Chris Martenson

Fannie, Freddie and You: What It Means to the Public (Sept 7 – NYT)

So what does the federal takeover of two mortgage finance giants mean to consumers?

Mortgage rates may fall a bit initially but probably not enough to halt the decline in home prices anytime soon. Some delinquent borrowers may have a better shot at modifying their loans and ending up with lower fixed payments. And the rules on new mortgages could slightly change.

Oh, and the federal government will help pay for it all, using your tax money.

Fannie and Freddie Bailout News

Fannie, Freddie and You: What It Means to the Public (Sept 7 – NYT)

So what does the federal takeover of two mortgage finance giants mean to consumers?

Mortgage rates may fall a bit initially but probably not enough to halt the decline in home prices anytime soon. Some delinquent borrowers may have a better shot at modifying their loans and ending up with lower fixed payments. And the rules on new mortgages could slightly change.

Oh, and the federal government will help pay for it all, using your tax money.

FDIC shutters Silver State Bank of Nevada (Sept 5 – CNNMoney)

WASHINGTON (AP) — Regulators on Friday shut

down Silver State Bank, saying the Nevada bank failed because of losses

on soured loans, mainly in commercial real estate and land development.

It was the 11th failure this year of a federally insured bank.

Nevada regulators closed Silver State and the Federal Deposit Insurance

Corp. was appointed receiver of the bank, based in Henderson, Nev. It

had $2 billion in assets and $1.7 billion in deposits as of June 30.

The FDIC estimated its resolution will cost the deposit insurance fund between $450 million and $550 million.

FDIC shutters Silver State Bank of Nevada

FDIC shutters Silver State Bank of Nevada (Sept 5 – CNNMoney)

WASHINGTON (AP) — Regulators on Friday shut

down Silver State Bank, saying the Nevada bank failed because of losses

on soured loans, mainly in commercial real estate and land development.

It was the 11th failure this year of a federally insured bank.

Nevada regulators closed Silver State and the Federal Deposit Insurance

Corp. was appointed receiver of the bank, based in Henderson, Nev. It

had $2 billion in assets and $1.7 billion in deposits as of June 30.

The FDIC estimated its resolution will cost the deposit insurance fund between $450 million and $550 million.

U.S. Near Deal on Fannie, Freddie (September 6, 2008)

Plan Could Amount to Government Takeover

WASHINGTON — The Treasury Department is putting the finishing touches

to a plan designed to shore up Fannie Mae and Freddie Mac, according to

people familiar with the matter, a move that would essentially result

in a government takeover of the mortgage giants.

The plan is

expected to involve putting the two companies into the conservatorship

of their regulator, the Federal Housing Finance Agency, said several

people familiar with the matter. That would mean the government would

take the reins of the companies, at least temporarily.

It is

also expected to involve the government injecting capital into Fannie

and Freddie. That could happen gradually on a quarter-by-quarter basis,

rather than in a single move, one person familiar with the matter said.

Fannie and Freddie nationalized. Treasury takes over.

U.S. Near Deal on Fannie, Freddie (September 6, 2008)

Plan Could Amount to Government Takeover

WASHINGTON — The Treasury Department is putting the finishing touches

to a plan designed to shore up Fannie Mae and Freddie Mac, according to

people familiar with the matter, a move that would essentially result

in a government takeover of the mortgage giants.

The plan is

expected to involve putting the two companies into the conservatorship

of their regulator, the Federal Housing Finance Agency, said several

people familiar with the matter. That would mean the government would

take the reins of the companies, at least temporarily.

It is

also expected to involve the government injecting capital into Fannie

and Freddie. That could happen gradually on a quarter-by-quarter basis,

rather than in a single move, one person familiar with the matter said.

Friday, September 5, 2008

This is an article I was asked to write for the VT Commons, where it appeared on the front page in August 2008. It is largely a significant re-write of my The End of Money article. This article lays out the very foundation of my entire line of thinking, and I think it should be widely circulated and debated.

Full permission to reprint, post, and/or distribute is granted.

The greatest shortcoming of the human race is our inability to understand the exponential function.

~ Dr. Albert Bartlett

Within the next twenty years, the most profound changes in all of economic history will sweep the globe. The economic chaos and turbulence we are now experiencing are merely the opening salvos in what will prove to be a long, disruptive period of adjustment. Our choices now are to either evolve a new economic model that is compatible with limited physical resources, or to risk a catastrophic failure of our monetary system, and with it the basis for civilization as we know it today.

