Tuesday, September 23, 2008

In this report, I delve into the bailout plan and why it is destined to fail, no matter how it is configured. It is important that you at least consider the possibility that it very well could fail, with disastrous consequences for the dollar and the continued operation of the US government in its current form.

“See, you know the way a bailout works? Here’s the way a bailout works. A failed president and a failed Congress invest $700 billion of your money in failed businesses. Believe me, this can’t fail.”

~ Jay Leno

The recently proposed bailout of failed Wall Street banks represents the most brazen attempt at grand larceny ever in our nation’s history. Some have even likened it to financial terrorism, because Wall Street went so far as to repeatedly say; “Either we get this bailout or the entire system goes under.”

This echoes, more or less precisely, what happened in the years after Ronald Reagan deregulated the S&L industry in 1982. Within a few short years, excesses and fraud were rampant within the system, and taxpayers were forced to cover the inevitable bust that followed. Many well-connected individuals made out like bandits on sweetheart deals meted out by the Resolution Trust Corporation (RTC).

But this crisis, which has been presented as if it caught everyone by surprise, was no surprise at all. It was years in the making, and the response was carefully planned over the past year. The bailout proposal, as originally presented (on Sat. 9/20/08), was shocking.

First, there was the sneaky language that the $700 billion figure was the most that could be spent at any one time, meaning that there was no limit on the spending at all. Second, the right of review by any court of law or other administrative body was to be stripped away, a distinctly unconstitutional and anti-American provision if ever there was one. Third, the Treasury Secretary was to be embodied with complete unitary power in selecting who was to be empowered with an open-ended taxpayer checkbook.

No review, no limits, no questions.

So what happens when you have vague language and an unlimited budget? Fraud and self-dealing, that’s what. Mark my words, this is the largest looting operation ever in the history of the US, and it’s all spelled out right there in the delightfully brief bailout document that Paulson and Bernanke are attempting to ram through a scared Congress.

Folks, if it looks like a looting operation, smells like a looting operation, and acts like a looting operation, it’s a looting operation.

There are some in Washington DC who ‘get it,’ including Bernie Sanders, who recently stated:

[quote] “While the middle class collapses, the richest people in this country have made out like bandits and have not had it so good since the 1920s. […] The wealthiest people, who have benefited from Bush’s policies and are in the best position to pay, are being asked for no sacrifice at all. This is absurd. This is the most extreme example that I can recall of socialism for the rich and free enterprise for the poor.” [/quote]

Hopefully, for the sake of justice, the bailout will be significantly modified prior to passage.

However, it won’t really matter much in the end, because there is no possible way for any bailout to succeed, no matter how it’s configured.

Three simple truths

Instead, there are three simple truths that have to be recognized, if we are to navigate our way through this crisis:

- The United States government is insolvent.

- The entire US financial system is insolvent.

- There is no combination of new debt/borrowing schemes that can possibly correct #1 and #2.

The first rule of life is, “When you are in a hole, stop digging.” The past 25 years have witnessed the greatest accumulation of debt ever recorded by our nation. That is our hole. Yet our current leaders have ordered a backhoe and promised to use it.

