We have a Fed meeting Wednesday; this week, there was no material change in rate increase projection from the futures markets: a roughly 81% chance of a 75 basis point rate increase, with more rate increases projected to come after that. (Source)

The European Central Bank actually did raise rates 50 bp this week, for the first time in 11 years; negative rates (a gift to Europe from Technocrat Draghi, who promised to “do whatever it takes”) are now a thing of the past. Wolf Richter has a good analysis (Source), which includes a new ECB “glue gun” (Wolf’s term) that attempts to make sure the rate increase won’t cause the probably-bankrupt Italian government (debt/GDP: 151%) bond yields to end up in the stratosphere while Germany’s (debt/GDP: 69%) bond yields remains near-zero, which might end up pushing Italy out of the EU. Guess how the ECB plans to make this work? Basically its selective QE. ECB will sell all its German bonds, and hoover up Italian bonds until those pesky Italian rates drop dutifully to where the ECB wants them to be. Another win for technocracy – a “vaccine passport” for near-bankrupt EU member bond rates.

Note that the ECB will give Italy a spanking by yanking the glue-gun if it spends too much. The EU bureaucrats also plan to bribe Italy with a trickle of money if they “do the right thing”. Its all very complicated, but it ends up with the unelected EU-Technocrats deciding what’s best for the widely divergent EU member nations once more. How long will central planning continue to work? Especially with the intensely unpopular “wartime inflation” caused by the EU member nations all jumping headlong into war? A good question.

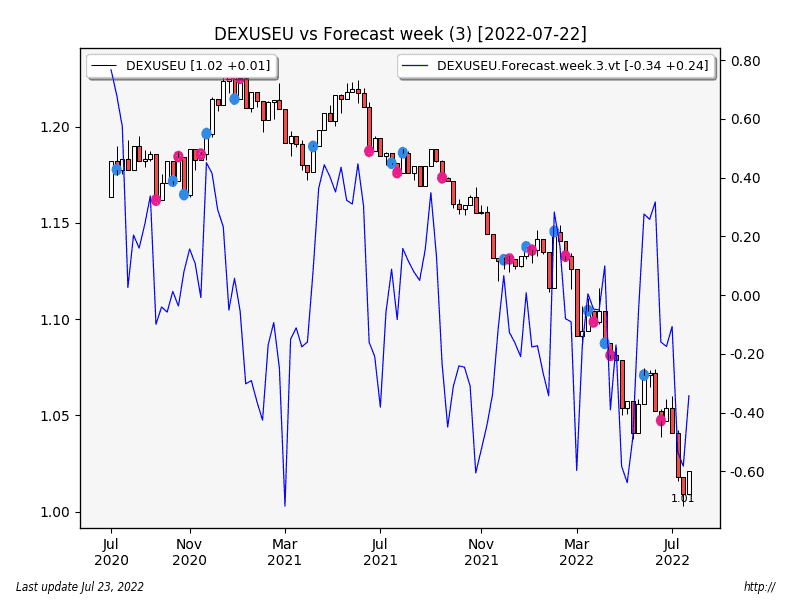

The 50 bp rate increase seemed to cause a modest Euro rally this week.

The current U.S. (and EU) inflation is comprised of a combination of “shortage inflation” along with “money-printing inflation.” When the Central Bank prints money, hands it to the banksters, who then go off and buy assets, that’s money-printing inflation. The Central Bank can easily turn this off whenever it likes – through rate increases, and quantitative tightening. Both the Fed and the ECB appear to be doing some of this tightening now.

However, when there are shortages of some important item (say – labor, due to widespread vaccine injury, or oil, due to peak production and/or “sanctions on Russia”, or food due to technocracy-dictated “climate change” fertilizer use restrictions) then the Central Bank policy has no control over this. Will Fed interest rate increases help bring those disabled people back into the labor force? Will the rate increases result in more oil production? More food production? No. Rate changes/money printing do not control “shortage inflation”.

The only way rate increases help address shortages is by demand destruction; enough rate increases might crush the overall economy so badly that the need for additional labor falls off, and/or the demand for oil too. If oil = economy, and massive rate increases crush the economy, that will eventually lead to a lower demand for oil. Note that rising oil prices do this too. If that’s the strategy, it will require a whole lot of rate-increase economic damage for this to work.

(Just parenthetically – at some point, when the widespread vax injury becomes public knowledge, the pressure will become intense to provide government support for the vax injured, many of whom were coerced into taking the shot by that same government. Take the U.S.: three million people times (say) $50,000/year for disability and another $50,000/year for treatment? That’s $300 billion annually. And subtract the vax-injured people’s contribution from GDP while you’re at it. Pharma/sickcare/government needs everyone to get vaxxed, and then get boosted a whole bunch of times! Then We the People get to pay to fix the damage! Sickcare wins coming and going! Perhaps that’s Pharma’s next harvesting plan? Vax injury advertisements on late-nite TV? “Were YOU or someone you LOVE injured in the Biden vax campaign?” I digress.)

Martin Armstrong explained Europe’s debt issues in the following 40-minute interview with Greg Hunter (Source). A thumbnail: in many EU countries, like Italy, the sovereign debt is unpayable. What’s worse is that the pension funds (which need 8% returns annually) were required by law to hold a lot of this debt, which has been yielding 0% for the past 11 years (thanks to Technocrat Draghi!). So, they’re way, way underfunded too. So, if nothing changes, at some point: No Pension For You, EU citizen. The “fix”? According to Armstrong: a war, a new monetary system, a “Great Reset”, with the pension losses blamed on the war. “Putin took your pension!” Along with “climate change.” You’ll own nothing. Will you be happy? Depends on your ESG score, I’m guessing.