In order to understand why, we must start at the beginning. While it was operating well, our monetary system was a great system, one that fostered incredible technological innovation and advances in standards of living, two characteristics that I fervently wish to continue. But every system has its pros and its cons, and our monetary system has a doozy of a flaw.

It is this: Our monetary system must continually expand, forever.

The US/world monetary system was designed and implemented at a time when the earth’s resources seemed limitless, so few gave much critical thought to the implications that every single dollar in circulation was to be loaned into existence by a bank with interest. In fact, most thought it a terribly “modern” concept, and most probably still do.

But anything that is continually expanding by some percentage amount, no matter how minuscule, is said to be growing geometrically, or exponentially.

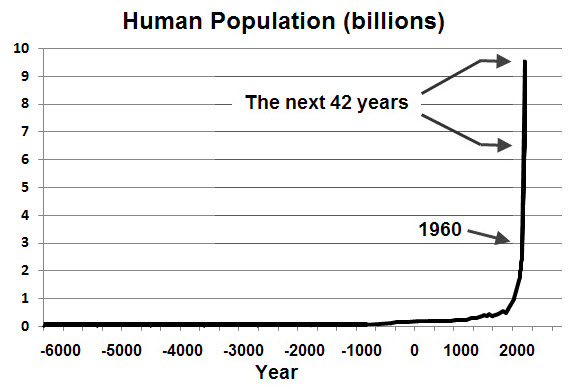

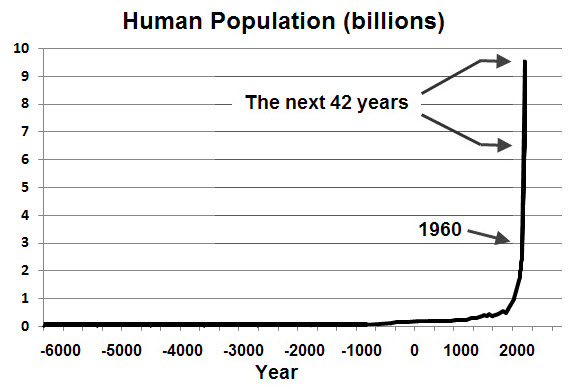

Geometric growth can be seen in this sequence of numbers (1, 2, 4, 8, 16, 32, 64), while an arithmetic growth sequence is (1, 2, 3, 4, 5, 6, 7). In 1798, Thomas Malthus postulated that the human population’s geometric growth would, at some point, exceed the arithmetic returns of the earth, principally in the arena of food. To paraphrase, he recognized that the exponential growth of human numbers would meet with the constraints imposed by a finite world. As seen in the chart below, human population is growing exponentially, and is on track to reach 9.5 billion by 2050. To put this in perspective, it was only in 1960 that the world first passed 3 billion in total population, the same amount that is projected to be added over the next 42 years. Each new person places additional demands on food, water, energy, and other finite resources.

In parallel with exponential population growth, our monetary system is also exhibiting exponential behavior. Consider this evidence:

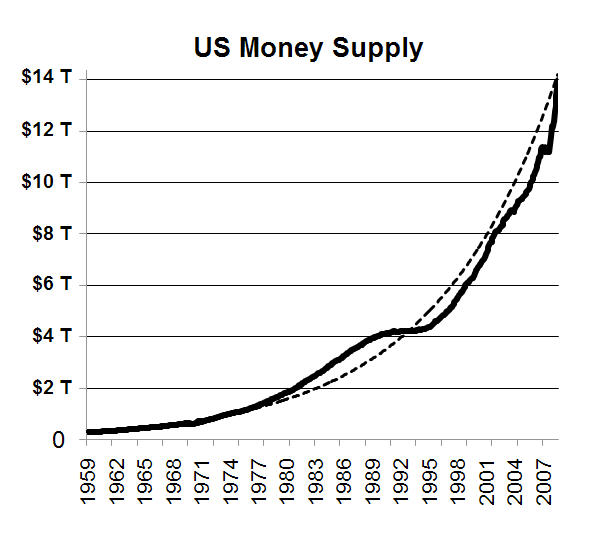

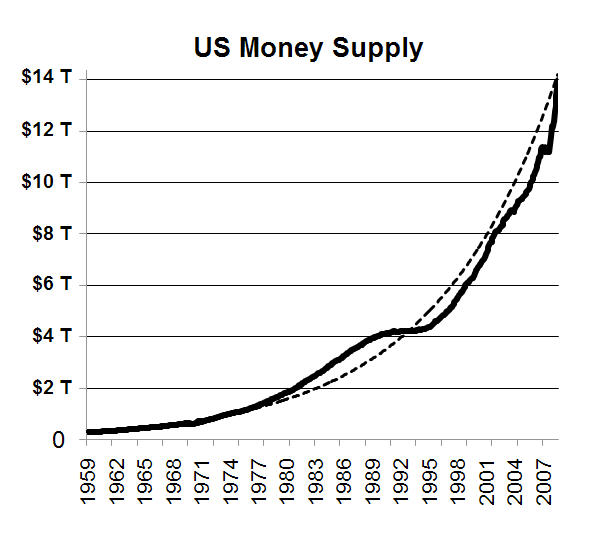

1) Money supply growth (see chart above). It took us from 1620 until 1973 to create the first $1trillion of US money stock (measured by adding up every bank account, CD, money market fund, etc). Every road, factory, bridge, school, and house built, together with every war fought and every other economic transaction that ever took place over those first 350 years, resulted in the creation of $1 trillion in money stock [1]. The most recent $1 trillion? That has been created in only 4.5 months. The dotted line in the chart is an idealized exponential curve, while the solid line is actual monetary data. The fit is nearly perfect (with a correlation of 0.98, for those interested). Data from the Federal Reserve.

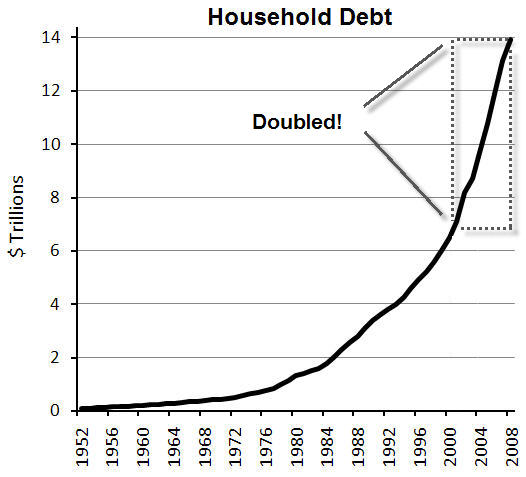

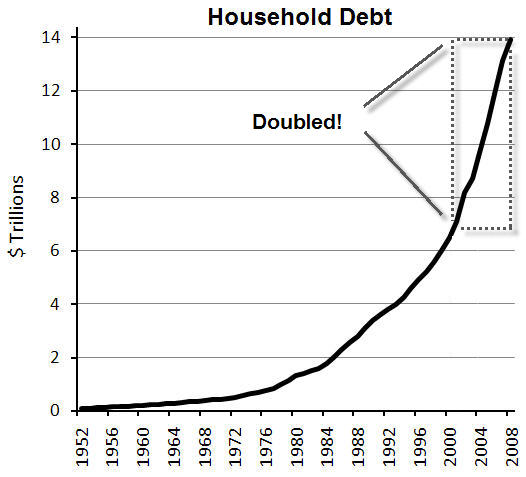

2) Household debt has doubled in only 7 years, growing from seven to fourteen trillion dollars. Think about that for a minute. It is a stunning turn of events. Have household incomes also doubled in 7 years? No, not even close; they have grown less than half as much, calling into question how these loans will be repaid, let alone doubled again. Data from the Federal Reserve.

