There were three big economic reports this week:

- Retail Sales (RSXFS): +1.26% m/m

- Industrial Production (INDPRO): -0.11% m/m

- Producer Prices (PPIACO): -1.3% m/m

Mostly, producer prices = energy, which is down from peak. Retail sales were strong, except for clothing which was flat. Industrial production was basically flat also. I have a pair of models (INDPRO, PPIACO) and both of them are now in downtrends. Here is the INDPRO model; the blue projection line is well below zero. When INDPRO tips over, that is generally bearish for the economy.

Crude was hit hard this week, falling 8.85 [-9.95%] to 80.11. Crude fell four days out of five. My hoped-for post-election crude oil rally has totally failed to materialize. Perhaps it is all the new talk of layoffs, which (for whatever reason) the Oligarchy-owned “essential business” didn’t say much about until after the midterms had safely passed. The plunge through the 50 moving average MA was definitely a bearish signal.

Weekly pillaging of the SPR continues – four million barrels last week. Rather than stopping post-election, the drain appears to be increasing. There are 392 mbbls left, which will last us another 98 weeks. What’s the current “emergency”? Who knows. Maybe the emergency is: the U.S. remains a superpower, the Biden-Handlers are not pleased, and that requires draining our “emergency” reserves, so as to magnify the negative impact of any future oil crisis. This makes about as much sense as anything else this group is doing.

Equities inched lower, losing 0.69% on the week. Crappy debt moved lower too, dropping 0.15%. SPX may have run into resistance at its 200 MA line, much as it did a few months ago. The sector map was bearish: discretionary led lower (-2.91%) along with REITs (-1.81%), while staples (+1.55%) and utilities (+1.12%) did best. That is a mostly-classic bearish sector map. These are hints of risk off.

The buck may be putting in a low; this week it rose +0.66 [+0.62%] to 106.83. The buck spent most of the week just chopping sideways. Call the action mildly bullish. It does seem to have found support at the 200 MA. While the weekly candle print wasn’t particularly bullish, the buck did manage to end the week relatively near the highs.

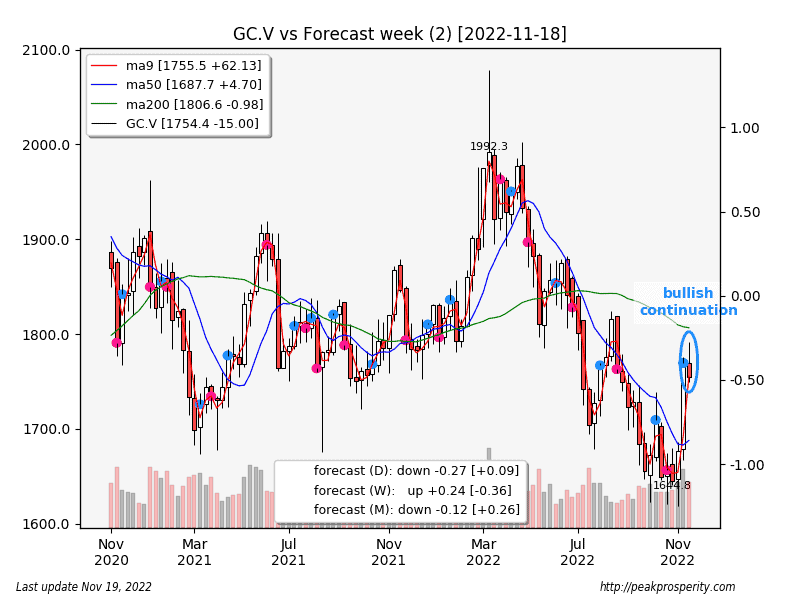

Gold fell three days out of five, ending the week off 15.00 [-0.85%] to 1754.40. Gold closed the week below the 9 MA, which is a short-term bearish signal. I suspect gold’s near-term future is tied to the dollar. One bit of good news – the banksters blew out of about 36k short contracts this week as price fell, or about 45% of the amount they’ve accumulated since the October lows. It is usually good news when the banksters close their shorts (and it also supports price), but it was a bit surprising for them to do so after just a $15 decline. Normally, they ring the cash register (and close their shorts) after a more significant drop.

