The markets were mixed for most of the week. However on Friday, there was a bit of a surprise rally in equities. Financial Entertainment News thought the pop on Friday was due to this:

That’s a very modest improvement over the 5.4% expectation earlier this month. In that same report, the consumer sentiment number came in at 50, which is a new all time low, vs last month’s reading of 58. This series goes back to the 1950s, and it does tend to be a predictor of where things are going next, so this new all time low is very bearish.

But timingwise, the sentiment numbers (10 a.m. Friday) did line up with a fairly brisk rally in equities, crappy debt, copper, and silver that started right at 10 a.m. I’m not sure what to make of it. “Rally on worst sentiment numbers ever” – really? Or was it on the 0.1% decline in inflation expectations? Or manipulation by “someone”? No idea.

Equities did move higher this week, rallying +6.45%, with half of the move happening on Friday right after that release. The candle print looked strong, the sector map was bullish (discretionary, sickcare, and tech were leaders), but does this really mark a low? Or is it just a dead cat bounce?

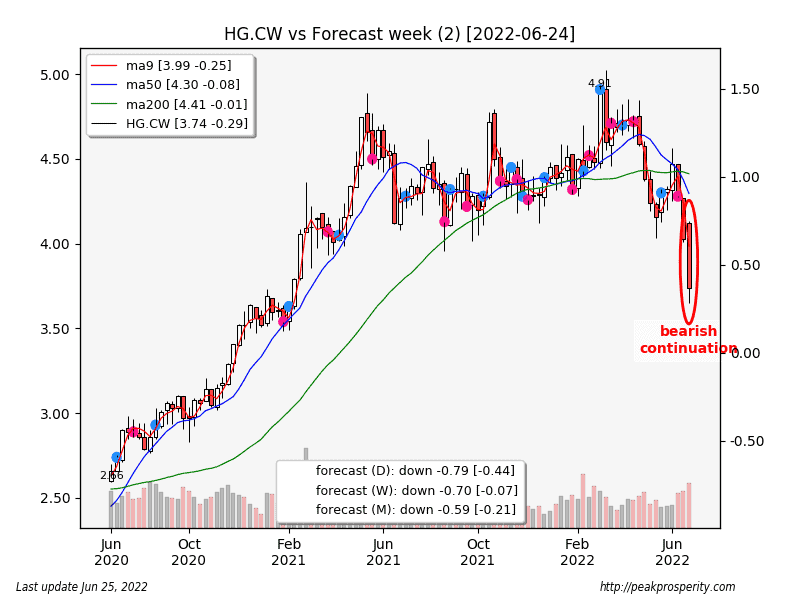

Let’s consult Doctor Copper. This week, copper fell for most of the week, losing -0.29 [-7.20%]. That’s a pretty bad week. While copper ended Friday flat, it wasn’t a bullish print. Copper’s downtrend remains quite strong, and the breakdown below support currently suggests: “dead cat bounce.”

Crude edged lower this week, falling -2.54 [-2.33%] to 106.34. Crude rallied on Friday, which erased what would have been half of crude’s weekly loss. Crude’s OI (blue line) remains quite low, which suggests to me that the banksters don’t really want to go short here, even with crude at near-decade highs. This hints at (probably) higher prices ahead. Higher crude = inflation.

And here’s the U.S. Strategic Petroleum Reserve (red line) & U.S.-non-SPR (black line) oil in storage. President Grandpa’s WEF-trained handlers are continuing to enthusiastically sell off the oil in our SPR, which we keep to help the nation deal with medium-term energy emergencies, at seven million barrels per week, but the U.S. commercial storage isn’t growing at all. The weekly-released SPR-crude is either being consumed in the U.S., or sold abroad. Emptying the SPR with no emergency is in service to the WEF-transnational goal: “the U.S. won’t be the sole superpower by 2030.” No energy = no civilization.

Gold moved down -11.27 [-0.61%] to 1838.30 with most of the loss coming on Thursday. The OI for gold remains quite low, and it fell this week, which continues to suggest we are closer to a low for gold than a high. At the very least, the banksters are not piling in short, which they tend to do at the highs.

The buck dropped -0.56 [-0.54%] on the week; this was a relatively quiet currency market this week, at least from the USD perspective. The buck remains quite close to a multi-decade high – last time we were here was back in 2003.