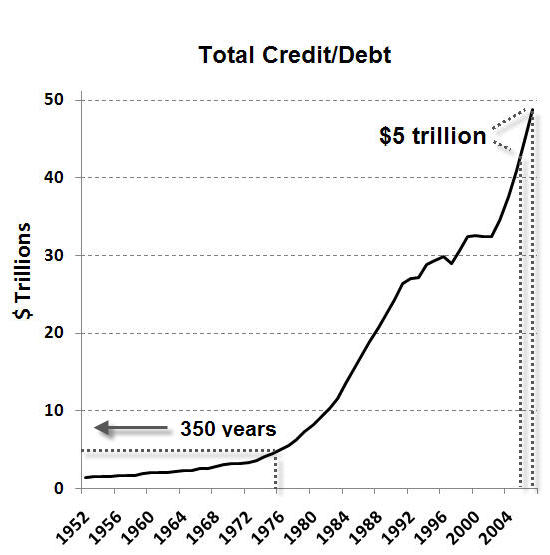

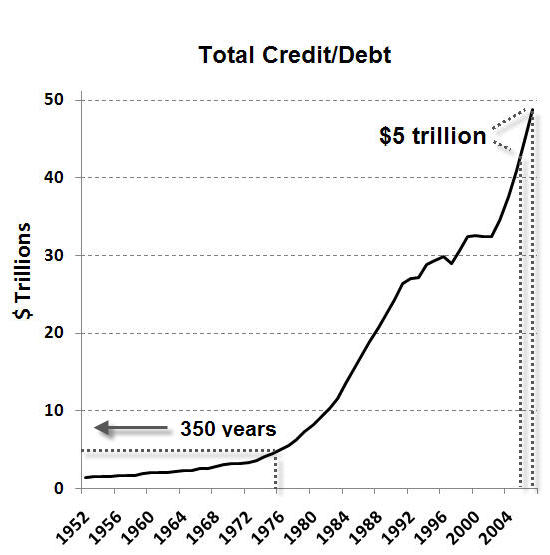

3) Total credit market debt (that’s all debt) had finally exceeded $5 trillion by 1975, but has recently increased by $5 trillion in just the past 2 years (from 2006 – 2008), and now stands at nearly $50 trillion. In order for the next twenty years to resemble the last twenty years, debt would have to expand by another 3 to 4 times, to somewhere between $150 trillion and $200 trillion. How likely do you think this is? Data from the Federal Reserve.

How do we make sense of money numbers this large and growing this fast? Why is this happening? Could it be that the US economy is so robust that it requires monetary and credit growth to double every 6-7 years? Are US households expecting a huge surge in wages, to be able to pay off all that debt? If not, then what’s going on? The key to understanding all three of the above money and debt charts was snuck in a few paragraphs ago; every single dollar in circulation is loaned into existence by a bank, with interest.

That little statement contains the entire mystery. As improbable as it may sound to you that all money is backed by debt, it is precisely correct, and while many of you are going to struggle with the concept, you’ll be in good company. John Kenneth Galbraith, the world-famous Harvard economist, said, “The process by which banks create money is so simple that the mind is repelled.” [2]

Here’s how money (and debt) creation works: Suppose we wipe the entire system clean and start over, so that we can more easily understand the process. Say you enter the first (and only) bank and receive the very first loan for $1000. At this point the bank has an asset (your loan) on the books, and you have $1000 in cash and a $1000 liability owed to the bank. After a month passes, and the first interest accrues, we peek into the system and observe that the $1000 in money still exists, but that your debt has grown by the size of the interest (let’s call that $10). Now your total debt to the bank is $1000 plus the $10 interest or $1010 in total.

Since there’s only $1000 floating around, and that’s all there is, clearly there’s not enough money to settle the whole debt. So where will the required $10 come from? In our system it must be loaned into existence, taking the form of $10 of new money plus $10 of new debt that must also be paid back with interest.

But if our system requires new and larger loans to enable the repayment of old loans, aren’t we actually just compounding the total amount of debt (and resulting money) with every passing year? Yes, that is precisely what is happening, and the three money/debt charts supplied above all provide confirmation of that dynamic.

In other words, our monetary system, and by extension our entire economy, are textbook examples of exponential systems. Yeast in a vat of sugar water, predator-free lemming populations, and algal blooms are natural examples of exponential growth. Plotted on graph paper, the lines tracking these populations start out slowly, begin to rise more quickly, and then, suddenly, shoot almost straight up, yielding a shape that resembles a hockey stick.

The key feature of exponential functions that our species desperately needs to understand is illustrated in this next example: [3]

Suppose I had a magic eyedropper that could dispense a drop of water with a most unusual trait – it will double in size every minute – and I place a drop of water in your hand. At first you’d just have a lonely drop of water sitting in your hand, but after one minute it would double in size, and after six minutes you’d have a blob of water that could fill a thimble. Do you have a sense of that growth? Now, follow me to Fenway Park, where I am going to place a drop from my magic eye dropper on the pitcher’s mound at 12:00 pm on January 1st of 2008. To make this interesting, let’s assume that the park is water-tight, and that I’ve handcuffed you to the highest row of bleacher seats. Way down there, on the mound, I bend over and plop a magic drop of water, so small you could not possibly see it from where you are sitting, and it begins to double. My question to you is, at what date and at what time would the park be completely filled? That is, how long do you have to escape from your handcuffs? Days? Weeks? Months? Years?