More metals tea leaves: gold/silver ratio +1.89 (bearish), GDX:Gold ratio -2.52% (bearish), GDXJ:GDX ratio +0.15% (mildly bullish).

Finally, copper was crushed, dropping 0.28 [-7.19%], falling five days out of five, erasing all the gains from last week, and a little bit more. It sure looks like copper ran into resistance at the 200 MA. The candle print was bearish; maybe Dr Copper didn’t like what he saw with all those layoffs. “I diagnose an impending recession.” Maybe. Some of the price moves started during Asia trading times, but not all of them did. China does seem to be tamping down at least some of the Zero COVID nonsense, but the mildly positive news didn’t seem to be enough to stop the plunge.

U.S. home prices appear to have topped out, but houses remain expensive. While number of sales have plunged, the prices really have not (Source – Wolf Street). The 30-year mortgage is at 6.6%, down off the highs. My sense: any “housing price recession” is at the very start, rather than near the end. Perhaps sellers right now are just hoping for the Fed to stop raising rates, and bring back the good old days of the bidding wars from six months ago. Recency bias. Remember that from mid-2006? The goal: You’ll Own Nothing.

Taken together, the drops in both copper and crude reinforces the “recession” hints from my INDPRO and PPIACO models, and the recent Oligarchy-owned “essential business” layoffs.

So, is that Zero Covid thing in China almost over? I continue to hear rumors that the local party officials aren’t locking down cities nearly as severely as in the past months, as well as some hints of protests (Source – ET). Perhaps it will be a slow retreat. I still think Zero Covid might have infected the minds of the Chinese Communist Party possibly via a Comprehensive National Power (CNP) calculation (Source – infogalactic).

Related: here’s a chart on China’s birth and death situation (Source – axios), which I suspect feeds into China’s CNP calculation. Perhaps all the studies on the drop in testosterone, plunging sperm count (Source – CHD), post C19 erectile disfunction (Source – Study) got the CCP’s attention, and lies near the heart of “Zero Covid”. Given the property bubble pop, the demographic cliff, peaking oil production, and the non-fondness for immigration into China, they really are right on the edge of a massive plunge in CNP. People get promoted for raising China’s CNP. People get spanked when it drops. Or so I hear. Does the chart below look good? No. China is turning into Japan. Now, add in COVID and nationwide spike protein shots for all the little people => not nearly enough babies. Just a hypothesis.

“Health”:

G20 Pushes Vaccine Passports For All Future International Travel (Source – zerohedge); criminals, when caught, always double down. That’s what this is.

Hypocrite Elites and Globalists Dine on Wagyu Beef During G20 Summit While They Push Bugs and Fake Meat on Peasants (Source – gatewaypundit); wagyu tenderloin for me, bugs for thee. Climate Change!

American Academy of Pediatrics urges Biden administration to declare emergency over ‘unprecedented’ RSV surge (Source – Fox); my guess: once the “RSV emergency” is declared, which should happen shortly, the plan is to deploy a poorly-tested, EUA mRNA/RSV shot. And then try to mandate it, of course. Pharma-criminals and their government-shills, doubling down once again.

Diagnosing and Managing Influenza and Respiratory Syncytial Virus (RSV) Infections in Adults (Source – FLCCC); RSV is actually a thing. This article includes signs and symptoms, along with the FLCCC treatment list: Naso-Oropharyngeal hygiene, Elderberry, Vitamin C, Nitazoxanide, Ivermectin, Zinc, N-acetylcysteine, sunlight and photobiomodulation, Melatonin. Not recommended: Tamiflu. Historically, sunlight was shockingly effective, reducing hospital mortality in the 1918 influenza pandemic by 75%. Video here (Source – flccc). “Sadly”, no on-patent substances in the list.

Overseas:

Lagarde Says ‘Mild Recession’ Won’t Tame Inflation: ECB Update (Source – bloomberg); old article, from 11/03, but reinforces a global “recession on the way.”

