The year 1971 saw the trajectories of nearly every major trend relative to our way of life shift massively.

That year is such a noticeable inflection point in so many data sets, that an intriguing website WTFHappenedIn1971.com has been created to drive the point home.

The website is a parade of data series visually showing how the world changed that year.

Be it income…

…the cost of living…

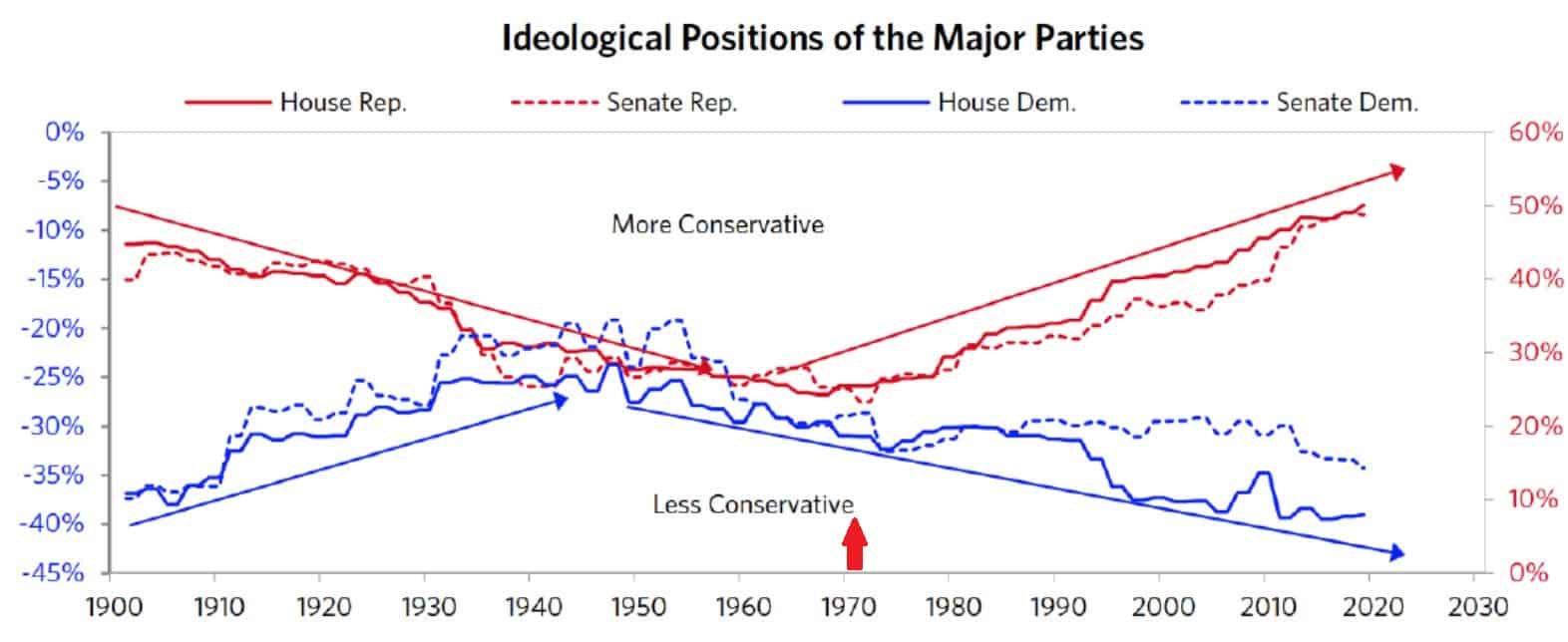

….political polarization…

… the divorce rate…

…and a kitchen sink’s worth of other statistics — from the national debt to deficit spending, childhood obesity, the incarceration rate, energy use per capita — pretty much all aspects of life as we know it changed materially and permanently in the early 1970s.

This week’s guest experts, Ben Prentice and Collin, founders of WTFHappenedIn1971.com, explain how virtually all of these changes are a direct or indirect result of the monetary system “breaking” that year with the Nixon Shock and the end of the Bretton Woods System.

On a personal note, interviewing Ben and Collin was an unexpected pleasure, as I found it encouraging to discover that members of the Millennial generation are engaging with the shortcomings of our modern debt-based fiat currency system with the same passion and critical thinking as we older cohorts. Perhaps the future might just turn out OK in their hands after all…

That said, Ben and Collin echo similar concerns and advice as our previous experts. The system is unfair, unsustainable, and in desperate need of reform. The prudent investor shouldn’t expect any real positive change until a painful enough shock forces an abandonment of the status quo — so it’s best to use the time now to position prudently in advance for that inevitability:

<<

Anyone interested in scheduling a free consultation and portfolio review with Mike Preston and John Llodra and their team at New Harbor Financial can do so by clicking here.

And if you’re one of the many readers brand new to Peak Prosperity over the past few months, we strongly urge you get your financial situation in order in parallel with your ongoing physical coronavirus preparations.

We recommend you do so in partnership with a professional financial advisor who understands the macro risks to the market that we discuss on this website. If you’ve already got one, great.

But if not, consider talking to the team at New Harbor. We’ve set up this ‘free consultation’ relationship with them to help folks exactly like you.