The answer is this: You have until 12:49 pm, on that same day, before the park is completely filled. You have only 49 minutes to escape your handcuffs. And at what time do you suppose that the park is still 97% empty space (and how many of you will appreciate the seriousness of your predicament)? The answer is that at 12:45 pm the park is still 97% unfilled. The first 44 minutes filled just 3% of the park, while the last 5 minutes filled the remaining 97%. From all of history until 1960 to reach a population of 3 billion humans; only 42 years from now to add another 3 billion.

And that’s why we need to appreciate exponential functions. For quite a while, everything seems just fine, and a few minutes later your park is overflowing. Time runs out in a hurry towards the end of any exponential growth system, forcing hurried decisions and limited options.

So how does this pertain to our economic problems, and why should you care? The truth is, there’s nothing inherently wrong with exponential growth, as long as you have unlimited room and resources. However, there are clear signs that several key resources on our planet are in their final minutes, to use our Fenway Park example.

And none of these are more important than crude oil. “Peak oil” is the global extension of the observation that individual oil fields, without exception, produce slightly more oil each year up to a point (“the peak”), after which they produce incrementally less and less oil each year, until their economics force abandonment. It is a fact that the US hit its peak of oil production in 1970 at approximately 10 million barrels a day and now produces barely more than 5 million barrels a day. It is now widely recognized that oil is a finite resource, and another cold, hard fact is that global oil discoveries peaked some 45 years ago. Because discoveries precede production (you’ve got to find it before you can pump it), we can be certain that production will peak too. We might disagree over the timing, but not the process.

I’m focusing on oil because energy drives an economy, not the other way around. The engine of any economy is energy, while money is merely the lubricating oil. Without energy, no amount of additional money would make the slightest difference in our lives. Economists love to say that higher oil prices will stimulate new oil production, as if demand could magically create supply. (Joke: If you lock three economists in a basement they won’t worry about starving, because they know their grumbling bellies will soon cause sandwiches to appear.) But just as there is no amount of additional price hikes that will cause more cod to come from the depleted oceans, oil fields will yield their treasures in accordance to geological limits, not human desire.

And here’s where the enormous monetary design flaw comes into the story. As Meadows, et al., in The Limits to Growth (1972) brilliantly predicted, we humans are now encountering physical, resource-constrained limits to our economic and population growth. So, on the one hand we have a monetary system that, by its very design, must expand exponentially in order to merely operate, while on the other hand we live on a spherical planet with finite resource limits.

When we started our exponential monetary system, initiated by the Bank of England around 1700 but kicked into high gear in 1971 with the international abandonment of gold settlement, nobody ever thought that the day would come when we’d find our ball park filled nearly to the brim. Who ever thought that oil production would hit a limit? Who knew that every acre of arable land, and then some, would someday be put into production? How could we possibly fish the seas empty? Yet all of these things have come to pass, and our monetary system demands that even more follow.

This is clearly an unsustainable arrangement. Someday soon, it will cease to be.

Repeating an opening sentence, our choices now are to either evolve a new economic model that is compatible with limited physical resources, or risk a catastrophic failure of our monetary system, and with it the basis for civilization as we know it today. I wish this collision between a finite planet and an exponential money system was far off in the future. Alas, it is certainly within the lifetime of people alive today, and likely already upon us.

We are leaving a legacy of debt to our children, born and unborn. Just as the direct printing of money favored by Wiemar Germany in the 1920s destroyed German’s purchasing power, so, too, does America’s debt accumulation promise to ruin our economy. Thus the moral argument beneath exponential growth in a finite context is: Should one generation consume beyond its means and either expect or hope that the next generations will somehow pick up the tab?

In summary, because our economic model and our entire system of money enforce a doctrine of limitless growth, they have become anachronisms incompatible with the well-being of the planet on which we live and depend. Our global money system might be complicated, and it might be sophisticated, but it is soon to be a vestige of the past.

Your job, your savings, your investments, and your future prospects and standard of living depend on the continuation of an unsustainable system now drawing to a close. You owe it to yourself to get ahead of the immense changes that are coming like water roiling up the steps towards the bleacher seat to which you are chained.

Next time: We’ll use this understanding of our monetary system to examine where we are, and solutions that you and your community should consider before the system collapses. Remember, the end of one thing is always the beginning of another.

