While the myth is that the stock market is a discounting machine, the reality is that it is mostly a liquidity measuring device.

What I mean by this is that the gigantic machinery of Wall Street, which includes all the people working at brokerages, as well as all of the buildings and infrastructure involved in operating a market, are not cheap, and the money to operate all of that has to come from somewhere.

It is safe to say that just keeping the machinery well-oiled requires several billions of new money each month to keep it fed at a subsistence level (for the pin-stripe crowd, I mean).

Yes, we could look at stock’s p/e ratios and scrutinize annual reports, but the sad truth is that if more money is leaving the market than entering it, prices will fall.

It’s very simple:

- More sellers than buyers = prices fall

- More buyers than sellers = prices rise

So for all the fancy analysis of stocks and earning and such, the most important measure is how much money is entering vs. leaving the market. It is in that sense that the stock market is, first and foremost, a liquidity measuring device.

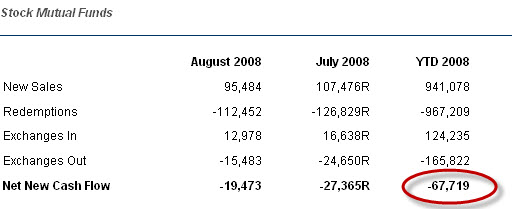

First, I have been watching the mutual fund money flows pretty carefully, because the constant flow of "retail" money from ordinary citizens (much of this via automatic 401k contributions) is the lifeblood of the industry.

Up through August it has been, well, disappointing, with up months and down months, but adding up to a net outflow for the year of more than $67 billion. This outflow is the primary reason there are so many articles in the mainstream media cajoling and sometimes berating people into "investing for the long haul" and "not making the unfortunate mistake of selling at the lows."

The reason, for such articles, I believe, has little to do with helping people make wise investment decisions and everything to do with helping out Wall Street by keeping retail money in the markets to provide essential nutrition to the money machine. Otherwise we would expect to see the counterpoint to these articles advising people to sell when new highs are reached, but I can’t recall ever reading any such article in a mainstream media source.

At any rate, as bad as the August data was, the early read on the September data is even worse.

Funds saw $104.4 bln outflows in September

BOSTON, Oct. 17, 2008 (Reuters) — Investors pulled out a record $104.4 billion from U.S. mutual funds in September as they were spooked by the credit crisis and turmoil in financial markets, research firm Lipper Inc said on Friday."We have never seen (monthly) outflow figures like this," said Jeff Tjornehoj, senior research analyst at Lipper. The data did not include flows of exchange-traded funds.

No wonder they trotted out Warren Buffet to calm the crowds – this is a disaster for the investment community. Now, I have to point out that my two data points are a bit of "apples to oranges," because the first data applies to stock mutual funds only and the second to ALL mutual funds, of which stocks are only a part. But the trend is worth noting.

And then there was this data that caught my eye:

Hedge funds’ assets off $210 billion in third quarter

SAN FRANCISCO (MarketWatch) — Hedge funds saw a record $210 billion drop in assets under management during the third quarter as investors redeemed an unprecedented amount of money from the industry after poor performance, according to a survey released Friday.Net capital redemptions totaled $31 billion in the quarter, also a record, the firm added.

Withdrawals came during a period of dismal performance for the funds.Funds of hedge funds, which invest in a range of outside managers, also saw assets under management fall by $78 billion as investors withdrew $13.3 billion in the third quarter, Hedge Fund Research said.

When a retail investor pulls money from a mutual fund, that is what we call "unleveraged money." A dollar pulled out represents a dollar that was in the market (for the most part). But hedge fund money? That is a different beast.

Hedge fund money is typically leveraged up, so the $31 billion withdrawn means that more than that was withdrawn from the the asset investment markets. How much more? Hard to say, since hedge funds use such widely varying levels of leverage, ranging from 1.2x to more than 30x.

Bottom line: Money is fleeing the markets, and this means we are not yet near a bottom. I am expecting more downside over the coming months.