Monday, December 10, 2007 (reprinted Saturday, March 15, 2008)

Executive Summary

- The credit bubble collapse is just getting started.

- Odds of a major systemic financial crisis now higher than ever.

- Dollar collapse is underway.

- Your opportunities to protect your assets are dwindling fast.

(Originally printed on 12-10-2007. Uncannily good predictions and recommendations, all of which I still stand by.)

The Great Credit Bubble, for which you can thank Alan Greenspan, is now in the process of bursting. While the US media implacably attempts to assure everyone that it is well contained or almost over, nothing could be further from the truth. As one financial commentator recently put it, "the good news is that the subprime crisis has been contained…to the planet earth."

The odds of a major systemic financial collapse are now higher than ever.

If you’ve seen the Crash Course (formerly the End of Money seminar), you know I’ve been concerned for a number of years about the toxic witch’s brew of poor-quality loans and unfathomably risky derivatives that are poisoning our financial body. Part of my concern stems from the fact that no matter how hard I try, I cannot understand how the derivatives markets work.

I’ve been unable to discover the most basic answers to the most basic questions, such as “how much capital is actually backing these things?” and “who’s holding the bag?” Wall Street and its ever-compliant financial propaganda services organizations (CNBC, WSJ, et al.) have maintained all along that these new products have completely eliminated risk by spreading it so thin that it has literally disappeared. I do not believe in financial alchemy, and I do not believe this version of ‘reality,’ because it makes no sense at all. Just as it made no sense to finance 19 houses to a part-time hairdresser in Las Vegas with subprime, negative amortization loans (true story), it makes no sense that this level of malinvestment could simply ‘disappear’.

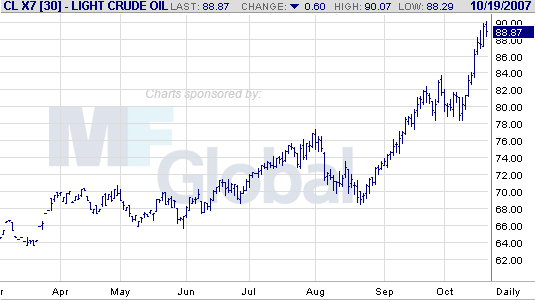

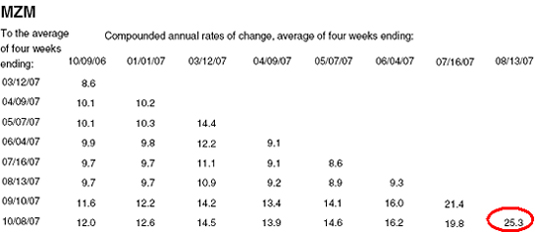

The rest of my concern centers on the fact that 3,800 paper currencies in the past have all gone to money heaven due to the exact same formula of mismanagement that our fiscal and monetary authorities are applying to the US dollar. A few key warning signs would be, (1) bailing out the poor decisions of big banks by flooding the markets with hundreds of billions of dollars of public money/credit, and (2) conducting a pair of very expensive wars “off budget,” while (3) expanding your total monetary base at an astounding, banana-republic double digit percentage rate (as we discussed last time).

I won’t be disappointed if you tend to believe proclamations from the titans of Wall Street more than you would from some random guy named Chris. However, before you place too much faith on the possibility that those guys on Wall Street “must know what they are doing,” I would ask you to consider these facts:

Exhibit A:

Out of all the toxic subprime mortgages ever issued, the subprime loans with highest rates of default were made in the first 6 months of 2007 .

While you and I and everybody else had figured out that the subprime jig was up in 2005 or 2006, the Wall Street machinery couldn’t figure out how to stop what it was doing even as late as July of 2007. Titans or nitwits? You be the judge.

Exhibit B:

Rather than admit they made a bunch of really stupid loans, Wall Street banks first went straight to the US Treasury to mediate a bailout, and, when that proved to be too slow a course of action, simply hid the extent of their losses by massively abusing an obscure accounting gimmick .

Nov. 7 (Bloomberg) Banks may be forced to write down as much as $64 billion on collateralized debt obligations of securities backed by subprime assets, from about $15 billion so far, Citigroup analysts led by Matt King in London wrote in a report e-mailed today. The data exclude Citigroup’s own projected writedowns.

Under FASB terminology, Level 1 means mark-to-market, where an asset’s worth is based on a real price. Level 2 is mark-to-model, an estimate based on observable inputs which is used when no quoted prices are available. Level 3 values are based on “unobservable” inputs reflecting companies’ “own assumptions” about the way assets would be priced.

In other words, these so-called “Level 3” assets are balance-sheet entries that company management value at whatever they say they’re worth. This is like your drunk uncle claiming to be a millionaire because he said he found a lottery ticket in the gutter on the way home last night, but he won’t let anybody see it. The value of these so-called assets is entirely in the eye of the beholder, or bank management in this case, who has decided that they are ‘worth’ every penny that they paid for them and that’s how much they are going to continue insisting they are worth, thank you very much.

Exhibit C:

As the subprime derivative debacle was unfolding, what do you suppose was the response of Wall Street? If you guessed “doubling down,” you are a winner!

Nov. 22 (Bloomberg) — The market for derivatives grew at the fastest pace in at least nine years to $516 trillion in the first half of 2007, the Bank for International Settlements said.

Credit-default swaps, contracts designed to protect investors against default and used to speculate on credit quality, led the increase, expanding 49 percent to cover a notional $43 trillion of debt in the six months ended June 30, the BIS said in a report published late yesterday.

Wow. Wowowowowow. This is shocking. First, because of how hard it is to set new records for the “fastest pace” at the same time that you are setting records for the total amount. This would be like a weightlifter setting a new world record by adding 700 pounds to the old record. Second, because the specific types of derivatives that expanded the fastest were those designed to speculate on credit quality – the very area that is most at risk right now. So we now know that even as the credit debacle was so completely obvious that people returning from year-long wilderness solos knew something was wrong, Wall Street and Hedge Funds were busy accelerating the pace at which they continued to pursue these broken bets on shaky mortgages. Rather than sound fiscal prudence, this appears to be a last desperate grab for what few chips remained on the table.

It is possible that each individual transaction made a lot of sense to the hedge fund managers, but to outsiders like us they look foolish collectively. Why? Because when everybody is hedged, nobody is. Hedging is a zero-sum game. For somebody to win, somebody has to lose. So while all these smarty-pants were busy ‘hedging their risk away,’ nobody seems to have taken stock of the fact that the assets they were hedging were themselves seriously impaired and were going to result in massive losses for somebody. In short, it is impossible to hedge a failed system.

So, there are three perfectly good reasons to suspect that the captains of Wall Street are rather mortal after all and possibly even less competent than the average soul. I could give you forty more, but in the interest of time, I won’t, except to offer the best explanation I’ve ever read on how the derivative market works (PDF) and the human mechanisms at play that allowed all this to get so out of hand. This article will be well worth your time.

Systemic Banking Crisis?

If you own a house, odds are you carry fire insurance. Not because the chance of a house fire is particularly large, but because the cost of a house fire is catastrophic. You carry fire insurance because you have rightly calculated that (small chance) x (a big cost) = unacceptable risk. So you offset that risk with insurance.

Now I want you to seriously consider what the cost to you would be if there were the equivalent of a house fire in the banking system. I’m talking about a major system ‘freeze’ where banks close, huge losses spread throughout the system, electronic interbank transfers become impossible (ATMs, credit cards, electronic funds transfers, wires, and all the rest simply stop), and many banks and brokerages simultaneously go out of business. I’d imagine the impact to you would be quite large. So the next question is, what can/should mature, responsible adults do to insure themselves against such an outcome? How much time, energy and money should one dedicate to insuring one’s financial house?

When I started giving The End of Money seminar three years ago, I had put the possibility of this sort of event at about 15% to 20% over the next 5-10 years. It turns out that I was a raging optimist compared to some financial professionals such as this guy:

Nov. 13 (Bloomberg) — There’s a greater than 50 percent probability that the financial system "will come to a grinding halt" because of losses from mortgages, Gregory Peters, head of credit strategy at Morgan Stanley, said.