[1] Having trouble picturing a trillion? Think of it this way: If you had a single thousand-dollar bill, you could have a pretty good night on the town with your friends. If you had a stack of thousand dollar bills that was 4 inches high, you’d be a millionaire. If you had a stack just 40 inches high, you would be worth ten million dollars. How high would your stack have to be in order for you to be a trillionaire? The answer is, a solid stack of thousand dollar bills 68.9 miles high.

[2] If you need more help on this concept, please visit chapters 7 & 8 of my free, on-line Crash Course at http://PeakProsperity.com/crashcourse.

[3] I gained a much deeper appreciation for the power of exponential functions from transcripts of speeches given by the mathematician Dr. Albert Bartlett. This link goes to an exceptional example of his ability to make this complex subject startlingly clear.

Exponential Money in a Finite World

PREVIEWFriday, September 5, 2008

This is an article I was asked to write for the VT Commons, where it appeared on the front page in August 2008. It is largely a significant re-write of my The End of Money article. This article lays out the very foundation of my entire line of thinking, and I think it should be widely circulated and debated.

Full permission to reprint, post, and/or distribute is granted.

The greatest shortcoming of the human race is our inability to understand the exponential function.

~ Dr. Albert Bartlett

Within the next twenty years, the most profound changes in all of economic history will sweep the globe. The economic chaos and turbulence we are now experiencing are merely the opening salvos in what will prove to be a long, disruptive period of adjustment. Our choices now are to either evolve a new economic model that is compatible with limited physical resources, or to risk a catastrophic failure of our monetary system, and with it the basis for civilization as we know it today.

In order to understand why, we must start at the beginning. While it was operating well, our monetary system was a great system, one that fostered incredible technological innovation and advances in standards of living, two characteristics that I fervently wish to continue. But every system has its pros and its cons, and our monetary system has a doozy of a flaw.

It is this: Our monetary system must continually expand, forever.

The US/world monetary system was designed and implemented at a time when the earth’s resources seemed limitless, so few gave much critical thought to the implications that every single dollar in circulation was to be loaned into existence by a bank with interest. In fact, most thought it a terribly “modern” concept, and most probably still do.

But anything that is continually expanding by some percentage amount, no matter how minuscule, is said to be growing geometrically, or exponentially.

Geometric growth can be seen in this sequence of numbers (1, 2, 4, 8, 16, 32, 64), while an arithmetic growth sequence is (1, 2, 3, 4, 5, 6, 7). In 1798, Thomas Malthus postulated that the human population’s geometric growth would, at some point, exceed the arithmetic returns of the earth, principally in the arena of food. To paraphrase, he recognized that the exponential growth of human numbers would meet with the constraints imposed by a finite world. As seen in the chart below, human population is growing exponentially, and is on track to reach 9.5 billion by 2050. To put this in perspective, it was only in 1960 that the world first passed 3 billion in total population, the same amount that is projected to be added over the next 42 years. Each new person places additional demands on food, water, energy, and other finite resources.

In parallel with exponential population growth, our monetary system is also exhibiting exponential behavior. Consider this evidence:

1) Money supply growth (see chart above). It took us from 1620 until 1973 to create the first $1trillion of US money stock (measured by adding up every bank account, CD, money market fund, etc). Every road, factory, bridge, school, and house built, together with every war fought and every other economic transaction that ever took place over those first 350 years, resulted in the creation of $1 trillion in money stock [1]. The most recent $1 trillion? That has been created in only 4.5 months. The dotted line in the chart is an idealized exponential curve, while the solid line is actual monetary data. The fit is nearly perfect (with a correlation of 0.98, for those interested). Data from the Federal Reserve.

2) Household debt has doubled in only 7 years, growing from seven to fourteen trillion dollars. Think about that for a minute. It is a stunning turn of events. Have household incomes also doubled in 7 years? No, not even close; they have grown less than half as much, calling into question how these loans will be repaid, let alone doubled again. Data from the Federal Reserve.

3) Total credit market debt (that’s all debt) had finally exceeded $5 trillion by 1975, but has recently increased by $5 trillion in just the past 2 years (from 2006 – 2008), and now stands at nearly $50 trillion. In order for the next twenty years to resemble the last twenty years, debt would have to expand by another 3 to 4 times, to somewhere between $150 trillion and $200 trillion. How likely do you think this is? Data from the Federal Reserve.

