Monday, December 10, 2007 (reprinted Saturday, March 15, 2008)

Executive Summary

- The credit bubble collapse is just getting started.

- Odds of a major systemic financial crisis now higher than ever.

- Dollar collapse is underway.

- Your opportunities to protect your assets are dwindling fast.

(Originally printed on 12-10-2007. Uncannily good predictions and recommendations, all of which I still stand by.)

The Great Credit Bubble, for which you can thank Alan Greenspan, is now in the process of bursting. While the US media implacably attempts to assure everyone that it is well contained or almost over, nothing could be further from the truth. As one financial commentator recently put it, "the good news is that the subprime crisis has been contained…to the planet earth."

The odds of a major systemic financial collapse are now higher than ever.

If you’ve seen the Crash Course (formerly the End of Money seminar), you know I’ve been concerned for a number of years about the toxic witch’s brew of poor-quality loans and unfathomably risky derivatives that are poisoning our financial body. Part of my concern stems from the fact that no matter how hard I try, I cannot understand how the derivatives markets work.

I’ve been unable to discover the most basic answers to the most basic questions, such as “how much capital is actually backing these things?” and “who’s holding the bag?” Wall Street and its ever-compliant financial propaganda services organizations (CNBC, WSJ, et al.) have maintained all along that these new products have completely eliminated risk by spreading it so thin that it has literally disappeared. I do not believe in financial alchemy, and I do not believe this version of ‘reality,’ because it makes no sense at all. Just as it made no sense to finance 19 houses to a part-time hairdresser in Las Vegas with subprime, negative amortization loans (true story), it makes no sense that this level of malinvestment could simply ‘disappear’.

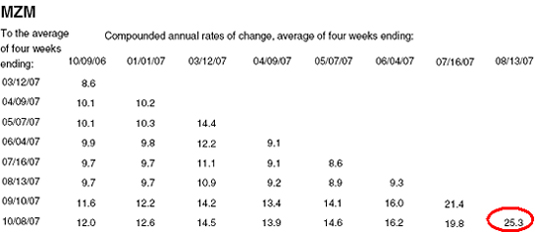

The rest of my concern centers on the fact that 3,800 paper currencies in the past have all gone to money heaven due to the exact same formula of mismanagement that our fiscal and monetary authorities are applying to the US dollar. A few key warning signs would be, (1) bailing out the poor decisions of big banks by flooding the markets with hundreds of billions of dollars of public money/credit, and (2) conducting a pair of very expensive wars “off budget,” while (3) expanding your total monetary base at an astounding, banana-republic double digit percentage rate (as we discussed last time).

I won’t be disappointed if you tend to believe proclamations from the titans of Wall Street more than you would from some random guy named Chris. However, before you place too much faith on the possibility that those guys on Wall Street “must know what they are doing,” I would ask you to consider these facts:

Exhibit A:

Out of all the toxic subprime mortgages ever issued, the subprime loans with highest rates of default were made in the first 6 months of 2007 .

While you and I and everybody else had figured out that the subprime jig was up in 2005 or 2006, the Wall Street machinery couldn’t figure out how to stop what it was doing even as late as July of 2007. Titans or nitwits? You be the judge.

Exhibit B:

Rather than admit they made a bunch of really stupid loans, Wall Street banks first went straight to the US Treasury to mediate a bailout, and, when that proved to be too slow a course of action, simply hid the extent of their losses by massively abusing an obscure accounting gimmick .

Nov. 7 (Bloomberg) Banks may be forced to write down as much as $64 billion on collateralized debt obligations of securities backed by subprime assets, from about $15 billion so far, Citigroup analysts led by Matt King in London wrote in a report e-mailed today. The data exclude Citigroup’s own projected writedowns.

Under FASB terminology, Level 1 means mark-to-market, where an asset’s worth is based on a real price. Level 2 is mark-to-model, an estimate based on observable inputs which is used when no quoted prices are available. Level 3 values are based on “unobservable” inputs reflecting companies’ “own assumptions” about the way assets would be priced.

In other words, these so-called “Level 3” assets are balance-sheet entries that company management value at whatever they say they’re worth. This is like your drunk uncle claiming to be a millionaire because he said he found a lottery ticket in the gutter on the way home last night, but he won’t let anybody see it. The value of these so-called assets is entirely in the eye of the beholder, or bank management in this case, who has decided that they are ‘worth’ every penny that they paid for them and that’s how much they are going to continue insisting they are worth, thank you very much.

Exhibit C:

As the subprime derivative debacle was unfolding, what do you suppose was the response of Wall Street? If you guessed “doubling down,” you are a winner!