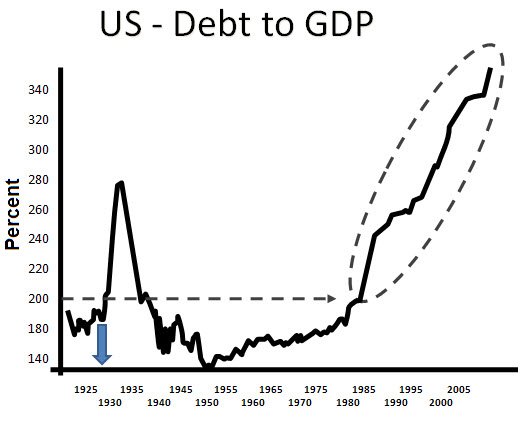

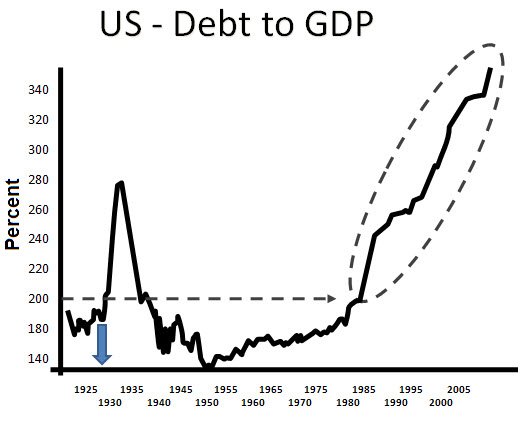

Figure 1: This chart compares total debt (or ‘credit’) in the US to GDP (or Gross Domestic Product) on a percentage basis. Current total credit market debt stands at more than 340% of total GDP. As we can see on this chart, the last time debts got even remotely close to current levels was back in the 1930’s, and that bears a bit of explanation. The debt-to-GDP ratio back then didn’t start to climb until after 1929 (solid arrow), because debts remained relatively fixed in size, while it was the GDP that fell away from under the debts. With the exception of the Great Depression anomaly, our country always held less than 200% of our GDP in debt (gray dotted arrow). In 1985 we violated that barrier and never looked back. What each of us knows to be “just how the economy works” is really a historically unusual experiment with debt that is barely 25 years old. In the sweep of economic history, this barely qualifies as a blink.

This 25-year-long borrowing binge has so badly distorted our collective sense of right from wrong that we no longer seem capable of setting simple priorities. The consideration by Washington DC of a $700 billion bailout proposal in the same week that it passed a record-setting $612 billion defense budget is a perfect example of this dynamic. No trade-offs mentioned; “Yes, we’ll have one of everything” is the reigning mentality.

Our first challenge in confronting this crisis

This crisis is fundamentally one of insolvency (definition below), not a failure to have enough dollars floating around, which means that it is not a liquidity crisis.

Definitions:

• Insolvency. A condition where one’s assets are exceeded by one’s liabilities to an insurmountable extent. Distinct from bankruptcy, which is a legal event precipitated by a final inability of cash flow to continue to carry an insolvent entity any further. Insolvency nearly always precedes bankruptcy.

• Liquidity. A measure of how much money exists in a useable form. A person with a $10 million house but no money in the bank is said to be “illiquid,” not “poor” or “broke.” A “liquid” market, like the stock market, offers a reliable and fast way to exchange assets for money. When the Fed is said to be adding “liquidity,” they are taking assets from banks in exchange for cash.

The institutions in question are as insolvent as a minimum-wage janitor trying to make payments on a $2 million beachfront house using only his earnings. The aggressive lowering of interest rates by the Fed in their attempt to help provide liquidity to the banks was like assuring that the janitor’s checks cleared at the bank a little faster. But improving liquidity did not help. It couldn’t, because the problem was one of solvency, not liquidity.

But if liquidity won’t do the trick, what will?

Here we must face the hard truth that merely transferring the failed loans from the insolvent banks to an insolvent nation will do nothing but forestall the problem until a slightly later date (when it will be larger and more severe, by the way). The fact that both candidates for president are openly supporting the bailout says that reality has not yet penetrated the inner beltway.

So the first challenge will be recognizing that it really is not possible for an insolvent nation to bail out an insolvent financial system by borrowing more money. This is an absurd notion, and in total it really is no more and no less complicated than that. One cannot solve a crisis rooted in debt by issuing more debt.

Our second challenge in confronting this crisis

On September 23rd, 2008, before the Senate banking committee, Bernanke said, “I believe if the credit markets are not functioning, that jobs will be lost, the unemployment rate will rise, more houses will be foreclosed upon, GDP will contract, that the economy will just not be able to recover.”

The palpably strong desire by the current politicians to “get the economy back on track” and to immediately return (if possible) to maximum consumption is absolutely the wrong response at this moment in history. We do not need to return to our borrow-and-borrow-more ways of the past. We desperately do need to demonstrate awareness that the future is loaded with challenges that only grow larger and more urgent with time. None of these challenges, ranging from energy dependence, to population, to a broken entitlement and pension system, will be helped by a return to our former credit-dependent ways. In fact, they will be exacerbated.

So our second challenge is to recognize that our first instincts to repair a broken system are wrong.

Instead, we need to have an honest accounting of our current economic condition, matched against the very real warning signs that our consumptive lifestyle is due for a radical overhaul. If we miss this chance to level with ourselves, we will have squandered an enormous opportunity.

Your biggest challenge

Recently, Senator Chris Dodd (CT) stated, “[W]e’re literally maybe days away from a complete meltdown of our financial system, with all the implications here at home and globally.” I know that the temptation is to trust that somehow these big players on Wall Street and in Washington DC have this all under control, or that they will fashion something workable to tide us over for a while. While they might be able to limp this along for a while longer, it might also fail sometime next Tuesday, and it will certainly fail sooner or later. When our economy finally suffers a complete meltdown, the resulting calamity will be as individually dramatic to each of us as if our homes burned to the ground. Your challenge is to accept that this crisis is fundamentally “unfixable” and that wherever the future takes us, it will not be a simple continuation of the past. With this acceptance, the challenge becomes assessing what might happen and what you can do about it.