How do we make sense of money numbers this large and growing this fast? Why is this happening? Could it be that the US economy is so robust that it requires monetary and credit growth to double every 6-7 years? Are US households expecting a huge surge in wages, to be able to pay off all that debt? If not, then what’s going on? The key to understanding all three of the above money and debt charts was snuck in a few paragraphs ago; every single dollar in circulation is loaned into existence by a bank, with interest.

That little statement contains the entire mystery. As improbable as it may sound to you that all money is backed by debt, it is precisely correct, and while many of you are going to struggle with the concept, you’ll be in good company. John Kenneth Galbraith, the world-famous Harvard economist, said, “The process by which banks create money is so simple that the mind is repelled.” [2]

Here’s how money (and debt) creation works: Suppose we wipe the entire system clean and start over, so that we can more easily understand the process. Say you enter the first (and only) bank and receive the very first loan for $1000. At this point the bank has an asset (your loan) on the books, and you have $1000 in cash and a $1000 liability owed to the bank. After a month passes, and the first interest accrues, we peek into the system and observe that the $1000 in money still exists, but that your debt has grown by the size of the interest (let’s call that $10). Now your total debt to the bank is $1000 plus the $10 interest or $1010 in total.

Since there’s only $1000 floating around, and that’s all there is, clearly there’s not enough money to settle the whole debt. So where will the required $10 come from? In our system it must be loaned into existence, taking the form of $10 of new money plus $10 of new debt that must also be paid back with interest.

But if our system requires new and larger loans to enable the repayment of old loans, aren’t we actually just compounding the total amount of debt (and resulting money) with every passing year? Yes, that is precisely what is happening, and the three money/debt charts supplied above all provide confirmation of that dynamic.

In other words, our monetary system, and by extension our entire economy, are textbook examples of exponential systems. Yeast in a vat of sugar water, predator-free lemming populations, and algal blooms are natural examples of exponential growth. Plotted on graph paper, the lines tracking these populations start out slowly, begin to rise more quickly, and then, suddenly, shoot almost straight up, yielding a shape that resembles a hockey stick.

The key feature of exponential functions that our species desperately needs to understand is illustrated in this next example: [3]

Suppose I had a magic eyedropper that could dispense a drop of water with a most unusual trait – it will double in size every minute – and I place a drop of water in your hand. At first you’d just have a lonely drop of water sitting in your hand, but after one minute it would double in size, and after six minutes you’d have a blob of water that could fill a thimble. Do you have a sense of that growth? Now, follow me to Fenway Park, where I am going to place a drop from my magic eye dropper on the pitcher’s mound at 12:00 pm on January 1st of 2008. To make this interesting, let’s assume that the park is water-tight, and that I’ve handcuffed you to the highest row of bleacher seats. Way down there, on the mound, I bend over and plop a magic drop of water, so small you could not possibly see it from where you are sitting, and it begins to double. My question to you is, at what date and at what time would the park be completely filled? That is, how long do you have to escape from your handcuffs? Days? Weeks? Months? Years?

The answer is this: You have until 12:49 pm, on that same day, before the park is completely filled. You have only 49 minutes to escape your handcuffs. And at what time do you suppose that the park is still 97% empty space (and how many of you will appreciate the seriousness of your predicament)? The answer is that at 12:45 pm the park is still 97% unfilled. The first 44 minutes filled just 3% of the park, while the last 5 minutes filled the remaining 97%. From all of history until 1960 to reach a population of 3 billion humans; only 42 years from now to add another 3 billion.

And that’s why we need to appreciate exponential functions. For quite a while, everything seems just fine, and a few minutes later your park is overflowing. Time runs out in a hurry towards the end of any exponential growth system, forcing hurried decisions and limited options.

So how does this pertain to our economic problems, and why should you care? The truth is, there’s nothing inherently wrong with exponential growth, as long as you have unlimited room and resources. However, there are clear signs that several key resources on our planet are in their final minutes, to use our Fenway Park example.

And none of these are more important than crude oil. “Peak oil” is the global extension of the observation that individual oil fields, without exception, produce slightly more oil each year up to a point (“the peak”), after which they produce incrementally less and less oil each year, until their economics force abandonment. It is a fact that the US hit its peak of oil production in 1970 at approximately 10 million barrels a day and now produces barely more than 5 million barrels a day. It is now widely recognized that oil is a finite resource, and another cold, hard fact is that global oil discoveries peaked some 45 years ago. Because discoveries precede production (you’ve got to find it before you can pump it), we can be certain that production will peak too. We might disagree over the timing, but not the process.

