Monday, October 6, 2008

My belief is that massive, unprecedented change is coming.

No, I believe that it is already underway. When the dust settles in one, five, or twenty years, the economic landscape will be utterly changed.

Another belief I hold is that by taking steps now, both small and large, you can significantly minimize disruptions in your life that so many others will experience. While we will all end up in the same place in twenty years, I want your path to be as gentle as possible. By undergoing voluntary change, you will have more opportunities to shape your path than those who find change involuntarily forced on them. Where others will someday reach a cliff face that needs to be scaled all at once, my goal is to walk with you up the side trail. Each Martenson Report is designed to reinforce the lessons of the Crash Course, with my goal being to help you navigate the changes ahead.

Beliefs

It all begins with beliefs. I created the Crash Course to provide all the intellectual evidence anyone could possibly need, laid out like an air-tight prosecution with the following conclusion: The next twenty years will be unlike the last twenty years. But if your underlying beliefs are in opposition to this message, you may find yourself taking no actions at all. Examples of such beliefs might be:

- “Technology will arise that will blunt or maybe even reverse the impact of Peak Oil”. If this is one of your core beliefs, then it won’t really matter how well I lay out the case that Peak Oil is not only real, but frighteningly near. So you won’t take any actions. You’ll continue to live at drivable distances from where you work and play, and you won’t bother to bolster your food security or maneuver your portfolio holdings away from exposed industries and companies or do anything else.

- “This is just a normal recession – we’ve faced them before, and they don’t last that long.” If you hold this belief, then you are open to the typical broker’s suggestion that the best strategy is to “buy and hold for the long-term.” You might also be tempted to tune out all the current market information as “noise” that provides no value to your understanding and is probably harmful in its potential to alter your outlook.

So, it can be said that beliefs drive our actions. Somebody else said it even better:

Your beliefs become your thoughts

Your thoughts become your words

Your words become your actions

Your actions become your habits

Your habits become your values

Your values become your destiny

~ Mahatma Gandhi

So I structured the Crash Course specifically to enable you to open up your beliefs to examination. Not because I have any particular assessment or judgment about whether you hold the “right ones” or the “wrong ones,” because I don’t. I did this because at key turning points, such as the one we are at right now, it is vitally important that you know what your beliefs are, so that you can be aware of the ways in which they are guiding, enhancing, or inhibiting your actions. It is a dead certainty that at a major point of change, most people will be holding limiting beliefs rooted in the status quo, while a smaller number of people will hold enhancing beliefs providing them with greater opportunities to take advantage of the changes when they arrive.

The Martenson Report

My weekly, and often daily, writings are designed to continue to expose the fact that the very change we are talking about is right here, it’s right now, and it’s massive. I seek to continually reinforce the notion that the past is gone and it’s not coming back, and that a new future is upon us. The breadth and depth of these changes literally touch every single support system and every political and corporate institution in existence. The possible range of ways to prepare is nearly infinite, requiring that we carefully and strategically sort them into smaller groupings that we can actually do something about. Because we can’t possibly prepare in every possible way, we need to have a brutally efficient means of prioritizing our actions into the ones that provide the most potential protection or return for the least investment of time and/or money.

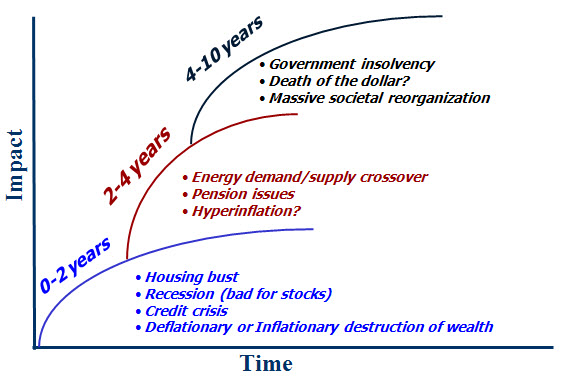

Because of this, I write The Martenson Report with three specific “Horizons” in mind as crudely depicted below.

I break my own thinking into three specific horizons spanning just a few years each and I “bucket” all the possible risks and events that I care to focus on into those three segments of time.

While it’s never too soon to begin to modify one’s actions in response to any major change, even if it’s 10 years out, it pays to begin with those elements that are closest and will have the most impact.

For example, I have mainly kept the Martenson Reports geared towards the first Horizon because that’s where I think most people have the most work to do, because it has the most immediate challenges, and because, as challenging as they are, we can get our minds around these changes. The Horizon II & III changes are big, hairy, and scary. Adapting to them will require lots of lead time and you should have them on your radar screen. However, I would council that you attend to Horizon I stuff before you put too much aggressive action towards the Horizon II and III stuff. Naturally, if you were going to make a big move anyway, perhaps sell a house and move somewhere, or buy a car, you should definitely put on your long-term thinking cap on and let those Horizon II and III possibilities inform your decision-making processes.