This is serious business especially now that the head of credit strategy at a major Wall Street bank is openly writing about it to their main clients. In fact, there are now many respected economists and financial professionals who are calling for a generalized systemic financial meltdown or a severe stock market decline. Even if you have no assets in the larger speculative financial markets (stocks and bonds), or have already taken steps to protect them by getting them out, you are still at risk if your assets are sitting in a risky bank. The possibility of massive bank failures is now a stark reality and it is my opinion that several are already insolvent, just not publicly (yet).

These sorts of crises always start at the edges and work in. First it was the shakier mortgage broker ‘bucket shops’ that began going under in late 2006. Then larger and seemingly firmer mortgage outfits began going under. Now more than 190 mortgage brokers, including most of the ‘top ten’, have gone bankrupt. And today not only is the very largest of them all (Countrywide Financial Corp) rumored to be a strong candidate for bankruptcy, the unthinkable seems to be unfolding before our very eyes. Both Fannie Mae and Freddie Mac, collectively holding several trillions of dollars worth of US mortgages and an even larger portfolio of associated interest rate derivatives, appear to be in some serious trouble . If either, or both, of these companies goes bust, it is highly unlikely (to me) that both the US banking system and the dollar could survive the event.

I am now putting out my strongest warning ever.

If you do not already own gold and/or silver, your time is running out. My best guess would be that once the world’s paper markets implode, the price of gold and silver will skyrocket to unimaginable and unreachable heights, if you can even locate any to buy. Get some.

By the time it is completely obvious that this is the right thing to do, you will find it difficult either due to price, availability, or both. Luckily, the world’s central banks are still capping the price of gold and silver, offering you a wonderful subsidy, which is really quite nice of them. Why do I advocate gold and silver? Simple. Because they are among the very few money-like assets that you can own (hold) that are not simultaneously somebody else’s liability. Consider that a bond (your asset) is the liability of a corporation or government. Even your checking account is your bank’s liability. A house owned free and clear would certainly qualify as a valuable asset, but a house is not very “money like.” When you go through the list (stocks, bonds, annuities, money-market accounts, etc), there is virtually no paper asset that you can identify that is not somebody else’s liability. Even a cash dollar is the liability of the Federal Reserve. But when you own physical precious metals (not mining shares or other paper claims), that’s the long and the short of it. It’s yours. Period.

Next, in order to protect from the possibility of a general banking ‘holiday’ (freeze), every family should have somewhere between one and six months worth of living expenses on hand in the form of cold, hard cash. You know, the bits of paper that work even if the ATMs and credit card readers do not. To be clear, I am not talking about cash in your checking account, I am talking about cash out of the bank and in your hands. Katrina, a natural storm, taught this lesson and we now need to apply that learning to the potential arrival of an economic storm.

Unfortunately, not very many people will be able to do this because the total cash available is a very small percentage of total deposits (~5%). Your bank will look at you funny when you take cash out, mainly because they do not have very much on hand at any given moment. If you plan to cash out more than a few thousand dollars, I highly recommend that you give your bank advance warning and thereby avoid the awkward social moment that will result when they have to tell you that they don’t actually have that much on hand. One thing to remember is that if you take out $10,000.00 or more of cash your bank is required to report you to the federal government via a SAR (Suspicious Activity Report). So the banks appreciate amounts smaller than that as it cuts down on the paperwork.

I would maintain a cash balance until we see clear signs that the evolving credit crisis is getting better, not worse. Given the latest data, which all point to a serious erosion of the credit markets, this could be awhile.

All that’s really happening here is that the long-awaited credit bust is finally upon us. It is important to remember that historically, bubbles have always deflated over approximately the same amount of time as they took to inflate. This means we are looking at a potential end to this crisis somewhere in the range of 2012 to 2020, depending on where you mark the beginning. In the meantime, there will be plenty of false dawns and countertrend rallies that will siphon even more wealth from the unwary.

Don’t be among them.

Uh Oh.

PREVIEW by Chris MartensonMonday, December 10, 2007 (reprinted Saturday, March 15, 2008)

Executive Summary

- The credit bubble collapse is just getting started.

- Odds of a major systemic financial crisis now higher than ever.

- Dollar collapse is underway.

- Your opportunities to protect your assets are dwindling fast.

(Originally printed on 12-10-2007. Uncannily good predictions and recommendations, all of which I still stand by.)

The Great Credit Bubble, for which you can thank Alan Greenspan, is now in the process of bursting. While the US media implacably attempts to assure everyone that it is well contained or almost over, nothing could be further from the truth. As one financial commentator recently put it, "the good news is that the subprime crisis has been contained…to the planet earth."

The odds of a major systemic financial collapse are now higher than ever.

If you’ve seen the Crash Course (formerly the End of Money seminar), you know I’ve been concerned for a number of years about the toxic witch’s brew of poor-quality loans and unfathomably risky derivatives that are poisoning our financial body. Part of my concern stems from the fact that no matter how hard I try, I cannot understand how the derivatives markets work.

I’ve been unable to discover the most basic answers to the most basic questions, such as “how much capital is actually backing these things?” and “who’s holding the bag?” Wall Street and its ever-compliant financial propaganda services organizations (CNBC, WSJ, et al.) have maintained all along that these new products have completely eliminated risk by spreading it so thin that it has literally disappeared. I do not believe in financial alchemy, and I do not believe this version of ‘reality,’ because it makes no sense at all. Just as it made no sense to finance 19 houses to a part-time hairdresser in Las Vegas with subprime, negative amortization loans (true story), it makes no sense that this level of malinvestment could simply ‘disappear’.

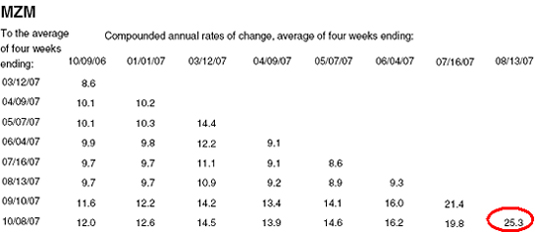

The rest of my concern centers on the fact that 3,800 paper currencies in the past have all gone to money heaven due to the exact same formula of mismanagement that our fiscal and monetary authorities are applying to the US dollar. A few key warning signs would be, (1) bailing out the poor decisions of big banks by flooding the markets with hundreds of billions of dollars of public money/credit, and (2) conducting a pair of very expensive wars “off budget,” while (3) expanding your total monetary base at an astounding, banana-republic double digit percentage rate (as we discussed last time).

I won’t be disappointed if you tend to believe proclamations from the titans of Wall Street more than you would from some random guy named Chris. However, before you place too much faith on the possibility that those guys on Wall Street “must know what they are doing,” I would ask you to consider these facts:

Exhibit A:

Out of all the toxic subprime mortgages ever issued, the subprime loans with highest rates of default were made in the first 6 months of 2007 .

While you and I and everybody else had figured out that the subprime jig was up in 2005 or 2006, the Wall Street machinery couldn’t figure out how to stop what it was doing even as late as July of 2007. Titans or nitwits? You be the judge.

Exhibit B:

Rather than admit they made a bunch of really stupid loans, Wall Street banks first went straight to the US Treasury to mediate a bailout, and, when that proved to be too slow a course of action, simply hid the extent of their losses by massively abusing an obscure accounting gimmick .

Nov. 7 (Bloomberg) Banks may be forced to write down as much as $64 billion on collateralized debt obligations of securities backed by subprime assets, from about $15 billion so far, Citigroup analysts led by Matt King in London wrote in a report e-mailed today. The data exclude Citigroup’s own projected writedowns.

Under FASB terminology, Level 1 means mark-to-market, where an asset’s worth is based on a real price. Level 2 is mark-to-model, an estimate based on observable inputs which is used when no quoted prices are available. Level 3 values are based on “unobservable” inputs reflecting companies’ “own assumptions” about the way assets would be priced.

