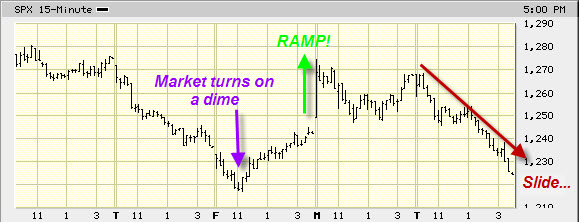

Actually, this bears a bit of explanation. In the chart below of the S&P 500 I have marked three arrows. At the purple arrow, I want you to note that the market was selling off quite severely, and then, magically, at 11:00 it turned around and went powerfully in the other direction. At the time, I watched that and thought to myself, “Huh, somebody knows something I don’t.”

Regardless, if you look at the chart carefully, you’ll note that the weekends are represented by thin double lines. The next arrow, the green one, shows the opening blast on Monday morning, yesterday, which was the openly stated targeted outcome of the Treasury department, which wanted to breathe some confidence back into the stock market. This is why they timed their main announcement to occur prior to the opening of the Asian stock markets on Sunday, and they said as much.

But today? The stock market lost 43 points today (red arrow), which more than gave up all of yesterdays miracle gains. Now we have to face the prospect that we’ve entered the second stage of the crisis – the deflationary stage. Stocks, commodities, and real estate, collectively comprising well over half of all assets, are all in full blown retreat. Our banking system is insolvent, as is the US government, and only the continued ability of the US government to borrow lots of money stands between us and actual bankruptcy. I’ll have more on this later. Bottom line is that events are moving too fast to stay on top of them all, although I am trying.