Hang on, it’s going to be a bumpy ride.

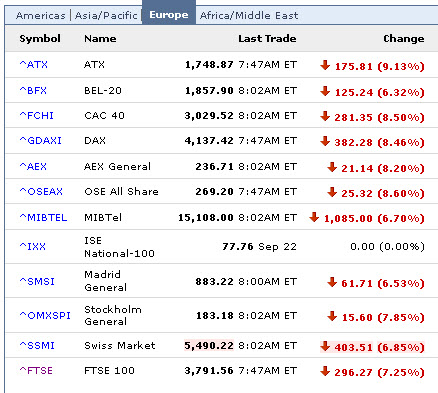

Last night global markets sold off more than 10% in a few spots in Asia (Korea & India) and are down between 7% and 8% in Europe.

Here in the US, our stock futures are "Lock Limit Down," meaning that automatic circuit breakers have tripped, preventing any further trading.

If the US markets are not rescued (or closed) and do not sell off by a similar amount, we are looking at a loss of between 500 and 700 points on the Dow.

We have clearly hit "phase II" of this crisis. We are witnessing the violent deleveraging of more than a decade of failed risk modeling and extravagant borrowing.

There are black box computer programs melting down in trading centers all over the globe as their fancy MIT programmers never anticipated a "3 sigma" event. A fat tail has arrived and swept across their trading platforms, destroying assumptions and wealth.

Gold and silver sold off as well last night, but I have never felt better about owning both. I know several relatively wealthy people in the US who have been attempting to buy both in size and they are on waiting lists.

What this tells me is that the world of paper wealth – all of it – is no longer sending appropriate pricing signals. That world is breaking down. I expect several decades of mistrust in all things paper to result from this mess.

Deflation is now firmly in control, and the central banks (assuming they wanted to prevent this) are not.

At any rate, take a deep breath, this too shall pass. Or, rather, we will find a new equilibrium, probably a lower one, and live there for a while before starting the next leg.

More to follow….