Okay, so now what?

The immediate risk that I see here centers on a collapse in the international value of the dollar, which will rapidly morph into a massive financial crisis for the federal government. When all is said and done, I fully expect the federal government to be half its current size, with states, to varying degrees of success, picking up the slack as best they can.

The chance that the US dollar will go into a steep decline from here is very high. I personally place the risk that a major dollar decline will ensue within the next 6 months at 50%. Here’s how that would play out.

In its full wisdom, while times were good, the US government opted largely to finance itself with short-term debt in the form of 3 month and 6 month “T-Bills.” In essence, because these T-Bills ‘roll over’ every 3 or 6 months at whatever the current interest rate is, the US government opted to finance itself with an Adjustable Rate Mortgage (ARM). Hold onto that thought.

Now that the government has embarked on a course of massive deficit spending that is sure to top $1 trillion next year (and possibly go as high as $2 trillion), this money will have to either be borrowed from overseas or printed out of thin air by the Federal Reserve. In either case, there is a very high probability that either/both of these actions will cause interest rates to climb, possibly quite steeply and suddenly.

And here is where the “vicious spiral” comes into play, exacerbated by the short-term (ARM-like) borrowing stance described earlier. The more the government needs to borrow, the higher interest rates will go. The higher that interest rates go, the greater the need to borrow. So more borrowing begets higher interest rates, which beget more borrowing, which beget higher interest rates, which….ah, you get the idea.

If (or when) this dynamic gets started, its self-reinforcing nature will cause both the dollar to collapse in value and interest rates to shoot upwards. Either of these effects alone would provide a serious hit to our debt-based way of life, but together they promise to deliver earth-shaking changes to those who are unprepared. Concurrent with this death-spiral for the dollar will come massive (hyper?) inflation of imported goods, the most important of which, to our daily lives, will be oil. Gasoline at $10 or even $50 per gallon is not unthinkable.

This means that you, individually, need to begin thinking about ways to economically insulate yourself from this possibility, as does each state in the union.

My advice to you is the same as it has been for months.

- Trim your expenses as far as humanly possible.

- Don’t take on any more debt for any circumstances, unless you are speculating and can manage the risks.

- Hold gold and silver, physical only. How much? That depends on how many of your US-dollar-denominated holdings you’d like to be absolutely sure do not go to zero.

- Keep cash out of the bank. Three months’ living expenses, if you can.

- Develop a sense of community, and get to know the people you can count on and who will count on you.

- When you can, keep things topped off around the home. You never know.

I laid out my investment thoughts back in May, which you should read when you get the chance. That Martenson Report is titled Charting a Course Through the Recession and is free to registered users.

The Greatest Looting Operation in History

PREVIEW by Chris MartensonTuesday, September 23, 2008

In this report, I delve into the bailout plan and why it is destined to fail, no matter how it is configured. It is important that you at least consider the possibility that it very well could fail, with disastrous consequences for the dollar and the continued operation of the US government in its current form.

“See, you know the way a bailout works? Here’s the way a bailout works. A failed president and a failed Congress invest $700 billion of your money in failed businesses. Believe me, this can’t fail.”

~ Jay Leno

The recently proposed bailout of failed Wall Street banks represents the most brazen attempt at grand larceny ever in our nation’s history. Some have even likened it to financial terrorism, because Wall Street went so far as to repeatedly say; “Either we get this bailout or the entire system goes under.”

This echoes, more or less precisely, what happened in the years after Ronald Reagan deregulated the S&L industry in 1982. Within a few short years, excesses and fraud were rampant within the system, and taxpayers were forced to cover the inevitable bust that followed. Many well-connected individuals made out like bandits on sweetheart deals meted out by the Resolution Trust Corporation (RTC).

But this crisis, which has been presented as if it caught everyone by surprise, was no surprise at all. It was years in the making, and the response was carefully planned over the past year. The bailout proposal, as originally presented (on Sat. 9/20/08), was shocking.

First, there was the sneaky language that the $700 billion figure was the most that could be spent at any one time, meaning that there was no limit on the spending at all. Second, the right of review by any court of law or other administrative body was to be stripped away, a distinctly unconstitutional and anti-American provision if ever there was one. Third, the Treasury Secretary was to be embodied with complete unitary power in selecting who was to be empowered with an open-ended taxpayer checkbook.

