I nominate this for understatement of the year:

Ryan Says Treasury to Need `Unprecedented’ Financing

"This year’s financing needs will be unprecedented,” said Anthony Ryan, the Treasury’s acting undersecretary for domestic finance, at a Securities Industry and Financial Markets Association conference in New York, where he was a last-minute substitute for Treasury Secretary Henry Paulson.

"Unprecedented" hardly does this justice; we need a more superlative word. "Ginormous" comes to mind.

Perhaps the Germans have a single word that means "future destroying" that we could use.

Mr. Ryan continues:

Ryan said the Bush administration’s July projection of a $482 billion deficit doesn’t include new programs launched to attack the credit crisis. The bank rescue program, a separate mortgage-backed securities program, the Fannie-Freddie takeover and a student loan program all need funding, Ryan said. Also, the Treasury is borrowing money on behalf of the Federal Reserve and the Federal Deposit Insurance Corp., he said.

First, how come we don’t have a more recent budget projection than from last July? A lot has happened since then, and I think the Treasury markets would enjoy a bit of guidance on how much paper they will be asked to absorb. Also, I deplore the use of budget projections that exclude items that are, uh, part of the budget.

And here’s one estimate of the range of total borrowing:

"The budget deficit for fiscal year 2009 might reach $1 trillion if Congress passes another stimulus package this winter,” said Lou Crandall, chief economist of Wrightson ICAP, in a research note. "And that’s just the beginning of the bad news — financing needs arising from off-budget items might be nearly as large as the on-budget deficit.”

Crandall estimates 2009’s total borrowing needs at $1.95 trillion. He says Treasury could raise this money with an "aggressive but sustainable” increase in regular borrowing, accompanied by one-time auctions as needed.

The difference, I suppose, between the $1 trillion and the $1.95 trillion number is the difference between the fiscal year (Sept 30 – Sept 30) and the calendar year. So I guess Mr. Crandall expects nearly a trillion of additional borrowing in the final 3 months of 2009.

For the record,because I factor in a loss of tax revenues and additional stimulus packages, I place next year’s fiscal year borrowing at between $2 trillion and $2.5 trillion.

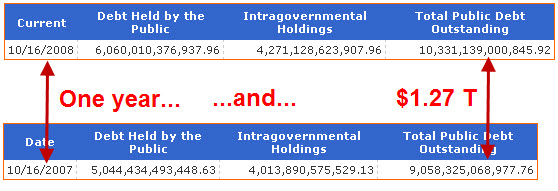

Also, I am cheating a little by knowing that this year’s deficit was nearly $1.3 trillion (the first $1 trillion plus deficit on record), even though only $455 billion of that was publicly admitted to by the Bush administration.

I have no good explanation for why the registered deficit was 179% larger than the admitted deficit. Normally the difference is in the vicinity of the excess Social Security funds that were siphoned off, or about $180 billion.

This difference is a whopping $815 billion.

My suspicion is that some of this can be found over on the Federal Reserve Balance sheet, but I cannot prove that yet.

Bottom line: The US Treasury department is about to shatter every borrowing record in all of history. Why is China continuing to hold all those US dollars?