What do I do first?

Even within any given Horizon, we need to further prioritize our actions. Let’s break them into three tiers. Tier I actions should always be initiated (and preferably completed) before starting on any Tier II actions, which should themselves precede any Tier III actions.

Tier I >> Tier II >> Tier III

Here’s an example. Let’s assume for the purposes of this discussion that you hold the personal view that there’s a risk, a chance, a possibility, that the US banking system could be forced to go “on holiday” at some point over the next year. Let’s give it some really outrageously high chance, like 33%. That is, a one-in-three chance that US banks could get shut down for a period of time, perhaps for a week or more at some point over the next year. What should you do?

My advice would be to consider all of the most likely things that could happen that you could easily remedy at low or no cost before moving on to harder stuff. Here is a simplified example, with only one item in each “tier”, of actions that you might take:

Tier I: Have some cash out of the bank, so that you can continue to buy things and operate even if your personal bank is not open, your ATM card does not work, and your credit card is inoperative. Cost? Whatever the lost interest would be, plus having to worry about how to safely store this money. Potential benefit? The ability to conduct your life relatively unhindered if the banks close down.

Tier II: Move money from distant, possibly unsafe banking/brokerage accounts to safer banks. This is important to do, but not as critical as getting a supply of cash on hand for emergencies. So you should get your Tier I cash needs taken care of before spending any time on moving your money around. Fortunately the Tier I action can be accomplished on your lunch break tomorrow so it’s not a big deal.

Tier III: Build your local community. Find out who can do what, who will need your help, and what you can do to help. Only do this after taking care of your personal issues, so that you can have a clear head and can really be helpful to others. If you’ve ever actually listened to those airplane cabin attendants, you are already familiar with this advice: “Please secure the oxygen mask over your own mouth and nose before helping your neighbor or child…” The same principle applies here. All of my advice follows this basic outline. The simple, low-cost, high potential return solutions are the ones I press first.

Why I follow the markets (and report on them) so closely

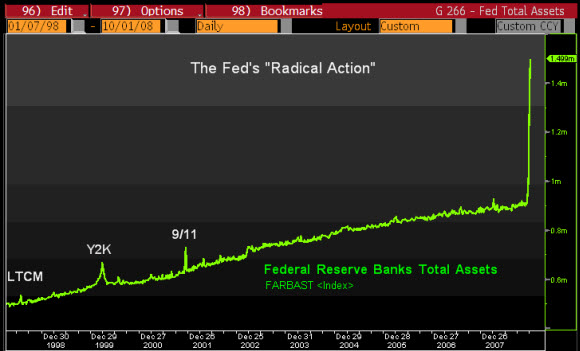

Often I will report on what some people consider to be “market noise.” I focus my attention on the markets because I believe they give me a valuable head start on what’s really happening. I have little faith that “we the people” are entrusted with the real situation by our leaders in the media and/or in politics. Therefore, my best source of timely and accurate information is the markets.

When I see certain things happen in the markets that will finally tell me which way this whole mess is going to break, I will personally be taking some very aggressive last-minute actions. For example, if/when the US dollar begins to head down in earnest at the same time that interest rates rise, that will be my cue to immediately swap out all of my remaining dollars for “things.” I have “buy lists” in place for items ranging from hard assets to basic staples.

It is only by closely monitoring the markets that I feel comfortable knowing what’s going on, even if this amounts to “reading tea leaves” and being subject to lots of truly random noise in addition to the small amounts of real signal.

What I do is monitor the stock, gold, dollar, interest rate, and credit markets, all day, every day that they are open. And then I report at PeakProsperity.com on what I am seeing and thinking in response to the day’s events. For those who cannot (or will not) monitor the markets this closely, I can be an important source of information.

But I do not monitor the markets to pick stocks or find bargains or make a killing. I think the markets are designed in such a way as to seriously discriminate against the small investor, and I also happen to believe that they are all going to sink a LOT lower over time to reflect the fact that too many claims have been made against the future. What are the chances for a small time investor to record gains in a broadly declining market? In my judgment, somewhere between zero and slim.

So, my aim is not to monitor the markets for gain, but for their informational content. If you want to play the markets, there are a lot of high quality newsletters and free sources of information out there to help you do this. I personally analyze the markets for what they can tell me about where we are along the Crash Curve. I want clues as to how long this will take to unfold and what it might look like when it gets there. So I monitor the markets and then report on them to you.

Summary

I write my reports with the clear intent of reinforcing your awareness that the future will be very different from the present, and I measure my success by whether you actually took actions or not – and, (if you did) by whether your actions were structured in such a way that you took care of the easy, low-cost stuff first before moving on to the harder items.

I want you to be safe and secure.

I have faith that, with reliable information, good advice, and a little bit of common sense for good measure, you and I will be able to navigate what lies ahead.