Lots of articles have recently come out about

food shortages, riots, and rapidly climbing prices. Last August the

Federal Reserve and European Central Bank started lowering interest

rates, pouring liquidity into the world marketplaces, and trading

prized treasuries for near-worthless debt. Food riots and central bank

maneuvers are more closely linked than you might suspect.

Here’s a selection of recent headlines about

world food shortages, prices spikes, and hoarding that I’ve been

gathering for a couple of months.

I want you to think very carefully about how rapidly this food

situation began and morphed into a situation where nations began

hoarding food. I want you to consider this because I have the same

concern about oil. That is, once a slight shortage is openly felt in

the marketplace, the time between normal trading of goods and hoarding

can be a matter of days, if not hours.

Below, in the registered section, I will draw the connections and

make the case that all of this began on August 16th, 2007 with the

Fed’s move to cut the discount window interest rate. Meanwhile, Wall

Street parties on.

Rising Grain Prices Panic Developing World (Wash. Post)

(April 4, 2008) SHANGHAI — A spike in the

price of rice and other food staples is triggering consumer panic,

including food riots in Yemen and Morocco, and hoarding in Hong Kong.

Governments around the world have taken radical measures in recent

weeks to control their countries’ supplies of rice. Egypt last week

said it would ban all rice exports for six months. Cambodia has stopped

all private-sector exports of rice, and India and Vietnam also have

imposed restrictions.

Egypt’s Rising Food Prices Swell Bread Lines (Bloomberg)

(April 9, 2008) “We have seen riots around the

world and there’s risk that these will spread because of rising prices

in countries where 50-60 percent of incomes go to food,” Jacques

Diouf, the director general of the United Nations Food and Agriculture

Organization, said in India today.

Record high grain prices have led to strikes in Argentina, riots in

Cameroon, Burkina Faso, Morocco and the Ivory Coast. The World Bank

says 33 countries from Mexico to Yemen may face social unrest because

of spiraling food and energy costs.

Rising wheat prices have far-reaching significance

(March 1, 2008) Food prices, though, reflect more

than just increased demand. Rising prices for other commodities can

have a compounding effect on food. Higher energy prices, for example,

add to production and shipping costs.

That, in turn, can have grave implications for world health. For

example, the U.N. found that the cost of food imported by the world’s

neediest countries last year rose by 24 percent, to $107 billion,

raising questions about nutrition.

‘Panic’ wheat buying across the US

(February 26, 2008)Panic over commodity shortages

continues to emerge as the dominant factor in the global markets, with

both end user and speculative buyers of corn, soybean, cotton, rice and

a host of other commodities taking note of what’s happening in the

wheat pit.

The net result has been declining stocks at the same time that expanding global wealth has demanded more raw commodities.

The net result on Monday was new all-time record high prices for corn, soybeans and wheat on the same day.

Sentiment in the marketplace is changing from, ‘buying

just-in-time’ to one of, ‘buy what you need at any price’ and then to

‘buy even more to restock the shelves’.

In other words, there’s evidence to suggest that we’re beginning to enter the hoarding phase of the inflationary cycle.

Wheat prices could defy a recession

(February 21, 2008) LONDON The global market for cereals looks well placed to withstand a U.S.

recession, its resistance bolstered by climate change and new dietary tastes in rapidly developing economies.

Declining water tables and unpredictable weather in major

production areas have hit crops, and much arable land has been diverted

to producing biofuels. Meanwhile, consumers in emerging markets like

China are eating more meat as they become wealthier, driving demand for

animal feed.

These factors are not likely to go away soon, even as general economic conditions worsen.

"It is mostly driven by world population growth, which is about 75

million people per year, and also by the more protein-rich nutrition

trend in Asia," said Jochen Hitzfeld, a commodities strategist at

Unicredit in Munich. He predicts a 50 percent rise in wheat, with

prices to average $15 a bushel in 2009.

The trend, in fact, is not a new one. In seven of the past eight

years, demand for wheat has been greater than supply, according to

Unicredit, though so far that demand has been met by drawing down

existing stockpiles.

The poor of the world are getting increasingly priced out of their

daily bread. Literally. For many, this is a true disaster, and the

wealthy nations are largely to blame.

Not because we are consuming any more than we used to, but because

our central banks were scared by what they thought might happen if the

big banks of the world were allowed to take their lumps for making

their ill-advised gambles on the housing market.

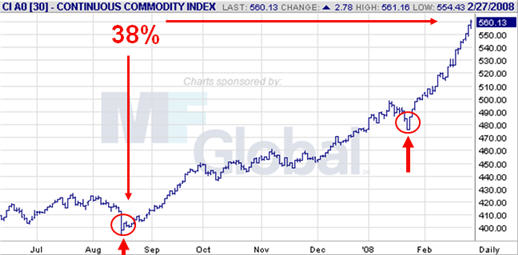

There are three dates I want you to remember as you view the charts

below. August 16th, the date of the first Fed rate cut (to the

‘discount window’), and January 22 & 30, two sets of cuts to the

Federal Funds rates of 75 and 50 basis points, respectively.

Now, let’s look at some charts. To help you out, I’ve circled those dates for you.

This first chart is of ALL commodities. That’s oil, grains, metals,

and fibers. The second chart is wheat, while the third is rice. As you

look at them, notice what happened after each set of rate cuts.

I see a very clear and immediate connection between the rate cuts and

the explosion in commodity prices. Of course, this should not have been

a surprise to anybody at the Federal Reserve, since hot commodity

prices and easy money have a long relationship with each other.