No review, no limits, no questions.

So what happens when you have vague language and an unlimited budget? Fraud and self-dealing, that’s what. Mark my words, this is the largest looting operation ever in the history of the US, and it’s all spelled out right there in the delightfully brief bailout document that Paulson and Bernanke are attempting to ram through a scared Congress.

Folks, if it looks like a looting operation, smells like a looting operation, and acts like a looting operation, it’s a looting operation.

There are some in Washington DC who ‘get it,’ including Bernie Sanders, who recently stated:

[quote] “While the middle class collapses, the richest people in this country have made out like bandits and have not had it so good since the 1920s. […] The wealthiest people, who have benefited from Bush’s policies and are in the best position to pay, are being asked for no sacrifice at all. This is absurd. This is the most extreme example that I can recall of socialism for the rich and free enterprise for the poor.” [/quote]

Hopefully, for the sake of justice, the bailout will be significantly modified prior to passage.

However, it won’t really matter much in the end, because there is no possible way for any bailout to succeed, no matter how it’s configured.

Three simple truths

Instead, there are three simple truths that have to be recognized, if we are to navigate our way through this crisis:

- The United States government is insolvent.

- The entire US financial system is insolvent.

- There is no combination of new debt/borrowing schemes that can possibly correct #1 and #2.

The first rule of life is, “When you are in a hole, stop digging.” The past 25 years have witnessed the greatest accumulation of debt ever recorded by our nation. That is our hole. Yet our current leaders have ordered a backhoe and promised to use it.

Figure 1: This chart compares total debt (or ‘credit’) in the US to GDP (or Gross Domestic Product) on a percentage basis. Current total credit market debt stands at more than 340% of total GDP. As we can see on this chart, the last time debts got even remotely close to current levels was back in the 1930’s, and that bears a bit of explanation. The debt-to-GDP ratio back then didn’t start to climb until after 1929 (solid arrow), because debts remained relatively fixed in size, while it was the GDP that fell away from under the debts. With the exception of the Great Depression anomaly, our country always held less than 200% of our GDP in debt (gray dotted arrow). In 1985 we violated that barrier and never looked back. What each of us knows to be “just how the economy works” is really a historically unusual experiment with debt that is barely 25 years old. In the sweep of economic history, this barely qualifies as a blink.

This 25-year-long borrowing binge has so badly distorted our collective sense of right from wrong that we no longer seem capable of setting simple priorities. The consideration by Washington DC of a $700 billion bailout proposal in the same week that it passed a record-setting $612 billion defense budget is a perfect example of this dynamic. No trade-offs mentioned; “Yes, we’ll have one of everything” is the reigning mentality.

Our first challenge in confronting this crisis

This crisis is fundamentally one of insolvency (definition below), not a failure to have enough dollars floating around, which means that it is not a liquidity crisis.

Definitions:

• Insolvency. A condition where one’s assets are exceeded by one’s liabilities to an insurmountable extent. Distinct from bankruptcy, which is a legal event precipitated by a final inability of cash flow to continue to carry an insolvent entity any further. Insolvency nearly always precedes bankruptcy.

• Liquidity. A measure of how much money exists in a useable form. A person with a $10 million house but no money in the bank is said to be “illiquid,” not “poor” or “broke.” A “liquid” market, like the stock market, offers a reliable and fast way to exchange assets for money. When the Fed is said to be adding “liquidity,” they are taking assets from banks in exchange for cash.

The institutions in question are as insolvent as a minimum-wage janitor trying to make payments on a $2 million beachfront house using only his earnings. The aggressive lowering of interest rates by the Fed in their attempt to help provide liquidity to the banks was like assuring that the janitor’s checks cleared at the bank a little faster. But improving liquidity did not help. It couldn’t, because the problem was one of solvency, not liquidity.

But if liquidity won’t do the trick, what will?

Here we must face the hard truth that merely transferring the failed loans from the insolvent banks to an insolvent nation will do nothing but forestall the problem until a slightly later date (when it will be larger and more severe, by the way). The fact that both candidates for president are openly supporting the bailout says that reality has not yet penetrated the inner beltway.

So the first challenge will be recognizing that it really is not possible for an insolvent nation to bail out an insolvent financial system by borrowing more money. This is an absurd notion, and in total it really is no more and no less complicated than that. One cannot solve a crisis rooted in debt by issuing more debt.