Nov. 22 (Bloomberg) — The market for derivatives grew at the fastest pace in at least nine years to $516 trillion in the first half of 2007, the Bank for International Settlements said.

Credit-default swaps, contracts designed to protect investors against default and used to speculate on credit quality, led the increase, expanding 49 percent to cover a notional $43 trillion of debt in the six months ended June 30, the BIS said in a report published late yesterday.

Wow. Wowowowowow. This is shocking. First, because of how hard it is to set new records for the “fastest pace” at the same time that you are setting records for the total amount. This would be like a weightlifter setting a new world record by adding 700 pounds to the old record. Second, because the specific types of derivatives that expanded the fastest were those designed to speculate on credit quality – the very area that is most at risk right now. So we now know that even as the credit debacle was so completely obvious that people returning from year-long wilderness solos knew something was wrong, Wall Street and Hedge Funds were busy accelerating the pace at which they continued to pursue these broken bets on shaky mortgages. Rather than sound fiscal prudence, this appears to be a last desperate grab for what few chips remained on the table.

It is possible that each individual transaction made a lot of sense to the hedge fund managers, but to outsiders like us they look foolish collectively. Why? Because when everybody is hedged, nobody is. Hedging is a zero-sum game. For somebody to win, somebody has to lose. So while all these smarty-pants were busy ‘hedging their risk away,’ nobody seems to have taken stock of the fact that the assets they were hedging were themselves seriously impaired and were going to result in massive losses for somebody. In short, it is impossible to hedge a failed system.

So, there are three perfectly good reasons to suspect that the captains of Wall Street are rather mortal after all and possibly even less competent than the average soul. I could give you forty more, but in the interest of time, I won’t, except to offer the best explanation I’ve ever read on how the derivative market works (PDF) and the human mechanisms at play that allowed all this to get so out of hand. This article will be well worth your time.

Systemic Banking Crisis?

If you own a house, odds are you carry fire insurance. Not because the chance of a house fire is particularly large, but because the cost of a house fire is catastrophic. You carry fire insurance because you have rightly calculated that (small chance) x (a big cost) = unacceptable risk. So you offset that risk with insurance.

Now I want you to seriously consider what the cost to you would be if there were the equivalent of a house fire in the banking system. I’m talking about a major system ‘freeze’ where banks close, huge losses spread throughout the system, electronic interbank transfers become impossible (ATMs, credit cards, electronic funds transfers, wires, and all the rest simply stop), and many banks and brokerages simultaneously go out of business. I’d imagine the impact to you would be quite large. So the next question is, what can/should mature, responsible adults do to insure themselves against such an outcome? How much time, energy and money should one dedicate to insuring one’s financial house?

When I started giving The End of Money seminar three years ago, I had put the possibility of this sort of event at about 15% to 20% over the next 5-10 years. It turns out that I was a raging optimist compared to some financial professionals such as this guy:

Nov. 13 (Bloomberg) — There’s a greater than 50 percent probability that the financial system "will come to a grinding halt" because of losses from mortgages, Gregory Peters, head of credit strategy at Morgan Stanley, said.

This is serious business especially now that the head of credit strategy at a major Wall Street bank is openly writing about it to their main clients. In fact, there are now many respected economists and financial professionals who are calling for a generalized systemic financial meltdown or a severe stock market decline. Even if you have no assets in the larger speculative financial markets (stocks and bonds), or have already taken steps to protect them by getting them out, you are still at risk if your assets are sitting in a risky bank. The possibility of massive bank failures is now a stark reality and it is my opinion that several are already insolvent, just not publicly (yet).

These sorts of crises always start at the edges and work in. First it was the shakier mortgage broker ‘bucket shops’ that began going under in late 2006. Then larger and seemingly firmer mortgage outfits began going under. Now more than 190 mortgage brokers, including most of the ‘top ten’, have gone bankrupt. And today not only is the very largest of them all (Countrywide Financial Corp) rumored to be a strong candidate for bankruptcy, the unthinkable seems to be unfolding before our very eyes. Both Fannie Mae and Freddie Mac, collectively holding several trillions of dollars worth of US mortgages and an even larger portfolio of associated interest rate derivatives, appear to be in some serious trouble . If either, or both, of these companies goes bust, it is highly unlikely (to me) that both the US banking system and the dollar could survive the event.

I am now putting out my strongest warning ever.

If you do not already own gold and/or silver, your time is running out. My best guess would be that once the world’s paper markets implode, the price of gold and silver will skyrocket to unimaginable and unreachable heights, if you can even locate any to buy. Get some.