Same thing (in reverse) for the Euro; the Euro is just above (104) support. If the Euro drops through support, it will worsen the inflation situation for our friends across the pond. Let’s hope peace breaks out in Ukraine before that happens.

For the most part, it was an uneventful week in the markets, although based on Doctor Copper’s continuing decline, I think the “risk” downtrend remains firmly in place.

“Outside, In”:

- Sri Lankan economy has ‘completely collapsed’, leader says. “The country of 22 million people is struggling with its worst economic crisis in seven decades.” I’m guessing the economic hitmen are landing in force.

- Goldman sees Turkey inflation of near 80% before relief comes. USD/TRY now 16.86; Jan 2021 it was 7.43. It has been chopped more than in half. Turkish central bank rate = 14% for an inflation rate heading to 80%.

- Violent clashes continue in Ecuador over rising food and gas prices. “…the capital city of Quito is virtually paralyzed as clashes with police continue into their second week.”

“Health”: The Narrative

- Americans Are Wasting Billions Every Year on Useless Supplements, Scientists Warn. “Unfortunately, based on the existing evidence, the Task Force cannot recommend for or against the use of most vitamins and minerals and is calling for more research,” says USPSTF interim chief scientific officer John Wong. Related: Fauci himself takes vitamin D, but can’t find enough evidence to recommend it to You and Me. Result: hundreds of thousands of people died.

- Gay and bisexual men WILL be offered monkeypox vaccine in targeted rollout. “UK steps up efforts to thwart outbreak amid warning it could get 10 TIMES bigger as health chiefs log another 200 cases.” UK: 793 cases, Spain: 497, Germany: 421, Portugal: 297. Average age: 37. Still no deaths.

- 20 million lives saved by COVID-19 vaccines in first year: report. “More than 4.3 billion people received an inoculation, saving 20 million lives, according to research published Thursday in the journal Lancet Infectious Diseases.” Since Pfizer’s own data [page 12] show that the shots kill more than they save, this suggests the shots have killed more than 20 million people. If only we had decided to employ early treatment instead of forced vaccination.

-

Shanghai Coronavirus Lockdown Ends After 65 Days and Millions Celebrate. Yay! All safe. At least until the next lockdown.

“Health”: Cracks in the Dam

- Deborah Birx had a tough day in congress; “hope” is no basis for health mandates or treatment policy [bad cattitude]. jj: “when the government told us the vaccinated could not transmit it (covid), was that a lie or a guess?” db: “i think it was hope”. Jim Jordan (jj) appears to have awakened.

- BREAKING: Austria to scrap mandatory Covid vaccination law. Note: Law suspended in March – now scheduled to be eliminated August 31st. Resistance is not futile.

- WHO and Lancet Commission Chiefs Come Out in Support of Lab Leak Theory.

- What Joe Biden Said About a ‘Second Pandemic’.

- Danish national board of health admits vaccinating kids for covid was a mistake [bad cattitude] “But what we have to hold on to is that there has been no damage from it.” They haven’t acknowledged the SAEs yet; we’re halfway to the truth.

Inflation:

- How it started: Biden praises high gas prices as part of ‘incredible transition’.

- How it is going: Biden to call for 3-month suspension of gas and diesel taxes.

- Powell tells Congress the Fed is ‘strongly committed’ on inflation, notes recession is a ‘possibility’. I’m old enough to remember when inflation was gonna be “transitory.” And now we hear that a recession is just a “possibility”?

Ukraine:

- Ukrainian forces retreating from eastern city Sievierodonetsk to avoid being encircled by Russians. “Russia controls around 95% of the Luhansk province and around 50% of the neighboring Donetsk province.”

- Ukraine must agree a peace deal with Russia. But at what price? The article points out that more guns won’t win the war; they just prolong it.

- EU plans for life without Russian gas amid inflation spike. “The EU relied on Russia for as much as 40% of its gas needs before the war – rising to 55% for Germany – leaving a huge gap to fill in an already tight global gas market.” Good luck with that.

- Russia and China are brewing up a challenge to dollar dominance by creating a new reserve currency. Actually, this challenge is composed of the BRICS nations (Brazil, Russia, India, China, and South Africa) not just Russia and China. Has the WEF been able to penetrate these BRICS cabinets with their flock of Young Global Leaders? My sense is no. I can just imagine Engineer Xi, or Putin’s response to such an attempt. This currency challenge is an unintended (but foreseeable) consequence of the West attempting to impose “sanctions” on Mister Price Hike Putin.