In other words, these so-called “Level 3” assets are balance-sheet entries that company management value at whatever they say they’re worth. This is like your drunk uncle claiming to be a millionaire because he said he found a lottery ticket in the gutter on the way home last night, but he won’t let anybody see it. The value of these so-called assets is entirely in the eye of the beholder, or bank management in this case, who has decided that they are ‘worth’ every penny that they paid for them and that’s how much they are going to continue insisting they are worth, thank you very much.

Exhibit C:

As the subprime derivative debacle was unfolding, what do you suppose was the response of Wall Street? If you guessed “doubling down,” you are a winner!

Nov. 22 (Bloomberg) — The market for derivatives grew at the fastest pace in at least nine years to $516 trillion in the first half of 2007, the Bank for International Settlements said.

Credit-default swaps, contracts designed to protect investors against default and used to speculate on credit quality, led the increase, expanding 49 percent to cover a notional $43 trillion of debt in the six months ended June 30, the BIS said in a report published late yesterday.

Wow. Wowowowowow. This is shocking. First, because of how hard it is to set new records for the “fastest pace” at the same time that you are setting records for the total amount. This would be like a weightlifter setting a new world record by adding 700 pounds to the old record. Second, because the specific types of derivatives that expanded the fastest were those designed to speculate on credit quality – the very area that is most at risk right now. So we now know that even as the credit debacle was so completely obvious that people returning from year-long wilderness solos knew something was wrong, Wall Street and Hedge Funds were busy accelerating the pace at which they continued to pursue these broken bets on shaky mortgages. Rather than sound fiscal prudence, this appears to be a last desperate grab for what few chips remained on the table.

It is possible that each individual transaction made a lot of sense to the hedge fund managers, but to outsiders like us they look foolish collectively. Why? Because when everybody is hedged, nobody is. Hedging is a zero-sum game. For somebody to win, somebody has to lose. So while all these smarty-pants were busy ‘hedging their risk away,’ nobody seems to have taken stock of the fact that the assets they were hedging were themselves seriously impaired and were going to result in massive losses for somebody. In short, it is impossible to hedge a failed system.

So, there are three perfectly good reasons to suspect that the captains of Wall Street are rather mortal after all and possibly even less competent than the average soul. I could give you forty more, but in the interest of time, I won’t, except to offer the best explanation I’ve ever read on how the derivative market works (PDF) and the human mechanisms at play that allowed all this to get so out of hand. This article will be well worth your time.

Systemic Banking Crisis?

If you own a house, odds are you carry fire insurance. Not because the chance of a house fire is particularly large, but because the cost of a house fire is catastrophic. You carry fire insurance because you have rightly calculated that (small chance) x (a big cost) = unacceptable risk. So you offset that risk with insurance.

Now I want you to seriously consider what the cost to you would be if there were the equivalent of a house fire in the banking system. I’m talking about a major system ‘freeze’ where banks close, huge losses spread throughout the system, electronic interbank transfers become impossible (ATMs, credit cards, electronic funds transfers, wires, and all the rest simply stop), and many banks and brokerages simultaneously go out of business. I’d imagine the impact to you would be quite large. So the next question is, what can/should mature, responsible adults do to insure themselves against such an outcome? How much time, energy and money should one dedicate to insuring one’s financial house?

When I started giving The End of Money seminar three years ago, I had put the possibility of this sort of event at about 15% to 20% over the next 5-10 years. It turns out that I was a raging optimist compared to some financial professionals such as this guy:

Nov. 13 (Bloomberg) — There’s a greater than 50 percent probability that the financial system "will come to a grinding halt" because of losses from mortgages, Gregory Peters, head of credit strategy at Morgan Stanley, said.

This is serious business especially now that the head of credit strategy at a major Wall Street bank is openly writing about it to their main clients. In fact, there are now many respected economists and financial professionals who are calling for a generalized systemic financial meltdown or a severe stock market decline. Even if you have no assets in the larger speculative financial markets (stocks and bonds), or have already taken steps to protect them by getting them out, you are still at risk if your assets are sitting in a risky bank. The possibility of massive bank failures is now a stark reality and it is my opinion that several are already insolvent, just not publicly (yet).

These sorts of crises always start at the edges and work in. First it was the shakier mortgage broker ‘bucket shops’ that began going under in late 2006. Then larger and seemingly firmer mortgage outfits began going under. Now more than 190 mortgage brokers, including most of the ‘top ten’, have gone bankrupt. And today not only is the very largest of them all (Countrywide Financial Corp) rumored to be a strong candidate for bankruptcy, the unthinkable seems to be unfolding before our very eyes. Both Fannie Mae and Freddie Mac, collectively holding several trillions of dollars worth of US mortgages and an even larger portfolio of associated interest rate derivatives, appear to be in some serious trouble . If either, or both, of these companies goes bust, it is highly unlikely (to me) that both the US banking system and the dollar could survive the event.

I am now putting out my strongest warning ever.

If you do not already own gold and/or silver, your time is running out. My best guess would be that once the world’s paper markets implode, the price of gold and silver will skyrocket to unimaginable and unreachable heights, if you can even locate any to buy. Get some.

By the time it is completely obvious that this is the right thing to do, you will find it difficult either due to price, availability, or both. Luckily, the world’s central banks are still capping the price of gold and silver, offering you a wonderful subsidy, which is really quite nice of them. Why do I advocate gold and silver? Simple. Because they are among the very few money-like assets that you can own (hold) that are not simultaneously somebody else’s liability. Consider that a bond (your asset) is the liability of a corporation or government. Even your checking account is your bank’s liability. A house owned free and clear would certainly qualify as a valuable asset, but a house is not very “money like.” When you go through the list (stocks, bonds, annuities, money-market accounts, etc), there is virtually no paper asset that you can identify that is not somebody else’s liability. Even a cash dollar is the liability of the Federal Reserve. But when you own physical precious metals (not mining shares or other paper claims), that’s the long and the short of it. It’s yours. Period.

Next, in order to protect from the possibility of a general banking ‘holiday’ (freeze), every family should have somewhere between one and six months worth of living expenses on hand in the form of cold, hard cash. You know, the bits of paper that work even if the ATMs and credit card readers do not. To be clear, I am not talking about cash in your checking account, I am talking about cash out of the bank and in your hands. Katrina, a natural storm, taught this lesson and we now need to apply that learning to the potential arrival of an economic storm.

Unfortunately, not very many people will be able to do this because the total cash available is a very small percentage of total deposits (~5%). Your bank will look at you funny when you take cash out, mainly because they do not have very much on hand at any given moment. If you plan to cash out more than a few thousand dollars, I highly recommend that you give your bank advance warning and thereby avoid the awkward social moment that will result when they have to tell you that they don’t actually have that much on hand. One thing to remember is that if you take out $10,000.00 or more of cash your bank is required to report you to the federal government via a SAR (Suspicious Activity Report). So the banks appreciate amounts smaller than that as it cuts down on the paperwork.

I would maintain a cash balance until we see clear signs that the evolving credit crisis is getting better, not worse. Given the latest data, which all point to a serious erosion of the credit markets, this could be awhile.

All that’s really happening here is that the long-awaited credit bust is finally upon us. It is important to remember that historically, bubbles have always deflated over approximately the same amount of time as they took to inflate. This means we are looking at a potential end to this crisis somewhere in the range of 2012 to 2020, depending on where you mark the beginning. In the meantime, there will be plenty of false dawns and countertrend rallies that will siphon even more wealth from the unwary.

Don’t be among them.

Monday, March 10, 2008

The greatest shortcoming of the human race is our inability to understand the exponential function.

~ Dr. Albert Bartlett

While it was operating well, our monetary system was a great system, one that fostered incredible technological innovation and advances in standards of living. But every system has its pros and its cons, and our monetary system has a doozy of a flaw.

It is run by humans.

Oh, wait, that’s a valid complaint, but not the one I was looking for. Here it is:

Our monetary system must continually expand, forever.

What’s going on here? Could it be that the US economy is so robust that it requires monetary and credit growth to double every 6 to 7 years? Are US households expecting a huge surge in wages, to be able to pay off all that debt? Are wealthy people really that much more productive than the rest of us? If not, then what’s going on?

