Integrity Bank Fails – FDIC Steps In (August 29 – AJC.com)

The Federal Deposit Insurance Corp. and state

regulators Friday shut down Integrity Bank, a troubled local lender

hurt by the real estate crisis.

Birmingham-based Regions

Financial will acquire Integrity’s $974 million in deposits, the FDIC

said. Integrity customers will have access to their accounts and no

interruption of service is expected, the FDIC said. Integrity’s five

branch offices will reopen Tuesday as Regions offices and customers can

continue to use those locations, the FDIC said.

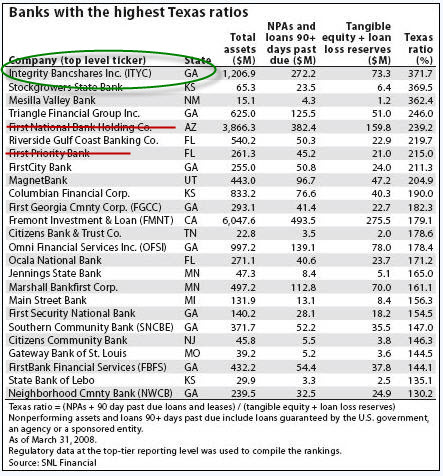

As ranked by its total assets of $1.1 billion, Integrity becomes the third-largest bank failure in Georgia history.

Another weekend and

another bank failure. The FDIC estimates that the cost to its Deposit

Insurance Fund will be between $250 million and $350 million. This was

no big surprise, as Integrity headed the Texas ratio bank list we’ve

been viewing for the past month (see below).

Also not a big

surprise here is that Integrity Bank is being investigated for fraud. I

make it a habit to stay away from enterprises that go out of their way

to bill themselves as honest, because there seems to be a shockingly

high chance of the opposite being true.

What did Shakespeare say? “Methinks the Senator doth protest too loudly?”