By the time it is completely obvious that this is the right thing to do, you will find it difficult either due to price, availability, or both. Luckily, the world’s central banks are still capping the price of gold and silver, offering you a wonderful subsidy, which is really quite nice of them. Why do I advocate gold and silver? Simple. Because they are among the very few money-like assets that you can own (hold) that are not simultaneously somebody else’s liability. Consider that a bond (your asset) is the liability of a corporation or government. Even your checking account is your bank’s liability. A house owned free and clear would certainly qualify as a valuable asset, but a house is not very “money like.” When you go through the list (stocks, bonds, annuities, money-market accounts, etc), there is virtually no paper asset that you can identify that is not somebody else’s liability. Even a cash dollar is the liability of the Federal Reserve. But when you own physical precious metals (not mining shares or other paper claims), that’s the long and the short of it. It’s yours. Period.

Next, in order to protect from the possibility of a general banking ‘holiday’ (freeze), every family should have somewhere between one and six months worth of living expenses on hand in the form of cold, hard cash. You know, the bits of paper that work even if the ATMs and credit card readers do not. To be clear, I am not talking about cash in your checking account, I am talking about cash out of the bank and in your hands. Katrina, a natural storm, taught this lesson and we now need to apply that learning to the potential arrival of an economic storm.

Unfortunately, not very many people will be able to do this because the total cash available is a very small percentage of total deposits (~5%). Your bank will look at you funny when you take cash out, mainly because they do not have very much on hand at any given moment. If you plan to cash out more than a few thousand dollars, I highly recommend that you give your bank advance warning and thereby avoid the awkward social moment that will result when they have to tell you that they don’t actually have that much on hand. One thing to remember is that if you take out $10,000.00 or more of cash your bank is required to report you to the federal government via a SAR (Suspicious Activity Report). So the banks appreciate amounts smaller than that as it cuts down on the paperwork.

I would maintain a cash balance until we see clear signs that the evolving credit crisis is getting better, not worse. Given the latest data, which all point to a serious erosion of the credit markets, this could be awhile.

All that’s really happening here is that the long-awaited credit bust is finally upon us. It is important to remember that historically, bubbles have always deflated over approximately the same amount of time as they took to inflate. This means we are looking at a potential end to this crisis somewhere in the range of 2012 to 2020, depending on where you mark the beginning. In the meantime, there will be plenty of false dawns and countertrend rallies that will siphon even more wealth from the unwary.

Don’t be among them.

Uh Oh.

PREVIEWMonday, December 10, 2007 (reprinted Saturday, March 15, 2008)

Executive Summary

- The credit bubble collapse is just getting started.

- Odds of a major systemic financial crisis now higher than ever.

- Dollar collapse is underway.

- Your opportunities to protect your assets are dwindling fast.

(Originally printed on 12-10-2007. Uncannily good predictions and recommendations, all of which I still stand by.)

The Great Credit Bubble, for which you can thank Alan Greenspan, is now in the process of bursting. While the US media implacably attempts to assure everyone that it is well contained or almost over, nothing could be further from the truth. As one financial commentator recently put it, "the good news is that the subprime crisis has been contained…to the planet earth."

The odds of a major systemic financial collapse are now higher than ever.

If you’ve seen the Crash Course (formerly the End of Money seminar), you know I’ve been concerned for a number of years about the toxic witch’s brew of poor-quality loans and unfathomably risky derivatives that are poisoning our financial body. Part of my concern stems from the fact that no matter how hard I try, I cannot understand how the derivatives markets work.

I’ve been unable to discover the most basic answers to the most basic questions, such as “how much capital is actually backing these things?” and “who’s holding the bag?” Wall Street and its ever-compliant financial propaganda services organizations (CNBC, WSJ, et al.) have maintained all along that these new products have completely eliminated risk by spreading it so thin that it has literally disappeared. I do not believe in financial alchemy, and I do not believe this version of ‘reality,’ because it makes no sense at all. Just as it made no sense to finance 19 houses to a part-time hairdresser in Las Vegas with subprime, negative amortization loans (true story), it makes no sense that this level of malinvestment could simply ‘disappear’.

The rest of my concern centers on the fact that 3,800 paper currencies in the past have all gone to money heaven due to the exact same formula of mismanagement that our fiscal and monetary authorities are applying to the US dollar. A few key warning signs would be, (1) bailing out the poor decisions of big banks by flooding the markets with hundreds of billions of dollars of public money/credit, and (2) conducting a pair of very expensive wars “off budget,” while (3) expanding your total monetary base at an astounding, banana-republic double digit percentage rate (as we discussed last time).