The key to understanding this situation was snuck in a few paragraphs ago: Every single dollar in circulation is loaned into existence by a bank, with interest.

That little statement contains the entire mystery. If all money in circulation is loaned into existence, it means that if every loan were paid back, all our money would disappear. As improbable as that may sound to you, it is precisely correct, although some of you are going to consider this proof that I could have saved a lot in tuition costs if I had simply drunk all that beer at home. But with a little investigation, you would readily discover that literally every single dollar in every single bank account can be traced back to a bank loan somewhere. For one person to have money in a bank account requires someone else to owe a similar-sized debt to a bank somewhere else.

But if all money is loaned into existence with interest, how does the interest get paid? Where does the money for that come from?

If you guessed "from additional loans," you are a winner! Said another way: For interest to be paid, the money supply must expand. Which means that next year there’s going to be more money in circulation, requiring a larger set of loans to pay off a larger set of interest charges, and so on, etc., etc., etc. With every passing year, the money supply must expand by an amount at least equal to the interest charges due on all the past money that was borrowed (into existence), or else severe stress will show up within our banking system. In other words, our monetary system is a textbook example of a compounding, or exponential, function.

Yeast in a vat of sugar water, lemming populations, and algal blooms are natural examples of exponential functions. Plotted on graph paper, they start out slowly, begin to rise more quickly, and then, suddenly, the line on the paper goes almost straight up, threatening to shoot off the paper and ruin your new desk surface. Fortunately, before this happens, the line always reverses somewhat violently back to the downside. Unfortunately, this means that our monetary system has no natural analog upon which we can model a happy ending.

When comparing the two graphs above, you are probably immediately struck by the fact that one refers to a nearly mythical creation especially revered at Christmas time, while the other is a graph of reindeer populations. You may have also noticed that our money supply looks suspiciously like any other exponential graph, except it hasn’t yet transitioned into the sharply falling stage.

To get the best possible understanding of the issues involved in exponential growth while spending only 10 minutes doing so, please read this supremely excellent transcript of a speech given by Dr. Albert Bartlett. If, like me, your lips move when you read, it may take 15 minutes, but I’d still recommend it. In this snippet he explains all:

Bacteria grow by doubling. One bacterium divides to become two, the two divide to become 4, become 8, 16 and so on. Suppose we had bacteria that doubled in number this way every minute. Suppose we put one of these bacterium into an empty bottle at eleven in the morning, and then observe that the bottle is full at twelve noon. There’s our case of just ordinary steady growth, it has a doubling time of one minute, and it’s in the finite environment of one bottle.

I want to ask you three questions:

First, at which time was the bottle half full? Well, would you believe 11:59, one minute before 12, because they double in number every minute?

Second, if you were an average bacterium in that bottle at what time would you first realize that you were running out of space? Well let’s just look at the last minute in the bottle. At 12 noon its full, one minute before its half full, 2 minutes before its 1/4 full, then 1/8th, then a 1/16th.

And inally, at 5 minutes before 12 when the bottle is only 3% full and is 97% open space just yearning for development, how many of you would realize there’s a problem?

And that’s it in a nutshell, right there. Exponential functions are sneaky buggers. One minute everything seems fine; the next minute your flask is full and there’s nowhere left to grow.

So, who cares, right? Perhaps you’re thinking that it’s possible, just this one time in the entire known universe of experience, for something to expand infinitely forever. But what happens if that’s not the case? What happens if a monetary system that must expand, can’t? Then what? How might that end come about? And when? For an excellent description of this process, read this article by Steven Lachance (emphasis mine):

A debt-based monetary system has a lifespan-limiting Achilles heel: as debt is created through loan origination, an obligation above and beyond this sum is also created in the form of interest. As a result, there can never be enough money to repay principal and pay interest unless debt is continually expanded. Debt-based monetary systems do not work in reverse, nor can they stand still without a liquidity buffer in the form of savings or a current account surplus.

When interest charges exceed debt growth, debtors at the margin are unable to service their debt. They must begin liquidating.

Mr. Lachance reveals the mathematical limit as being the moment that new debt creation falls short of existing interest charges. When that day comes, a wave of defaults will sweep through the system. Which is why our fiscal and monetary authorities are doing everything they can to keep money/debt creation robust.

But it’s a losing game, and they are only buying time. How do I know? Because nothing can expand infinitely forever. The evidence clearly points to exponentially rising levels of money and credit creation. As the bacterium example shows, once an exponential function gets rolling along, its self-reinforcing nature quickly takes over, requiring larger and larger aggregate amounts, even as the percentage remains seemingly tame.

Similarly, our supremely wealthy suffer only from an inability to spend what they ‘earn’ on their capital (interest & dividend income), which means their principal is compounding. But, because each dollar is loaned into existence, it means that when Bill Gates ‘earns’ $2 billion on his holdings, a whole lot of people somewhere else had to borrow that $2 billion. Taken to its logical extreme, and without enforced redistribution, this system would ultimately conclude with one person owning all of the world’s wealth. Game over, time for a Jubilee, hit the reset button, and start again.

When we started our monetary system, nobody ever thought that we would fill up our empty bacterium bottle. Nobody really thought through what it would mean to society once wealthy people earned more in interest & dividends than they could possibly spend. Nobody considered whether it was wise to place 100% of our economic chips into a monolithic banking system that requires perpetual, endless growth in order to merely function.

So, we must ask ourselves: Does it seem possible that our money supply can continue to double every 6 years forever? How about another 100 years? How about another six? What will it feel like when we are adding another $1 trillion every month, week, day, and then, finally, every hour?

Just remember, money is supposed to be a store of value; or, said another way, a store of human effort. Currently it seems to be failing at meeting that characteristic and therefore is failing at being money.

Who ever thought that oil production would hit a limit? Who knew that every acre of arable land, and then some, would someday be put into production? How could we possibly fish the seas empty?

We have parabolic money on a spherical planet. The former demands perpetual growth while the latter has definitive boundaries. Which will win?

What will happen when a system that must grow, can’t? How will an economic paradigm, so steeped in the necessity of growth that economists unflinchingly use the term ‘negative growth,’ suddenly evolve into an entirely new system? If compound interest based monetary systems have a fatal math problem, what will banks do if they can’t charge interest? And what shall we replace them with?

Since I’ve never read a single word on the subject, I suspect there’s even less interest in exploring this subject by our leaders than there is in being honest about our collective $53 trillion federal shortfall.

I am convinced that our monetary system’s encounter with natural and/or mathematical limits will be anything but smooth (possibly fatal), and I have placed my bets accordingly. It seems that our money system is thoroughly incompatible with natural laws and limits, and therefore is destined to fail.

Now you know why I have entitled my initial economic seminar series "The End of Money." [Although I later renamed it The Crash Course.]

But the end of something is always the beginning of something else. Where’s our modern day Adam Smith? We need a new economic model.

The greatest shortcoming of the human race is our inability to understand the exponential function. ~ Dr. Albert Bartlett

The End of Money

PREVIEW by Chris MartensonMonday, March 10, 2008

The greatest shortcoming of the human race is our inability to understand the exponential function.

~ Dr. Albert Bartlett

While it was operating well, our monetary system was a great system, one that fostered incredible technological innovation and advances in standards of living. But every system has its pros and its cons, and our monetary system has a doozy of a flaw.

It is run by humans.

Oh, wait, that’s a valid complaint, but not the one I was looking for. Here it is:

Our monetary system must continually expand, forever.

What’s going on here? Could it be that the US economy is so robust that it requires monetary and credit growth to double every 6 to 7 years? Are US households expecting a huge surge in wages, to be able to pay off all that debt? Are wealthy people really that much more productive than the rest of us? If not, then what’s going on?

The key to understanding this situation was snuck in a few paragraphs ago: Every single dollar in circulation is loaned into existence by a bank, with interest.