I’m focusing on oil because energy drives an economy, not the other way around. The engine of any economy is energy, while money is merely the lubricating oil. Without energy, no amount of additional money would make the slightest difference in our lives. Economists love to say that higher oil prices will stimulate new oil production, as if demand could magically create supply. (Joke: If you lock three economists in a basement they won’t worry about starving, because they know their grumbling bellies will soon cause sandwiches to appear.) But just as there is no amount of additional price hikes that will cause more cod to come from the depleted oceans, oil fields will yield their treasures in accordance to geological limits, not human desire.

And here’s where the enormous monetary design flaw comes into the story. As Meadows, et al., in The Limits to Growth (1972) brilliantly predicted, we humans are now encountering physical, resource-constrained limits to our economic and population growth. So, on the one hand we have a monetary system that, by its very design, must expand exponentially in order to merely operate, while on the other hand we live on a spherical planet with finite resource limits.

When we started our exponential monetary system, initiated by the Bank of England around 1700 but kicked into high gear in 1971 with the international abandonment of gold settlement, nobody ever thought that the day would come when we’d find our ball park filled nearly to the brim. Who ever thought that oil production would hit a limit? Who knew that every acre of arable land, and then some, would someday be put into production? How could we possibly fish the seas empty? Yet all of these things have come to pass, and our monetary system demands that even more follow.

This is clearly an unsustainable arrangement. Someday soon, it will cease to be.

Repeating an opening sentence, our choices now are to either evolve a new economic model that is compatible with limited physical resources, or risk a catastrophic failure of our monetary system, and with it the basis for civilization as we know it today. I wish this collision between a finite planet and an exponential money system was far off in the future. Alas, it is certainly within the lifetime of people alive today, and likely already upon us.

We are leaving a legacy of debt to our children, born and unborn. Just as the direct printing of money favored by Wiemar Germany in the 1920s destroyed German’s purchasing power, so, too, does America’s debt accumulation promise to ruin our economy. Thus the moral argument beneath exponential growth in a finite context is: Should one generation consume beyond its means and either expect or hope that the next generations will somehow pick up the tab?

In summary, because our economic model and our entire system of money enforce a doctrine of limitless growth, they have become anachronisms incompatible with the well-being of the planet on which we live and depend. Our global money system might be complicated, and it might be sophisticated, but it is soon to be a vestige of the past.

Your job, your savings, your investments, and your future prospects and standard of living depend on the continuation of an unsustainable system now drawing to a close. You owe it to yourself to get ahead of the immense changes that are coming like water roiling up the steps towards the bleacher seat to which you are chained.

Next time: We’ll use this understanding of our monetary system to examine where we are, and solutions that you and your community should consider before the system collapses. Remember, the end of one thing is always the beginning of another.

[1] Having trouble picturing a trillion? Think of it this way: If you had a single thousand-dollar bill, you could have a pretty good night on the town with your friends. If you had a stack of thousand dollar bills that was 4 inches high, you’d be a millionaire. If you had a stack just 40 inches high, you would be worth ten million dollars. How high would your stack have to be in order for you to be a trillionaire? The answer is, a solid stack of thousand dollar bills 68.9 miles high.

[2] If you need more help on this concept, please visit chapters 7 & 8 of my free, on-line Crash Course at http://PeakProsperity.com/crashcourse.

[3] I gained a much deeper appreciation for the power of exponential functions from transcripts of speeches given by the mathematician Dr. Albert Bartlett. This link goes to an exceptional example of his ability to make this complex subject startlingly clear.

A Market Decline in Search of a Reason (NYT – Sept 4)

Stocks on Wall Street plunged on Thursday, but few investors seemed to know why.

A broad sell-off sent the Dow Jones industrial average more than 320 points in afternoon trading, hours after the government reported that the number of Americans filing for unemployment benefits unexpectedly rose last week.

“Victory has many fathers, but failure is an orphan.”

A Market Decline in Search of a Reason (NYT – Sept 4)

Stocks on Wall Street plunged on Thursday, but few investors seemed to know why.

A broad sell-off sent the Dow Jones industrial average more than 320 points in afternoon trading, hours after the government reported that the number of Americans filing for unemployment benefits unexpectedly rose last week.

Community

Hard Assets Alliance

Learn more