I won’t be disappointed if you tend to believe proclamations from the titans of Wall Street more than you would from some random guy named Chris. However, before you place too much faith on the possibility that those guys on Wall Street “must know what they are doing,” I would ask you to consider these facts:

Exhibit A:

Out of all the toxic subprime mortgages ever issued, the subprime loans with highest rates of default were made in the first 6 months of 2007 .

While you and I and everybody else had figured out that the subprime jig was up in 2005 or 2006, the Wall Street machinery couldn’t figure out how to stop what it was doing even as late as July of 2007. Titans or nitwits? You be the judge.

Exhibit B:

Rather than admit they made a bunch of really stupid loans, Wall Street banks first went straight to the US Treasury to mediate a bailout, and, when that proved to be too slow a course of action, simply hid the extent of their losses by massively abusing an obscure accounting gimmick .

Nov. 7 (Bloomberg) Banks may be forced to write down as much as $64 billion on collateralized debt obligations of securities backed by subprime assets, from about $15 billion so far, Citigroup analysts led by Matt King in London wrote in a report e-mailed today. The data exclude Citigroup’s own projected writedowns.

Under FASB terminology, Level 1 means mark-to-market, where an asset’s worth is based on a real price. Level 2 is mark-to-model, an estimate based on observable inputs which is used when no quoted prices are available. Level 3 values are based on “unobservable” inputs reflecting companies’ “own assumptions” about the way assets would be priced.

In other words, these so-called “Level 3” assets are balance-sheet entries that company management value at whatever they say they’re worth. This is like your drunk uncle claiming to be a millionaire because he said he found a lottery ticket in the gutter on the way home last night, but he won’t let anybody see it. The value of these so-called assets is entirely in the eye of the beholder, or bank management in this case, who has decided that they are ‘worth’ every penny that they paid for them and that’s how much they are going to continue insisting they are worth, thank you very much.

Exhibit C:

As the subprime derivative debacle was unfolding, what do you suppose was the response of Wall Street? If you guessed “doubling down,” you are a winner!

Nov. 22 (Bloomberg) — The market for derivatives grew at the fastest pace in at least nine years to $516 trillion in the first half of 2007, the Bank for International Settlements said.

Credit-default swaps, contracts designed to protect investors against default and used to speculate on credit quality, led the increase, expanding 49 percent to cover a notional $43 trillion of debt in the six months ended June 30, the BIS said in a report published late yesterday.

Wow. Wowowowowow. This is shocking. First, because of how hard it is to set new records for the “fastest pace” at the same time that you are setting records for the total amount. This would be like a weightlifter setting a new world record by adding 700 pounds to the old record. Second, because the specific types of derivatives that expanded the fastest were those designed to speculate on credit quality – the very area that is most at risk right now. So we now know that even as the credit debacle was so completely obvious that people returning from year-long wilderness solos knew something was wrong, Wall Street and Hedge Funds were busy accelerating the pace at which they continued to pursue these broken bets on shaky mortgages. Rather than sound fiscal prudence, this appears to be a last desperate grab for what few chips remained on the table.

It is possible that each individual transaction made a lot of sense to the hedge fund managers, but to outsiders like us they look foolish collectively. Why? Because when everybody is hedged, nobody is. Hedging is a zero-sum game. For somebody to win, somebody has to lose. So while all these smarty-pants were busy ‘hedging their risk away,’ nobody seems to have taken stock of the fact that the assets they were hedging were themselves seriously impaired and were going to result in massive losses for somebody. In short, it is impossible to hedge a failed system.

So, there are three perfectly good reasons to suspect that the captains of Wall Street are rather mortal after all and possibly even less competent than the average soul. I could give you forty more, but in the interest of time, I won’t, except to offer the best explanation I’ve ever read on how the derivative market works (PDF) and the human mechanisms at play that allowed all this to get so out of hand. This article will be well worth your time.

Systemic Banking Crisis?

If you own a house, odds are you carry fire insurance. Not because the chance of a house fire is particularly large, but because the cost of a house fire is catastrophic. You carry fire insurance because you have rightly calculated that (small chance) x (a big cost) = unacceptable risk. So you offset that risk with insurance.

Now I want you to seriously consider what the cost to you would be if there were the equivalent of a house fire in the banking system. I’m talking about a major system ‘freeze’ where banks close, huge losses spread throughout the system, electronic interbank transfers become impossible (ATMs, credit cards, electronic funds transfers, wires, and all the rest simply stop), and many banks and brokerages simultaneously go out of business. I’d imagine the impact to you would be quite large. So the next question is, what can/should mature, responsible adults do to insure themselves against such an outcome? How much time, energy and money should one dedicate to insuring one’s financial house?