That little statement contains the entire mystery. If all money in circulation is loaned into existence, it means that if every loan were paid back, all our money would disappear. As improbable as that may sound to you, it is precisely correct, although some of you are going to consider this proof that I could have saved a lot in tuition costs if I had simply drunk all that beer at home. But with a little investigation, you would readily discover that literally every single dollar in every single bank account can be traced back to a bank loan somewhere. For one person to have money in a bank account requires someone else to owe a similar-sized debt to a bank somewhere else.

But if all money is loaned into existence with interest, how does the interest get paid? Where does the money for that come from?

If you guessed "from additional loans," you are a winner! Said another way: For interest to be paid, the money supply must expand. Which means that next year there’s going to be more money in circulation, requiring a larger set of loans to pay off a larger set of interest charges, and so on, etc., etc., etc. With every passing year, the money supply must expand by an amount at least equal to the interest charges due on all the past money that was borrowed (into existence), or else severe stress will show up within our banking system. In other words, our monetary system is a textbook example of a compounding, or exponential, function.

Yeast in a vat of sugar water, lemming populations, and algal blooms are natural examples of exponential functions. Plotted on graph paper, they start out slowly, begin to rise more quickly, and then, suddenly, the line on the paper goes almost straight up, threatening to shoot off the paper and ruin your new desk surface. Fortunately, before this happens, the line always reverses somewhat violently back to the downside. Unfortunately, this means that our monetary system has no natural analog upon which we can model a happy ending.

When comparing the two graphs above, you are probably immediately struck by the fact that one refers to a nearly mythical creation especially revered at Christmas time, while the other is a graph of reindeer populations. You may have also noticed that our money supply looks suspiciously like any other exponential graph, except it hasn’t yet transitioned into the sharply falling stage.

To get the best possible understanding of the issues involved in exponential growth while spending only 10 minutes doing so, please read this supremely excellent transcript of a speech given by Dr. Albert Bartlett. If, like me, your lips move when you read, it may take 15 minutes, but I’d still recommend it. In this snippet he explains all:

Bacteria grow by doubling. One bacterium divides to become two, the two divide to become 4, become 8, 16 and so on. Suppose we had bacteria that doubled in number this way every minute. Suppose we put one of these bacterium into an empty bottle at eleven in the morning, and then observe that the bottle is full at twelve noon. There’s our case of just ordinary steady growth, it has a doubling time of one minute, and it’s in the finite environment of one bottle.

I want to ask you three questions:

First, at which time was the bottle half full? Well, would you believe 11:59, one minute before 12, because they double in number every minute?

Second, if you were an average bacterium in that bottle at what time would you first realize that you were running out of space? Well let’s just look at the last minute in the bottle. At 12 noon its full, one minute before its half full, 2 minutes before its 1/4 full, then 1/8th, then a 1/16th.

And inally, at 5 minutes before 12 when the bottle is only 3% full and is 97% open space just yearning for development, how many of you would realize there’s a problem?

And that’s it in a nutshell, right there. Exponential functions are sneaky buggers. One minute everything seems fine; the next minute your flask is full and there’s nowhere left to grow.

So, who cares, right? Perhaps you’re thinking that it’s possible, just this one time in the entire known universe of experience, for something to expand infinitely forever. But what happens if that’s not the case? What happens if a monetary system that must expand, can’t? Then what? How might that end come about? And when? For an excellent description of this process, read this article by Steven Lachance (emphasis mine):

A debt-based monetary system has a lifespan-limiting Achilles heel: as debt is created through loan origination, an obligation above and beyond this sum is also created in the form of interest. As a result, there can never be enough money to repay principal and pay interest unless debt is continually expanded. Debt-based monetary systems do not work in reverse, nor can they stand still without a liquidity buffer in the form of savings or a current account surplus.

When interest charges exceed debt growth, debtors at the margin are unable to service their debt. They must begin liquidating.

Mr. Lachance reveals the mathematical limit as being the moment that new debt creation falls short of existing interest charges. When that day comes, a wave of defaults will sweep through the system. Which is why our fiscal and monetary authorities are doing everything they can to keep money/debt creation robust.

But it’s a losing game, and they are only buying time. How do I know? Because nothing can expand infinitely forever. The evidence clearly points to exponentially rising levels of money and credit creation. As the bacterium example shows, once an exponential function gets rolling along, its self-reinforcing nature quickly takes over, requiring larger and larger aggregate amounts, even as the percentage remains seemingly tame.

Similarly, our supremely wealthy suffer only from an inability to spend what they ‘earn’ on their capital (interest & dividend income), which means their principal is compounding. But, because each dollar is loaned into existence, it means that when Bill Gates ‘earns’ $2 billion on his holdings, a whole lot of people somewhere else had to borrow that $2 billion. Taken to its logical extreme, and without enforced redistribution, this system would ultimately conclude with one person owning all of the world’s wealth. Game over, time for a Jubilee, hit the reset button, and start again.

When we started our monetary system, nobody ever thought that we would fill up our empty bacterium bottle. Nobody really thought through what it would mean to society once wealthy people earned more in interest & dividends than they could possibly spend. Nobody considered whether it was wise to place 100% of our economic chips into a monolithic banking system that requires perpetual, endless growth in order to merely function.

So, we must ask ourselves: Does it seem possible that our money supply can continue to double every 6 years forever? How about another 100 years? How about another six? What will it feel like when we are adding another $1 trillion every month, week, day, and then, finally, every hour?

Just remember, money is supposed to be a store of value; or, said another way, a store of human effort. Currently it seems to be failing at meeting that characteristic and therefore is failing at being money.

Who ever thought that oil production would hit a limit? Who knew that every acre of arable land, and then some, would someday be put into production? How could we possibly fish the seas empty?

We have parabolic money on a spherical planet. The former demands perpetual growth while the latter has definitive boundaries. Which will win?

What will happen when a system that must grow, can’t? How will an economic paradigm, so steeped in the necessity of growth that economists unflinchingly use the term ‘negative growth,’ suddenly evolve into an entirely new system? If compound interest based monetary systems have a fatal math problem, what will banks do if they can’t charge interest? And what shall we replace them with?

Since I’ve never read a single word on the subject, I suspect there’s even less interest in exploring this subject by our leaders than there is in being honest about our collective $53 trillion federal shortfall.

I am convinced that our monetary system’s encounter with natural and/or mathematical limits will be anything but smooth (possibly fatal), and I have placed my bets accordingly. It seems that our money system is thoroughly incompatible with natural laws and limits, and therefore is destined to fail.

Now you know why I have entitled my initial economic seminar series "The End of Money." [Although I later renamed it The Crash Course.]

But the end of something is always the beginning of something else. Where’s our modern day Adam Smith? We need a new economic model.

The greatest shortcoming of the human race is our inability to understand the exponential function. ~ Dr. Albert Bartlett

Monday, December 17, 2007

Executive Summary

- A series of government bailouts attack the symptoms, utterly failing to address the root cause.

- The bailouts were for the big banks, not you.

- House prices need to decline in price by 30% to 50%, and they will.

- Trillions of dollars of losses lurk in ultra-safe pension bond funds and small Norwegian towns, as well as in some unlikely places.

- Current crisis is one of solvency, not liquidity.

Q: “Has the housing market bottomed, is it soon to bottom, or is it in the process of bottoming?”

A: No, nope, and no.

There is no means of avoiding the final collapse of a boom brought about by credit (debt) expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit (debt) expansion, or later as a final and total catastrophe of the currency system involved.

~ Ludwig Von Mises

In order to get at the question of ‘Just how bad is the current housing crisis?’ we need to understand the dimensions of the problem. It is a complicated mess if one considers all the scenery in detail, but it’s startlingly simple when viewed from a distance.

![]()

The threat to our banking system is described by the extent of the mortgage losses, and those will depend on how far (and how fast) house prices fall, together with the impact of outright fraud. Below we shall explore the (very) simple reasons that explain why house prices must fall by 30% to 50%. Each one can be lumped into a category of fraud, reducing demand, or boosting supply.

- House prices rose far above income gains. Too far. They became unaffordable, and now they are in the process of correcting back to affordable levels. What goes up must come down. Simple as that.

