Saturday, August 24, 2008

Nobody can borrow and consume their way to wealth; no city can do it, no state, and no country either. For the past 25 years the US has been progressively producing less and less, consuming more and more, and borrowing to cover the difference.

Today I stacked wood for the winter, which is always satisfying, and thought about where we really are in this credit crisis. That was decidedly less satisfying.

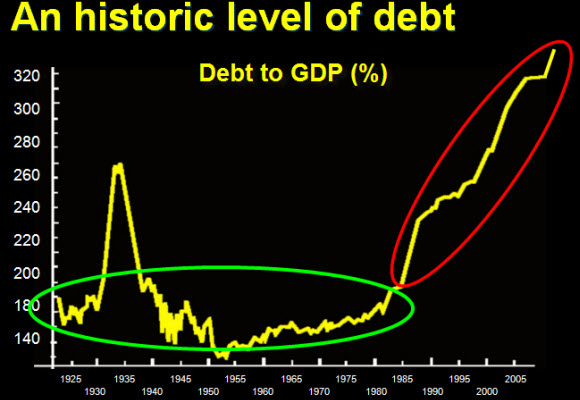

It is important to remember that we did not get here all at once, and that this crisis was not caused by subprime mortgage defaults. Rather, those were effects, while the cause was the cumulation of 25 years of progressively larger borrowing…

…circled in red below:

Nobody can borrow and consume their way to wealth; no city can do it, no state, and no country either. For the past 25 years the US has been progressively producing less and less, consuming more and more, and borrowing to cover the difference.

This is not how things are supposed to work, and we did not even embark on this path all that recently. While it may seem like this is just how things work, I can assure you that, this is both a recent and a magnificent departure from our historical roots. This path of easy riches has been tried countless times by individuals and empires alike, throughout history, and it has never worked.

To put a slightly different look on this, let’s take a peek at the US national trade deficit, which is the difference between what we buy and what we sell, as measured in dollars. We’ll do this by looking at what is called the Current Account Deficit, which measures the total flow of money into and out of the country. The largest portion of this flow of money is the actual deficit in goods and services – the so-called "trade deficit" which you hear about regularly in the news. But what we should actually care about is the total flow of money into and out of the country. It is the total flow that defines whether the dollar will rise or fall over time. More dollars leaving than returning? The dollar will fall. A negative Current Account reading will usually result in a weakening currency, so I keep an eye on it to see what it is saying.