Former Trump advisor: Biden admin has no end goal for Ukraine war (Source – JTN); “You’ll hear the Chairman of the Joint Chiefs, General Milley saying he wants to negotiate. Then we hear from the National Security Council that we don’t want to negotiate. So, there’s friction within the administration.” Biden-Handlers in a state of chaos?

Ukraine Has Lost 40% Of Energy System As Kyiv Sees First Snow, Freezing Temps (Source – ZH); General Winter has arrived, along with the destruction of almost half the power grid. Perhaps that’s why we saw the Ukranian false flag “missile” operation, trying to start WWIII. Once the newly mobilized Russian Army appears…and the rest of the power grid is taken out (the transformers are very difficult to replace)…then what?

Domestic:

Disgraced cryptocurrency exchange FTX founder and Democrat super donor Sam Bankman-Fried lent $1 billion to himself through his hedge fund Alameda Research, which likely sourced the money from FTX customer funds (Source – breitbart); can I borrow a billion dollars too? Maybe Hunter can help.

Day After 1,200 Twitter Employees Resign, Elon Musk’s SOS To Engineers [Elon Musk asked software engineers to fly to San Francisco and be at the Twitter office in person.] (Source – ntv); When I worked in the valley, and in San Francisco, I went to the office every single blessed workday. Crazy, huh?

Misinformation threatens Twitter’s function as a public safety tool (Source – NPR); Oligarchy panic marker via MSM re Twitter. This is just one of many.

We’re back. Let that sink in (Source – twtr/babylonbee); mocking the Oligarchy’s narrative is the threat.

You’re welcome (Source – twtr/musk/AOC); Musk vs. AOC – not a fair fight. Woke just isn’t funny, nor is it smart.

GOP House Opens Probe into Biden Family for Potential Tax Evasion, Money Laundering, Human Trafficking Violations (Source – breitbart); Uniparty-performative, or for real?

Dozens of court docs relating to eight of pedophile Jeffrey Epstein’s associates – including billionaire hotel magnate and female Brit – will be UNSEALED after judge rules public interest outweighs right to privacy (Source – DailyMail); could be a big deal – if it happens.

“In order to make America great and glorious again I am tonight announcing my candidacy for President of the United States,” Trump said. (Source – ET); ignored entirely by Uniparty Media.

It turns out, RSV is a thing. But the remedy? The contrast between criminal-Pharma and the FLCCC could not be more stark. I suspect that the criminals seek to force-vaccinate everyone (“its an RSV EMERGENCY!”) allegedly to “save Baby”, while the FLCCC empowers by providing signs and symptoms, as well as a list of compounds that have evidence of efficacy. Which future will we select?

Twitter’s near-term outcome is still up in the air. Code reviews are in progress, lots of twitterites have been fired and/or quit, the situation is quite fluid, but the wave of negative commentary from MSM gives me hope. Is forcing employees to actually show up for work tyrannical? Not so much.

Bad Orange is back. The media is trying really hard to pretend he no longer exists. This tells me he’s a mortal threat to our Hybrid War opponents. I mean, I could wish for someone more perfect, but – they really hate him. And our opponents appear to want us all dead. Or impoverished and locked down, in a pod, eating bugs, being force-vaccinated every few months for “whatever”, with declining sperm counts, falling testosterone, surviving on basic income delivered by CBDC, while playing meta – because “Climate Change.” I’ll take the Bad Orange option. If the MSM gave off the same fear signals about DeSantis, I’d focus on him. For whatever reason, they just don’t.

I believe there is an outside chance the Ukraine war ends within the next month or so. The arrival of General Winter, plus 300,000 mobilized Russian soldiers, plus a destroyed electric grid is the possible mechanism of action. Milley hinting at negotiation could be a tell. But, as usual, the MSM will tell us we are “winning the war” in Ukraine (c.f. “the Ghost of Kiev!!”) right up until the helicopters are called in to evac our people from the rooftops. If it plays out this way, I claim this disaster will mark yet another low for “trust in media”. They just can’t stop themselves from lying. This seemingly irresistable impulse towards reputational self-destruction is a key component of the Fourth Turning. Same behavior is evident from Pharma, their shills in government, and the Climate Changers too. They just can’t help it. It is just who they are.