The removal of oil from the U.S. Strategic Petroleum Reserve continued a bit more slowly this week; “just” five million barrels. No reason was given for the continued SPR drain. It’s as if we’re all in a jetliner, and the Captain’s flunky comes by periodically and releases emergency oxygen from the air tanks “just because.” How would you feel if you were a passenger? “Hey flunky! Shouldn’t you be saving this emergency oxygen supply so we can all breathe during an actual emergency?” It’s almost as if the flunky wants us dead. Or just doesn’t care. Or something.

At the current drain rate of 5m barrels/week, You and Me have 96 weeks left before the SPR is completely dry. And while President Grandpa flew off this week to grovel at the feet of former-pariah Saudi ruler MBS to get more oil, it was to no avail. After the probable-covid-laden fist-bump, MBS said something about “peak oil has arrived”, as Chris has pointed out. Uh oh. The U.S. might need that SPR oil sooner than we think. Maybe someone should tell the Biden-flunky to cease and desist draining the economic oxygen from our emergency tanks prior to an actual oxygen emergency appearing?

For recession indicators – the 10-1 (10-year minus 1-year) yield remains inverted – meaning it has dropped below 0 and is still there. This indicator has done reasonably well at predicting a recession (red line) in the offing. Curiously, it is when the 10-1 yield returns back to positive territory after plunging below 0% which seems to be the signal that the recession is about to hit. That hasn’t happened yet.

We also got an update for the Margin Debt data, which has continued to plunge, losing 10% of its total value this month alone. This really looks awful; comparing today with 2008, we could easily be in a recession right now based on this number. The leveraged players are racing to repay their margin loans. Numbers like this usually lead to a large sell-off in equities; I am reminded that September is often a bad month for equities.

Some other updates:

- Gold +23.80 [+1.40%]

- Silver +0.02 [+0.12%]

- Copper +0.12 [+3.57%]

- Crude -2.89 [-2.96%]

- Natgas +1.18 [+16.80%]

- USD -1.29 [-1.20%] (weekly swing high)

- SPX +99.47 [+2.55%]

Gold had a nice Friday – I still don’t have that futures data, so I am back to using stock charts. On the daily chart, we can see a bounce off <30 in the RSI-14, along with a MACD bullish crossover, as well as a daily swing low candle pattern, which all adds up to “bullish reversal.” Unfortunately, this was not confirmed by the miners, or by silver. Still, it’s a pretty bullish chart, and it might mean something. Although maybe its just a blip driven by the (probably temporary) Euro rally.

“Health”:

EXCLUSIVE: CDC Says It Performed Vaccine Safety Data Mining After Saying It Didn’t (Source).

CDC appears to have lied on a FOIA response to Children’s Health Defense, and it is now backpedaling. Is there a penalty for lying on a FOIA response? Think President Grandpa’s DOJ will prosecute the offenders?

Birx Says COVID-19 Vaccines Were Never ‘Going to Protect Against Infection’ (Source). Fauci: “We need vaccines that are better. That are better because of the breadth and the durability, because we know that immunity wanes over several months. And that’s the reason why we have boosters,” he said. “But also, we need vaccines that protect against infection.”

So, a booster every “several” months. Any downside to that, Tony? Still – Birx and Fauci just admitted the shots are crappy. Public knowledge. I wonder if this encouraged the CDC to backpedal on that FOIA lie.

The Centers for Disease Control and Prevention (CDC) will no longer report COVID outbreaks on cruise ships. (Source)

Since all cruisers have to be vaccinated, its probably best to ignore any outbreaks that happen on cruise ships, in order to reduce vaccine hesitancy.

WHO declares monkeypox a public health emergency of international concern (Source). Tedros said while the committee was unable to reach a consensus, he came to the decision after considering the five elements required on deciding whether an outbreak constitutes a public health emergency of international concern.

Teddy pulled the trigger on this one all on his own because the committee vote went against him. I’m guessing there was a “vote” cast by a “special voter” behind the scenes that carried the day.

WHO reports 14,000 cases of monkeypox globally, five deaths in Africa (Source)

With no deaths outside Africa, they are looking quite desperate. And by they, I mean either Mr Gates, or the WEF technocracy. Or maybe both. They are shrieking “PANDEMIC” for a rash that kills nobody, but its the best they’ve got. And we all know just how excited Mr. Gates gets when he hears the word “pox.”

Maybe its just me, but I’m seeing some pretty surprising admissions of issues with the Magic Juice, alongside a probably-Gates-inspired transition to Monkeypox. My gut says that Omicron’s dramatic mutations have turned the long-awaited current event into a “pandemic of the vaccinated”, and so the longer they focus on covid, the worse the Juice (and their credibility) looks, and so the leadership responsible for the current plague are now trying to tiptoe away from it all. Quadruple-vaxxed President Grandpa catching the plague is the beginning of the end.

Perhaps this Malone substack article on Birx’s book (Source) helped me tie it all up in a bow?

That, along with the very strong discontent from the staff inside NIH/CDC, described in this July 14th article by Marty Makary (Source). Which sure feels as though it is threatening to break into public knowledge given the large number of people involved.

My question: how do the Technocrats survive the inevitable fallout from the Magic Juice and the three million vax-damaged Americans? A NATO-declared hot war with Russia? Plus an invasion of Taiwan? In that environment, the Technocrats can sure try and crack down even harder on any “traitorous” counter-narrative “Russian disinformation” (vax damage news) if a real shooting war “starts”. But as they say, no plan survives contact with the enemy. Example: all those gleefully-announced “sanctions” sure have proven to be a grand success – for Russia and the Ruble. Oops.

And it would probably be the perfect forcing function for launching the BRICS currency, which is definitely not in the interest of the Technocracy at all.

Armstrong’s computer sees things starting to get worse by September, and then things really come unglued by Q1 2023.