A

truly laughably fraudulent GDP report was released by the government

today. However, we’re getting close to this just being a sad parody of

Soviet crop reports of old, which were famous for being utterly out of

alignment with reality.

3.3% GDP Growth Stronger Than Expected (August 28 -New York Times)

The economy expanded faster from April to June

than originally thought, the government said on Thursday, catching many

economists off-guard and cheering investors on Wall Street.

Gross domestic product rose at a 3.3 percent clip

in the second quarter, the Commerce Department said, a significant jump

over the original estimate of 1.9 percent growth. G.D.P., the broadest

measure of the nation’s economic activity, is considered a good

barometer of America’s economic health.

The revised G.D.P. figure suggests resilience in the economy,

especially compared with the anemic 0.9 percent growth rate from

January to March, and a contraction in the final three months of 2007.

Still, spending by American consumers stayed relatively soft, despite

the infusion of the government’s tax stimulus program. Corporate

profits remained weak.

Shame on the New York Times for printing propaganda and then charging for it. That should be free.

When this report of 3.3% growth for the second quarter came out, I

laughed out loud. That is how preposterous it was. Besides this

completely rigged report by the government, almost every other,

non-fudgeable number is in agreement; we are in a deep recession.Cars,

houses, retail, job claims, the ECRI, you name it – they all say

"recession".

How did they arrive at this very funny 3.3% reading? Two ways.

First, they had to concoct a massive upward revision to exports.

Next, they did

something that shocked even me; they knocked inflation for the second

quarter of 2008 to only 1.3%, the second lowest reading in of the past

15 quarters.

That is, the claim they are making here is that

inflation for April, May, and June was down, and down a lot. Here’s the

picture:

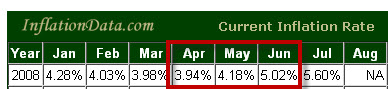

See that yellow

circle? That’s the amount of inflation that was subtracted for the

nominal GDP reading to derive the so-called “real” GDP that was just

reported. Today that term “real” took on new, ironic overtones. Let’s

review a few of the things that actually happened during April, May,

and June. Here’s the CPI for that period:

Even as

badly mangled as the CPI data is, it averaged 4.38% for those three

months – a full 329% HIGHER than the number used to calculate the GDP.

Gas prices hit a record, oil prices hit a record, food inflation edged

close to double digits, and yet, through all of this, the US government

puts out an completely preposterous number of only 1.3%, utterly secure

in the knowledge that nobody, not even the New York Times, would ask so

much as a single uncomfortable question about whether or not this is a

believable number. In fact, the NYT did the opposite, by immediately

pointing out that this surprisingly strong GDP reading suggests

‘resiliency’ in the economy.

And Wall Street rallied hard on

this news today, just as they were supposed to. However, anybody who

bought stocks on this news was defrauded and will almost certainly

regret the decision.