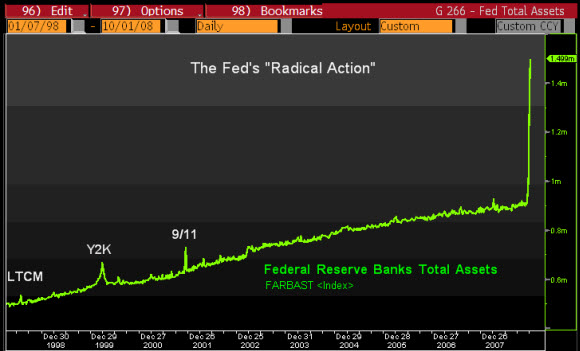

In 1998, the Long Term Capital Management (LTCM) blow-up (aka "the worst financial crisis of all time,") happened. To fight the pernicious effects of this crisis, the Fed expanded its asset base, which is a fancy way of saying that they pushed a bunch of cash out into the banking system

Well, that crisis passed, and the Fed slowly re-absorbed that excess cash and returned to a more normal rate of exponential money expansion.

Then the Y2K ‘crisis’ came along and the Fed shoved tons of money into the banking system in anticipation of a crisis that never was. (Hey, they didn’t know that.) Unfortunately, all this hot money poured onto an already-raging stock market mania and served to fuel the final blow-off that finally burst in the spring of 2000.

Then 9/11 came along, and this was by far a larger shock to the system than either of the prior crises. Again, money was shoved into the system and then reeled back in later.

Well, then, this picture will help you put this current crisis into context.

Yikes.

The opportunity for this level of monetary monkeying to end up in the hyperinflationary ditch is very, very high.