actually address “Climate Change”, and it might also free humanity from Oligarchy control.

‘Very Difficult’: Electric Vehicle Owner Took 15 Hours to Drive 175 Miles (Source – Epoch Times); Our technocrat-planned future. Should we choose to accept it.

“health”:

Bill Gates Has Big News About Terrible Disease (Source – thestreet); I guess the monkeypox panic is over? Now, back to “polio sewage.”

Surge In Respiratory Illnesses In CT Children ‘Unprecedented’: Reports (Source – patch); pre-marketing for the upcoming Moderna mRNA RSV shot? The mRNA RSV/Flu/COVID19 shot? Is MSM all about Pharma marketing or what?

Our Third COVID Winter Is Coming. America Isn’t Ready. (Source – Time); MSM is complaining bitterly about how little the Biden-Handlers seem to care. And yet: Pfizer 2022 revs = $32 billion for the Holy Shot + $22 billion for Paxlovid. (Source – CNBC). Not Nearly Enough for some, I suspect.

REFILE-U.S. CDC advisers approve adding COVID shots to vaccine schedules (Source – yahoo). When you are deep in a hole, “experts” say you should stop digging. But not these guys. To Save the Children, we must Defund CDC. I’m not joking. Not even a little.

80 Anti-Vaccine Bills Have Been Introduced In State Legislatures (Source – technocracy news); “…experts fear the politicized backlash to the Covid-19 vaccines is already fostering skepticism about routine vaccinations generally, from childhood immunizations to flu shots.” The “technocracy” article is really unhappy, because the Holy Shot propaganda campaign – followed by all the injury and death – woke a huge number of people up. This unsurprising result is why I say the WEFer/Technocrats really aren’t that bright. They appear to be rich people, surrounded by well-paid yes-men that tell them what they want to hear. Action-reaction. Cause-effect. It’s not even a complex system. Mandate (and profit from) an action that kills and injures millions, including children, and not surprisingly this produces a strong negative reaction from the injured victims and their families. Duh. Now – finally – we are seeing consequences play out.

Alberta is deliberately erasing hospital records of vaccine injury… (Source – stevekirsh); Oligarchy Action.

New Alberta premier says unvaccinated ‘most discriminated against group’ after swearing-in (Source – CBC); “Smith also said Albertans should expect rapid changes to who is managing health care in the province. She will replace Alberta’s chief medical officer of health, Dr. Deena Hinshaw, and recruit a new team of advisers in public health that consider COVID-19 to be an endemic disease.” To start with – perhaps those hospital records won’t be erased any longer? Consequence.

One in Every 500 Small Children Who Receive the Pfizer Vaccine are Hospitalised By It, Study Finds (Source – dailyskeptic); “One in every 500 children under five years who received the Pfizer mRNA Covid vaccine were hospitalised with a vaccine injury, and one in 200 had symptoms ongoing for weeks or months afterwards, a study has found. The study published in JAMA included 7,806 children aged five or younger who were followed for an average of 91.4 days after their first Pfizer vaccination.” This was just after the FIRST shot. How many children would have been hospitalized after the second shot?

96 doctors in Quebec call for an end to vaccinating children for COVID (Source – stkirsch).

Kari Lake Harnesses Her Inner Peter McCullough and Unloads an Array of Truth Bombs Against the Jab (Source – vigilantvox); “You see these soccer players who have the healthiest hearts on the planet, and they’re dropping dead on the field — after these shots.” Kari Lake, candidate for Governor of AZ, gave a no-holds-barred 2-minute hit on Newsmax, and it could be a sign of things to come. If she becomes AZ Governor, her much-less-brave compatriots will notice and emulate – similar to how the mainstream Republicans have finally started to make the snarky comments after a year of Biden-Handler SPR pillaging. This [1m.51s] (via substack) video is a must-see.