- Mortgage lending standards are tightening up, leading to fewer people qualifying for loans. Fewer qualified buyers means demand will drop and prices will fall. Simple as that.

- From 2000 to 2007, regulatory oversight of lending practices was so lax that there was effectively none. This means that lots of fraud was committed (a fantastic summary of types of real estate fraud can be found here), and an even larger pile of bad loans were made to people who will never be able to pay them back. That money is gone, gone, gone, and somebody is going to have to eat those losses. Simple as that.

- More than one out of every four homes sold in 2005 and 2006 were sold to speculators, and now house prices are at or below 2005 levels. This means that the speculators’ investments are wiped out (and then some, considering transaction costs). Speculator demand is gone, and will not return for many years. Less demand equals lower prices. Simple as that.

- Developers overbuilt the national housing stock by a very large amount, in part to meet the false speculator demand; I calculate somewhere in the vicinity of two to three million excess units. We have too much housing stock, and it will be a minimum of three years before population gains naturally work it off. All things housing-related will be in recession until that oversupply is worked off. Simple as that.

- Even though the subprime foreclosure crisis is much closer to the beginning than the end, already hundreds of billions of dollars of losses have been recorded by small towns in Norway, in state and municipal investment funds, and by institutional money market funds. While big banks have managed to stuff all these investment channels with dodgy mortgage paper, they themselves remain as exposed to real estate loans as they’ve ever been. Truly, there is no historical precedent to inform us to how bad this could get. I estimate somewhere between $1 trillion and $2 trillion in losses, which means that the entire capital of the entire US banking system could be wiped out. This is an issue of solvency, not liquidity, and therefore this is a major crisis that goes far beyond the official actions and statements to date. Simple as that.

- In summary, real estate supply, demand, and price are severely out of whack and can only be fixed by a significant decline in prices, which means that a whole lot of individuals and financial institutions are in trouble as a consequence. It all adds up to one simple conclusion: Banks, pensions, hedge funds, and money market funds will all have to dispose of a whole lot of bad paper. Possibly up to $2 trillion dollars worth, if my calculations are correct, meaning that the potential exists for the entire capital of the US banking system to be wiped out.

Now you have all the information you need to understand why there really are no policy fixes to this mess (e.g. ‘freezing interest rates’), only an inevitable date with lower house prices. If you care to continue, below I provide my supporting data for the above statements.

From a purely logical standpoint, house prices need to fall to match those at the start of the bubble in 2000. Why? Because otherwise we have to believe in The Free Lunch. For The Free Lunch to be true, it must be possible for a person to buy a house, do nothing except sit on a couch drinking beer for the next 5 years, and get rich in the process. Examining 70 past examples of asset bubbles, we find that The Free Lunch has never worked before. It’s not going to work out this time, either.

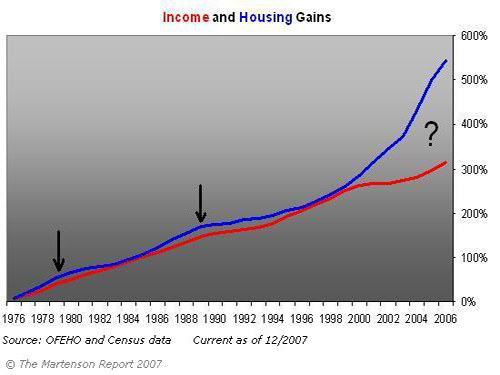

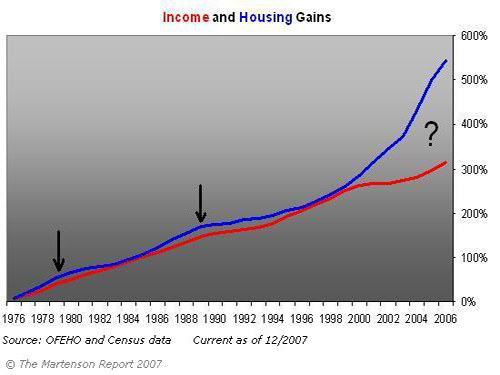

To illustrate, I put together the chart below by combining data from two government sources, the Census Bureau for income and the OFHEO for housing price gains.

What is immediately obvious is that house prices and income gains have historically tracked each other very, very closely through the entire data series until about 2000, where house prices pull significantly away from income gains. I have marked two historical housing bubbles (1979 and 1989) with arrows, noteworthy because they were well supported by income gains and therefore seem insignificant when viewed on this graph. But that in itself is noteworthy, because, as both homebuilders and house sellers during those periods can attest, it means that even a very slight departure between the blue and the red lines can be quite painful. It also means that we have no historical precedent for the territory in which we currently find ourselves.

So, onto the primary question: “What would be required to bring house prices and income gains back in line?”

The answer to that is either:

- An income gain of 51%

- A decline in house prices of 34%

Of the two, income gains or house price declines, which seems more likely? Before you answer that, you should know that the average income gain over the past 6 years has been 2.3% per year (not inflation-adjusted). At that rate it would take 21 years, or until 2028, to close the gap. In the meantime, house prices would have to remain frozen at today’s prices. In a normal world, we would see a bit of both, with house prices falling and incomes rising to meet somewhere down the road.

However, I expect house prices to do most of the heavy lifting, and I am expecting a decline of even more than 34%, possibly as much as 50%, because of the correlated job losses that will result from the housing wipeout. An outsized proportion of the meager job gains recorded since the recession of 2001 were in some way linked to housing. The ripple effect of job losses will extend far beyond realtors and mortgage brokers, and into window manufacturing, lumber, plumbing fixtures, nail salons, BMW detailing services, and so forth.

My calculations are therefore in rough alignment with those at economy.com:

NEW YORK (Reuters) – Housing markets from Punta Gorda, Florida, to Stockton, California, will crash and suffer price drops of more than 30 percent before the housing crisis is over, a report from Moody’s Economy.com said on Thursday.

On a national level, the housing market recession will continue through early 2009, said the report, co-authored by Mark Zandi, chief economist, and Celia Chen, director of housing economics.

At this particular moment in time, banks are about as heavily exposed to mortgages (as a total percent of assets) as they have ever been. Further, banks are holding an enormous quantity of commercial real estate loans, especially in the rah-rah areas such as Florida, the Southwest, and in California. The FDIC reported last year that more than 50% of all the banks in the southeast and west regions had exposure to commercial real estate loans that exceeded their total capital by 300% or more. Holy smokes!

Here’s how it happens. As the housing bubble takes off, people get into a buying frenzy, while builders get into a building frenzy. Soon enough, the commercial builders get excited and say to themselves “Saaaaay, would you lookit all these houses going up? We better build a few more malls and condos out this way!” They then go to a local or regional bank, who agrees that there’s no possible downside to building more shopping areas and condos, and so they loan huge amounts of money to these developers. When the inevitable bust comes, everybody acts surprised, and the banks go to the FDIC for a bailout. At least, that’s how it usually works. This time, because the amount of excessive building was so over the top and the banks were so unfavorably leveraged, I fully expect the FDIC to be inadequate for the job, which means Congress will have to get involved.

To put it in the simplest of terms, the total amount of bank capital in the entire country is a little over $1.1 trillion, while more than $11 trillion in real estate loans exist, meaning that a 10% to 15% loss on those loans would translate into the complete bankruptcy of the US banking system. What this all means is that we have a crisis of solvency, not liquidity. Currently the Federal Reserve has teamed up with European central banks to provide vast new sources of liquidity (unlimited, really) to the banking system. That is, banks can trade in their piles of dodgy loans for cash for a specified period of time. This gives banks access to cash. However, as currently structured, they have to buy those dodgy loans back at par, at some point in the future. If those loans are bad (which they are), then this maneuver by the Fed simply won’t work. Instead, we need wipe those bad loans out, which means we will lose a financial intuition or two (or thirty) along the way.

It is against this relatively simple backdrop of overly expensive, overbuilt housing that the government recently launched an awful, poorly conceived and named subprime bailout plan named the New Hope Alliance. “Hope?” Well, I suppose since ‘hope’ is what got us into this mess, it makes sense that the government might choose to use ‘hope’ to get us back out of it. “Hope” is not a sound strategy, which makes it a natural fit for the current housing crisis.

