As bad as the US is, there are worse problems elsewhere. This is why I think this credit crisis will not play out like any previously and why I think there’s a better than even chance of a systemic banking crisis.

In times past when a country experienced a bubble or a banking crisis, there was always a country next door that hadn’t where the savvy could hide out. Where does one hide out today?

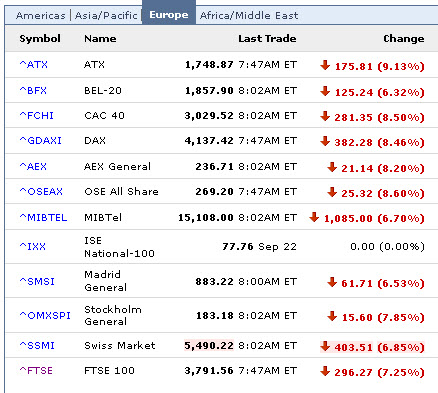

Europe on the brink of currency crisis meltdown

The financial crisis spreading like wildfire across the former Soviet bloc threatens to set off a second and more dangerous banking crisis in Western Europe, tipping the whole Continent into a fully-fledged economic slump.Currency pegs are being tested to destruction on the fringes of Europe’s monetary union in a traumatic upheaval that recalls the collapse of the Exchange Rate Mechanism in 1992.

“This is the biggest currency crisis the world has ever seen,” said Neil Mellor, a strategist at Bank of New York Mellon.

Stephen Jen, currency chief at Morgan Stanley, says the emerging market crash is a vastly underestimated risk. It threatens to become “the second epicentre of the global financial crisis,” this time unfolding in Europe rather than America.

Austria’s bank exposure to emerging markets is equal to 85pc of GDP – with a heavy concentration in Hungary, Ukraine, and Serbia – all now queuing up (with Belarus) for rescue packages from the International Monetary Fund.

Exposure is 50pc of GDP for Switzerland, 25pc for Sweden, 24pc for the UK, and 23pc for Spain. The US figure is just 4pc. America is the staid old lady in this drama.

Those figures in the bottom two paragraphs are quite the eye-openers. Somehow Austria’s bank system loaned out 85% of Austria’s GDP to emerging markets that are even now resorting to emergency measures to stem the erosion of the their currencies against the dollar. The problem, apparently, is that these countries were loaned vast amounts of money denominated in dollars. The faster their currencies fall, the more it costs them to pay back their loans.

Some of these currencies have fallen by 40% in a matter of weeks.

International instability

by Chris MartensonAs bad as the US is, there are worse problems elsewhere. This is why I think this credit crisis will not play out like any previously and why I think there’s a better than even chance of a systemic banking crisis.

In times past when a country experienced a bubble or a banking crisis, there was always a country next door that hadn’t where the savvy could hide out. Where does one hide out today?

Europe on the brink of currency crisis meltdown

The financial crisis spreading like wildfire across the former Soviet bloc threatens to set off a second and more dangerous banking crisis in Western Europe, tipping the whole Continent into a fully-fledged economic slump.Currency pegs are being tested to destruction on the fringes of Europe’s monetary union in a traumatic upheaval that recalls the collapse of the Exchange Rate Mechanism in 1992.

“This is the biggest currency crisis the world has ever seen,” said Neil Mellor, a strategist at Bank of New York Mellon.

Stephen Jen, currency chief at Morgan Stanley, says the emerging market crash is a vastly underestimated risk. It threatens to become “the second epicentre of the global financial crisis,” this time unfolding in Europe rather than America.

Austria’s bank exposure to emerging markets is equal to 85pc of GDP – with a heavy concentration in Hungary, Ukraine, and Serbia – all now queuing up (with Belarus) for rescue packages from the International Monetary Fund.

Exposure is 50pc of GDP for Switzerland, 25pc for Sweden, 24pc for the UK, and 23pc for Spain. The US figure is just 4pc. America is the staid old lady in this drama.

Those figures in the bottom two paragraphs are quite the eye-openers. Somehow Austria’s bank system loaned out 85% of Austria’s GDP to emerging markets that are even now resorting to emergency measures to stem the erosion of the their currencies against the dollar. The problem, apparently, is that these countries were loaned vast amounts of money denominated in dollars. The faster their currencies fall, the more it costs them to pay back their loans.

Some of these currencies have fallen by 40% in a matter of weeks.