Our second challenge in confronting this crisis

On September 23rd, 2008, before the Senate banking committee, Bernanke said, “I believe if the credit markets are not functioning, that jobs will be lost, the unemployment rate will rise, more houses will be foreclosed upon, GDP will contract, that the economy will just not be able to recover.”

The palpably strong desire by the current politicians to “get the economy back on track” and to immediately return (if possible) to maximum consumption is absolutely the wrong response at this moment in history. We do not need to return to our borrow-and-borrow-more ways of the past. We desperately do need to demonstrate awareness that the future is loaded with challenges that only grow larger and more urgent with time. None of these challenges, ranging from energy dependence, to population, to a broken entitlement and pension system, will be helped by a return to our former credit-dependent ways. In fact, they will be exacerbated.

So our second challenge is to recognize that our first instincts to repair a broken system are wrong.

Instead, we need to have an honest accounting of our current economic condition, matched against the very real warning signs that our consumptive lifestyle is due for a radical overhaul. If we miss this chance to level with ourselves, we will have squandered an enormous opportunity.

Your biggest challenge

Recently, Senator Chris Dodd (CT) stated, “[W]e’re literally maybe days away from a complete meltdown of our financial system, with all the implications here at home and globally.” I know that the temptation is to trust that somehow these big players on Wall Street and in Washington DC have this all under control, or that they will fashion something workable to tide us over for a while. While they might be able to limp this along for a while longer, it might also fail sometime next Tuesday, and it will certainly fail sooner or later. When our economy finally suffers a complete meltdown, the resulting calamity will be as individually dramatic to each of us as if our homes burned to the ground. Your challenge is to accept that this crisis is fundamentally “unfixable” and that wherever the future takes us, it will not be a simple continuation of the past. With this acceptance, the challenge becomes assessing what might happen and what you can do about it.

Okay, so now what?

The immediate risk that I see here centers on a collapse in the international value of the dollar, which will rapidly morph into a massive financial crisis for the federal government. When all is said and done, I fully expect the federal government to be half its current size, with states, to varying degrees of success, picking up the slack as best they can.

The chance that the US dollar will go into a steep decline from here is very high. I personally place the risk that a major dollar decline will ensue within the next 6 months at 50%. Here’s how that would play out.

In its full wisdom, while times were good, the US government opted largely to finance itself with short-term debt in the form of 3 month and 6 month “T-Bills.” In essence, because these T-Bills ‘roll over’ every 3 or 6 months at whatever the current interest rate is, the US government opted to finance itself with an Adjustable Rate Mortgage (ARM). Hold onto that thought.

Now that the government has embarked on a course of massive deficit spending that is sure to top $1 trillion next year (and possibly go as high as $2 trillion), this money will have to either be borrowed from overseas or printed out of thin air by the Federal Reserve. In either case, there is a very high probability that either/both of these actions will cause interest rates to climb, possibly quite steeply and suddenly.

And here is where the “vicious spiral” comes into play, exacerbated by the short-term (ARM-like) borrowing stance described earlier. The more the government needs to borrow, the higher interest rates will go. The higher that interest rates go, the greater the need to borrow. So more borrowing begets higher interest rates, which beget more borrowing, which beget higher interest rates, which….ah, you get the idea.

If (or when) this dynamic gets started, its self-reinforcing nature will cause both the dollar to collapse in value and interest rates to shoot upwards. Either of these effects alone would provide a serious hit to our debt-based way of life, but together they promise to deliver earth-shaking changes to those who are unprepared. Concurrent with this death-spiral for the dollar will come massive (hyper?) inflation of imported goods, the most important of which, to our daily lives, will be oil. Gasoline at $10 or even $50 per gallon is not unthinkable.

This means that you, individually, need to begin thinking about ways to economically insulate yourself from this possibility, as does each state in the union.

My advice to you is the same as it has been for months.

- Trim your expenses as far as humanly possible.

- Don’t take on any more debt for any circumstances, unless you are speculating and can manage the risks.

- Hold gold and silver, physical only. How much? That depends on how many of your US-dollar-denominated holdings you’d like to be absolutely sure do not go to zero.

- Keep cash out of the bank. Three months’ living expenses, if you can.

- Develop a sense of community, and get to know the people you can count on and who will count on you.

- When you can, keep things topped off around the home. You never know.

I laid out my investment thoughts back in May, which you should read when you get the chance. That Martenson Report is titled Charting a Course Through the Recession and is free to registered users.