Since this new plan of Hope will not prevent house prices from falling, it is pretty much dead on arrival, at least as far as actually helping to solve the primary problem. The primary problem is how a lack of housing affordability will lead to a decline in prices, as brilliantly captured by this industry insider:

One final thought. How can any of this get repaired unless home values stabilize? And how will that happen? In Northern California, a household income of $90,000 per year could legitimately pay the minimum monthly payment on an Option ARM on a million home for the past several years. Most Option ARMs allowed zero to 5% down. Therefore, given the average income of the Bay Area, most families could buy that million dollar home. A home seller had a vast pool of available buyers.

Now, with all the exotic programs gone, a household income of $175,000 is needed to buy that same home, which is about 10% of the Bay Area households. And inventories are up 500%. So, in a nutshell, we have 90% fewer qualified buyers for five times the number of homes. To get housing moving again in Northern California, either all the exotic programs must come back, everyone must get a 100% raise, or home prices have to fall 50%. None, except the last, sound remotely possible.

Wow. A tenfold reduction in buyers and a fivefold increase in house supply. There is only one way for that to resolve, and that is through reduced prices.

As presented, the purpose of the program of Hope was to help prevent or delay foreclosures – as if they were the problem. Unfortunately, foreclosures are merely the symptom. The cause is the fact that people bought overpriced houses they couldn’t afford, while hoping that rising house prices would provide a ready source of cashout mortgage money. House prices are no longer rising, they are falling. That is the root of the current crisis, and this most recent government fix does absolutely nothing about it. So we can score the plan a zero on that front. Where the New Hope Alliance really breaks down and becomes a solid negative, though, is in how it undermines confidence in the sanctity of US contract law.

Dec. 7 (Bloomberg) — President George W. Bush’s plan to freeze interest rates on some subprime mortgages may prove to be a cure that breeds another disease.

“If the government goes in and changes contracts it will definitely have a chilling effect on the securitization of mortgages,” said Milton Ezrati, senior economist and market strategist at Lord Abbett & Co. in Jersey City, New Jersey, which oversees $120 billion in assets.

“When the government comes in and says you have contracted to have this arrangement and you can no longer have it, I think it opens the door for lawsuits.”

What’s being said here is that enforceable contracts are a vital component of the US financial industry. Heck, of the entire US way of life, since it is the trust foreigners place in our ‘system’ that gives them the confidence to loan us back the money we spent on their products. Without the trust that a given contract will be collectible, then those contracts either get written at a much higher price to compensate for the risk of not being paid, or they do not get written at all. So if part of the subprime crisis is reduced house prices resulting from reduced demand, would we expect a serious disturbance in mortgage contract enforceability to result in more or fewer mortgages written? Who will be able to afford significantly higher mortgage payments? Who will issue them? Who would buy them and hold them?

This is an important concept, because a huge prop to our economy over the past decade has been the flood of foreign funds that allowed us to enjoy low interest rates even as our trade deficit plumbed new depths. Part of the reason foreigners felt comfortable, if not confident, investing in the US, is that our contract laws and supporting legal infrastructure are exceptionally strong in protecting investors’ claims. Foreign investors bought many packaged mortgage products from Wall Street banks at a price based on expected returns that included future rate adjustments. That’s now at risk. This would be no different than your boss telling you that next year’s 5% raise, which you are counting on and have in writing, is actually going to be 0% – but could you please loan him another few hundred bucks?

So what was the purpose of the New Hope deal? Simple. It’s meant to bail out big banks and mortgage companies who simply do not wish to recognize the actual value of the mortgages they hold at current market prices. When houses enter foreclosure and then get sold, a price discovery event happens that ‘hits the books’ of the financial institution involved.

Here’s the best explanation of the week, courtesy of the San Francisco Gate:

Now, just unveiled Thursday, comes the “freeze,” the brainchild of Treasury Secretary Henry Paulson. It sounds good: For five years, mortgage lenders will freeze interest rates on a limited number of “teaser” subprime loans. Other homeowners facing foreclosure will be offered assistance from the Federal Housing Administration.

But unfortunately, the “freeze” is just another fraud – and like the other bailout proposals, it has nothing to do with U.S. house prices, with “working families,” keeping people in their homes or any of that nonsense.

The sole goal of the freeze is to prevent owners of mortgage-backed securities, many of them foreigners, from suing U.S. banks and forcing them to buy back worthless mortgage securities at face value – right now almost 10 times their market worth.

The ticking time bomb in the U.S. banking system is not resetting subprime mortgage rates. The real problem is the contractual ability of investors in mortgage bonds to require banks to buy back the loans at face value if there was fraud in the origination process.

And, to be sure, fraud is everywhere. It’s in the loan application documents, and it’s in the appraisals. There are e-mails and memos floating around showing that many people in banks, investment banks and appraisal companies – all the way up to senior management – knew about it.

However, this was actually the third bailout/remedy by the government. There were already two past bailouts that were simply not well publicized, and those are the ones to which you should be paying attention, because they involve vast gobs of public money.

The first was this eye-popping advance by the Federal Home Loan Bank system (FHLB) to the overall mortgage market in October:

NEW YORK (Fortune) — As the credit crunch hit hard in the third quarter, most banks were forced to cut back their lending. But one group of banks increased lending by an incredible $182 billion. Who were these deep-pocketed lenders — and are they capable of handling such a large rise in loans, especially at a time when credit markets are unsettled and mortgage defaults on the rise?

The lenders in question were the 12 Federal Home Loan Banks, set up under a government charter during the Great Depression to provide support to the housing market by advancing funds to over 8000 member banks that make mortgages. In the third quarter, loans to member banks, also called ‘advances,’ totaled $822 billion, a 28% leap from $640 billion at the end of June.

This is a staggering amount of mortgage-buying activity. Where did this $182 billion come from? Did the FHLB just happen to have nearly $200 billion lying around? If not, how was it that the FHLB was able to find buyers for mortgage paper at a time when the mortgage markets were more or less frozen? What sorts of mortgages were purchased? Were they high grade or the subbiest of the subprime? In point of fact, it is a bailout, plain and simple. It is an egregious use of public monies that was not voted on, but is guaranteed, by the public. But the FHLB fiduciary stewards did not stop there. They went further, by advancing a stunning $51 billion to Countrywide Financial Corp, recently voted as most likely to fail by its classmates. How bad does this move smell? Bad enough for a US Senator to notice.

In a letter to the regulator of the Federal Home Loan Bank system, Sen. Charles Schumer said Countrywide, the largest U.S. mortgage lender, may be abusing the program.

At the end of September, Countrywide had borrowed $51.1 billion from the Federal Home Loan Bank system — a government-sponsored program.

“Countrywide is treating the Federal Home Loan Bank system like its personal ATM,” Schumer, a New York Democrat who heads the housing panel of the Senate Banking Committee, said in the letter. “At a time when Countrywide’s mortgage portfolio is deteriorating drastically, FHLB’s exposure to Countrywide poses an unreasonable risk.”

So what we have here is a case where the fiscal and monetary authorities are desperately shoving enormous amounts of money (and new policy) into a very stressed and ultimately unsavable situation. On a personal level, this bothers me a great deal. Partly because I have been prudent and saved and rented while waiting for the silliness to end, yet the very first response of my government is to punish me and reward the imprudent. But mainly because big bailouts doubly punish us all; first, by the inevitable inflation that results, and second, because our future options will be diminished by debt.

What needs to happen is very clear. The bad debts need to be wiped out. The mal-investments need to be written off.

So now that we know this thing is going to implode, the only relevant part left is to ask the questions, ‘How am I exposed, and how can I avoid having the bag passed to me?’

Here I will revert to my past recommendations:

- Get out of debt.

- Be very careful about where you keep your money. Already several high profile money market funds have suffered losses and closed down, returning less than the deposit amount to their clients. Expect this to get worse.