When I started giving The End of Money seminar three years ago, I had put the possibility of this sort of event at about 15% to 20% over the next 5-10 years. It turns out that I was a raging optimist compared to some financial professionals such as this guy:

Nov. 13 (Bloomberg) — There’s a greater than 50 percent probability that the financial system "will come to a grinding halt" because of losses from mortgages, Gregory Peters, head of credit strategy at Morgan Stanley, said.

This is serious business especially now that the head of credit strategy at a major Wall Street bank is openly writing about it to their main clients. In fact, there are now many respected economists and financial professionals who are calling for a generalized systemic financial meltdown or a severe stock market decline. Even if you have no assets in the larger speculative financial markets (stocks and bonds), or have already taken steps to protect them by getting them out, you are still at risk if your assets are sitting in a risky bank. The possibility of massive bank failures is now a stark reality and it is my opinion that several are already insolvent, just not publicly (yet).

These sorts of crises always start at the edges and work in. First it was the shakier mortgage broker ‘bucket shops’ that began going under in late 2006. Then larger and seemingly firmer mortgage outfits began going under. Now more than 190 mortgage brokers, including most of the ‘top ten’, have gone bankrupt. And today not only is the very largest of them all (Countrywide Financial Corp) rumored to be a strong candidate for bankruptcy, the unthinkable seems to be unfolding before our very eyes. Both Fannie Mae and Freddie Mac, collectively holding several trillions of dollars worth of US mortgages and an even larger portfolio of associated interest rate derivatives, appear to be in some serious trouble . If either, or both, of these companies goes bust, it is highly unlikely (to me) that both the US banking system and the dollar could survive the event.

I am now putting out my strongest warning ever.

If you do not already own gold and/or silver, your time is running out. My best guess would be that once the world’s paper markets implode, the price of gold and silver will skyrocket to unimaginable and unreachable heights, if you can even locate any to buy. Get some.

By the time it is completely obvious that this is the right thing to do, you will find it difficult either due to price, availability, or both. Luckily, the world’s central banks are still capping the price of gold and silver, offering you a wonderful subsidy, which is really quite nice of them. Why do I advocate gold and silver? Simple. Because they are among the very few money-like assets that you can own (hold) that are not simultaneously somebody else’s liability. Consider that a bond (your asset) is the liability of a corporation or government. Even your checking account is your bank’s liability. A house owned free and clear would certainly qualify as a valuable asset, but a house is not very “money like.” When you go through the list (stocks, bonds, annuities, money-market accounts, etc), there is virtually no paper asset that you can identify that is not somebody else’s liability. Even a cash dollar is the liability of the Federal Reserve. But when you own physical precious metals (not mining shares or other paper claims), that’s the long and the short of it. It’s yours. Period.

Next, in order to protect from the possibility of a general banking ‘holiday’ (freeze), every family should have somewhere between one and six months worth of living expenses on hand in the form of cold, hard cash. You know, the bits of paper that work even if the ATMs and credit card readers do not. To be clear, I am not talking about cash in your checking account, I am talking about cash out of the bank and in your hands. Katrina, a natural storm, taught this lesson and we now need to apply that learning to the potential arrival of an economic storm.

Unfortunately, not very many people will be able to do this because the total cash available is a very small percentage of total deposits (~5%). Your bank will look at you funny when you take cash out, mainly because they do not have very much on hand at any given moment. If you plan to cash out more than a few thousand dollars, I highly recommend that you give your bank advance warning and thereby avoid the awkward social moment that will result when they have to tell you that they don’t actually have that much on hand. One thing to remember is that if you take out $10,000.00 or more of cash your bank is required to report you to the federal government via a SAR (Suspicious Activity Report). So the banks appreciate amounts smaller than that as it cuts down on the paperwork.

I would maintain a cash balance until we see clear signs that the evolving credit crisis is getting better, not worse. Given the latest data, which all point to a serious erosion of the credit markets, this could be awhile.

All that’s really happening here is that the long-awaited credit bust is finally upon us. It is important to remember that historically, bubbles have always deflated over approximately the same amount of time as they took to inflate. This means we are looking at a potential end to this crisis somewhere in the range of 2012 to 2020, depending on where you mark the beginning. In the meantime, there will be plenty of false dawns and countertrend rallies that will siphon even more wealth from the unwary.

Don’t be among them.