My current guess is that the Biden-Handlers will stop the SPR draining, and then – probably – start refilling the SPR once the midterms are safely behind them. Because – duh, Climate Change. What will that higher oil price do to bonds and inflation? Look to the 1970s for the case study. Additional wildcard is the services workforce. We’ll get another update to that in two weeks – November 4 – two days after the Fed meeting. We just had a burst of 8-mouse boosters – about 21 million people. How many workers will that disable, and when? We will have to see.

Something to look forward to: when the reaction of the mainstream politicians regarding the massive amount of vaccine injury starts to look like the response to the draining of the SPR. The SPR-draining is currently “safe” for politicians to talk about, so a bunch of Republicans are dumping on the Biden-Handlers for doing so. The deadly-and-ineffective vaccines: we are absolutely not there yet. But the Kari Lake case suggests we may be just starting to see it in the distance.

Observation, related: very few politicians are leaders. Most appear to be risk-averse herd creatures. Mostly, we have to be the leaders. Of course, 99% of politicians will only “take action” when we have made it “safe” for them to do so. We are the ones that we have been waiting for. If that makes sense. WE have to make it safe for THEM to talk. That’s just how things are.

We have now moved into the “reaction” stage of the mass forced-vaccination campaign. The Oligarchy is a tiny group; they are just a bunch of rich people (along with their corrupt allies) surrounded by yes-men, and once we react, they have no hope of resistance. The size of the reaction will prevail. Case Study: Paypal. Reaction took a day; boom – no more Paypal Disinformation Bureau. And now Alberta, and Quebec doctors, and Kari Lake. The vaccine reaction is a much slower process to be sure, due to the Oligarchy’s massive censorship campaign, but I think Kari Lake is a sign of things to come. And it will just get stronger. And due to the gaslighting and repression, I suspect the intensity of this reaction is a pent up force. Who likes being gaslit every single day? “That new medical event is all in your head.” (Slap!) “You fell down again.” (Slap!) “Boy you are clumsy.” (Slap!) There are millions of Americans being gaslit like this, along with an even larger number of family members who must support them.

Kanye West’s interview on Tucker provided some fascinating insights into the techniques the Oligarchy uses to keep the influential entertainers from straying from the narrative. What would they have done to Carlin, if he were still alive today? Kanye West provides some “inside baseball” stories in his interview, which were then confirmed as true by the wave of attacks he received in the two weeks after. Note: I didn’t post the interview until after I saw that he was (reputationally and legally) assaulted multiple times for giving it. In the modern age, nothing confirms a fact like a Pfizer/Reuters “fact-check.” Nothing confirms significance like a bunch of reputational & legal assaults following a long-form interview. Example: Rogan + Malone/McCullough. First pass filter: people the Oligarchy is scared of = people that may have an important message for us to hear.

Something I say fairly often: the Oligarchy isn’t that bright. They have been so used to working behind the scenes, operating through cutouts, surrounded by yes-men, winning just about every time, tipping the scales here and there with their massive money-pot, they imagine it will work just the same – maybe even better – when scaled up by 100x. Unfortunately for them, the more aggressive the action, the stronger the reaction. But I’m thinking now this is more than stupidity.

Hypothesis of the day: Victory Disease. (Source – Wiki/archive). In war, overwhelming hubris often arises after a number of victories – the condition is termed Victory Disease. Just as the Oligarchy has been winning their corruption battles over the years, controlling the medical journals, capturing the FDA, the CDC, and the NIH, the Congress, rigging elections, controlling the medical schools, milking America for hundreds of billions per year, the U.S. Army prior to Vietnam had also won too many battles to even conceive of losing. How did that work out again?

Evidence: when the WEF told us, “You Will Own Nothing! And You Will Be Happy!” And they post the video! This, knowing that all human beings are born with the requirement for fairness – built into our DNA – that even monkeys have as part of their inner nature (Source – YT/capuchin monkeys). So, why did they go this crazy?

They just couldn’t help themselves. Like Hitler in Russia, Napoleon in Russia, America in Vietnam, Custer at the Little Bighorn, the Oligarchy has won too many “battles” to entertain the possibility of losing “the war.”

Its called Victory Disease.