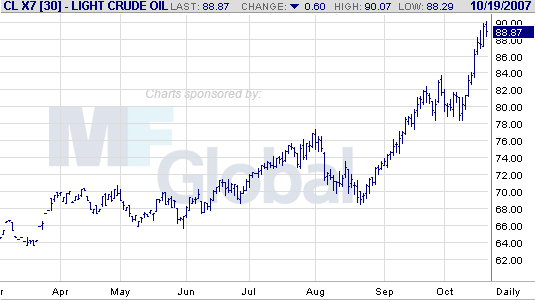

- The dollar is in a precarious situation, especially if the Fed begins buying up bad debt for paper money in a big way. Gold. Silver. Top off your oil tank at home.

- Be aware that pensions, municipal investment accounts, and even your bank are all highly likely to be exposed to the leveraged losses that are now upon us. If you are exposed here, figure out how not to be.

- If you are a citizen of a country whose central bank insists on bailing out the monied elite (big banks) with your current and/or future tax dollars, use every possible avenue available to legally apply pressure upon your political representatives to prevent this from happening.

Now, go back to the top and re-read the quote by Ludwig Von Mises. It neatly describes everything you need to know. The preceding 20 paragraphs were my way of illustrating that there will be no voluntary abandonment of credit expansion. In fact, the data shows that our fiscal and monetary authorities are fighting that possible outcome tooth and nail. That leaves the dollar exposed to the risk of losing its reserve currency status as it heads towards international pariah status. Not that there’s anything wrong with that…unless you think we might, someday, need to import oil, or something made out of plastic, or electronics, or underwear, or …

Housing – Simple As That

PREVIEW by Chris MartensonMonday, December 17, 2007

Executive Summary

- A series of government bailouts attack the symptoms, utterly failing to address the root cause.

- The bailouts were for the big banks, not you.

- House prices need to decline in price by 30% to 50%, and they will.

- Trillions of dollars of losses lurk in ultra-safe pension bond funds and small Norwegian towns, as well as in some unlikely places.

- Current crisis is one of solvency, not liquidity.

Q: “Has the housing market bottomed, is it soon to bottom, or is it in the process of bottoming?”

A: No, nope, and no.

There is no means of avoiding the final collapse of a boom brought about by credit (debt) expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit (debt) expansion, or later as a final and total catastrophe of the currency system involved.

~ Ludwig Von Mises

In order to get at the question of ‘Just how bad is the current housing crisis?’ we need to understand the dimensions of the problem. It is a complicated mess if one considers all the scenery in detail, but it’s startlingly simple when viewed from a distance.

![]()

The threat to our banking system is described by the extent of the mortgage losses, and those will depend on how far (and how fast) house prices fall, together with the impact of outright fraud. Below we shall explore the (very) simple reasons that explain why house prices must fall by 30% to 50%. Each one can be lumped into a category of fraud, reducing demand, or boosting supply.

- House prices rose far above income gains. Too far. They became unaffordable, and now they are in the process of correcting back to affordable levels. What goes up must come down. Simple as that.

- Mortgage lending standards are tightening up, leading to fewer people qualifying for loans. Fewer qualified buyers means demand will drop and prices will fall. Simple as that.

- From 2000 to 2007, regulatory oversight of lending practices was so lax that there was effectively none. This means that lots of fraud was committed (a fantastic summary of types of real estate fraud can be found here), and an even larger pile of bad loans were made to people who will never be able to pay them back. That money is gone, gone, gone, and somebody is going to have to eat those losses. Simple as that.

- More than one out of every four homes sold in 2005 and 2006 were sold to speculators, and now house prices are at or below 2005 levels. This means that the speculators’ investments are wiped out (and then some, considering transaction costs). Speculator demand is gone, and will not return for many years. Less demand equals lower prices. Simple as that.

- Developers overbuilt the national housing stock by a very large amount, in part to meet the false speculator demand; I calculate somewhere in the vicinity of two to three million excess units. We have too much housing stock, and it will be a minimum of three years before population gains naturally work it off. All things housing-related will be in recession until that oversupply is worked off. Simple as that.

- Even though the subprime foreclosure crisis is much closer to the beginning than the end, already hundreds of billions of dollars of losses have been recorded by small towns in Norway, in state and municipal investment funds, and by institutional money market funds. While big banks have managed to stuff all these investment channels with dodgy mortgage paper, they themselves remain as exposed to real estate loans as they’ve ever been. Truly, there is no historical precedent to inform us to how bad this could get. I estimate somewhere between $1 trillion and $2 trillion in losses, which means that the entire capital of the entire US banking system could be wiped out. This is an issue of solvency, not liquidity, and therefore this is a major crisis that goes far beyond the official actions and statements to date. Simple as that.

- In summary, real estate supply, demand, and price are severely out of whack and can only be fixed by a significant decline in prices, which means that a whole lot of individuals and financial institutions are in trouble as a consequence. It all adds up to one simple conclusion: Banks, pensions, hedge funds, and money market funds will all have to dispose of a whole lot of bad paper. Possibly up to $2 trillion dollars worth, if my calculations are correct, meaning that the potential exists for the entire capital of the US banking system to be wiped out.

Now you have all the information you need to understand why there really are no policy fixes to this mess (e.g. ‘freezing interest rates’), only an inevitable date with lower house prices. If you care to continue, below I provide my supporting data for the above statements.

From a purely logical standpoint, house prices need to fall to match those at the start of the bubble in 2000. Why? Because otherwise we have to believe in The Free Lunch. For The Free Lunch to be true, it must be possible for a person to buy a house, do nothing except sit on a couch drinking beer for the next 5 years, and get rich in the process. Examining 70 past examples of asset bubbles, we find that The Free Lunch has never worked before. It’s not going to work out this time, either.

To illustrate, I put together the chart below by combining data from two government sources, the Census Bureau for income and the OFHEO for housing price gains.

What is immediately obvious is that house prices and income gains have historically tracked each other very, very closely through the entire data series until about 2000, where house prices pull significantly away from income gains. I have marked two historical housing bubbles (1979 and 1989) with arrows, noteworthy because they were well supported by income gains and therefore seem insignificant when viewed on this graph. But that in itself is noteworthy, because, as both homebuilders and house sellers during those periods can attest, it means that even a very slight departure between the blue and the red lines can be quite painful. It also means that we have no historical precedent for the territory in which we currently find ourselves.

So, onto the primary question: “What would be required to bring house prices and income gains back in line?”

The answer to that is either:

- An income gain of 51%

- A decline in house prices of 34%

Of the two, income gains or house price declines, which seems more likely? Before you answer that, you should know that the average income gain over the past 6 years has been 2.3% per year (not inflation-adjusted). At that rate it would take 21 years, or until 2028, to close the gap. In the meantime, house prices would have to remain frozen at today’s prices. In a normal world, we would see a bit of both, with house prices falling and incomes rising to meet somewhere down the road.

However, I expect house prices to do most of the heavy lifting, and I am expecting a decline of even more than 34%, possibly as much as 50%, because of the correlated job losses that will result from the housing wipeout. An outsized proportion of the meager job gains recorded since the recession of 2001 were in some way linked to housing. The ripple effect of job losses will extend far beyond realtors and mortgage brokers, and into window manufacturing, lumber, plumbing fixtures, nail salons, BMW detailing services, and so forth.

My calculations are therefore in rough alignment with those at economy.com:

NEW YORK (Reuters) – Housing markets from Punta Gorda, Florida, to Stockton, California, will crash and suffer price drops of more than 30 percent before the housing crisis is over, a report from Moody’s Economy.com said on Thursday.

On a national level, the housing market recession will continue through early 2009, said the report, co-authored by Mark Zandi, chief economist, and Celia Chen, director of housing economics.

At this particular moment in time, banks are about as heavily exposed to mortgages (as a total percent of assets) as they have ever been. Further, banks are holding an enormous quantity of commercial real estate loans, especially in the rah-rah areas such as Florida, the Southwest, and in California. The FDIC reported last year that more than 50% of all the banks in the southeast and west regions had exposure to commercial real estate loans that exceeded their total capital by 300% or more. Holy smokes!